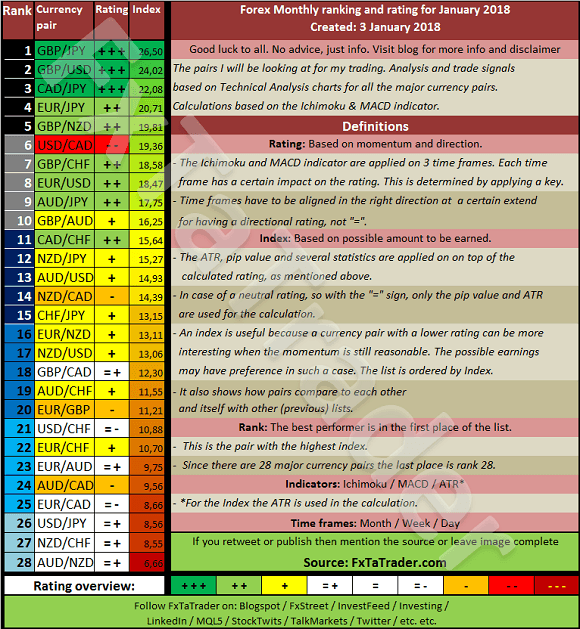

The Top 10 of the Ranking and Rating list for the coming month shows the following stronger currencies being well represented for going long: the GBP(5X) followed by the EUR(2X) with the CAD(2X). The weaker currencies are the JPY(4X) followed by the USD(3X).

By diversifying a nice combination can be traded in the coming month like e.g.:

-

GBP/JPY with the USD/CAD

-

GBP/USD with the EUR/JPY

______________________________________

Ranking and Rating list

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every month the Forex ranking rating list will be prepared around the change of the month. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

______________________________________

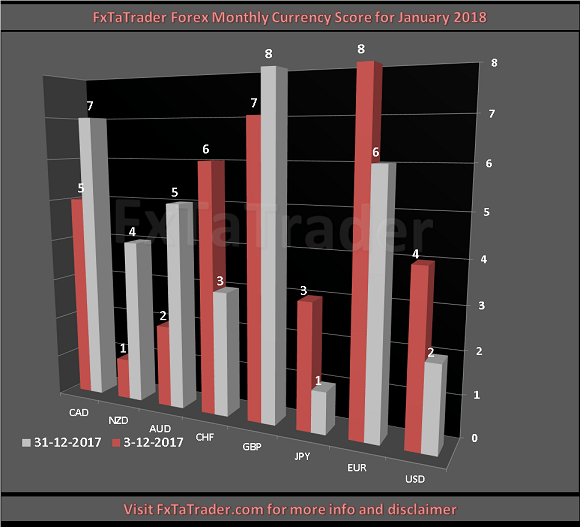

For analyzing the best pairs to trade looking from a longer-term perspective the last 12 months Currency Classification can be used in support.

This classification was updated on 3 January 2018 and is provided here for reference purposes:

Strong: USD, EUR, AUD, CAD. The preferred range is from 5 to 8.

Neutral: AUD, NZD, GBP. The preferred range is from 2 to 4.

Weak: JPY, GBP. The preferred range is 1.

When comparing the 12 months Currency Classification with the pairs mentioned in the Ranking List above some would then become less interesting. On the other hand, these pairs are at the top of the list partly also because of their volatility. It seems best to take positions for a short period then and take advantage of the high price movements.

With the FxTaTrader Strategy, these pairs are not traded because these would be trades in the 4 Hour chart or in a lower Time Frame. Nevertheless, they may offer good chances for the short term trader.

______________________________________

Currency Score Chart

The Currency Score analysis is one of the parameters used for the Ranking and Rating list which is published also in this article. The Currency Score is my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 Time Frames: the monthly, weekly, daily and 4 hours. The result of the technical analysis is the screenshot here below.

When comparing the 12 months Currency Classification with the recent Currency Score, as provided in the image above, we can determine the deviations. In the article "Forex Strength and Comparison" this is analyzed in more detail.

______________________________________

Chart of the Month

The Chart for this month is the AUD/JPY Weekly chart.

Price is clearly in an uptrend and made a high lately. It made a pullback towards the Ichimoku cloud and recovered. Price broke last week through an important resistance level, see the yellow dotted line. The PSAR turned also positive for taking long positions.

A nice buy opportunity would be when the MACD crosses the signal line and this will be clear at the end of this week. As long as the MACD remains above the signal line and price remains above the Tenkan-Sen, Kijun-Sen and the Ichimoku cloud taking long positions seems a good opportunity.

Taking long positions on the Daily chart seems a good opportunity too. This can be done based on pullbacks towards the Kijun-Sen as explained in several set-ups of my previous articles.

-

This is a pair that fits best in Point 1 of the Comparison Table Guide. For more information read my other Monthly article called the "Forex Strength and Comparison".

-

The AUD is a strong currency and the JPY a Weak currency. The Currency Score Difference is 4.

The set-up mentioned remains valid as long as the pair remains in the Top 10 of the coming Monthly Ranking and Rating lists and continues to comply with the point of the Comparison Table Guide mentioned above.

The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.