The era of US Dollar has truly come. Maybe this statement is quite late, but it is never too late to trade with the trend.

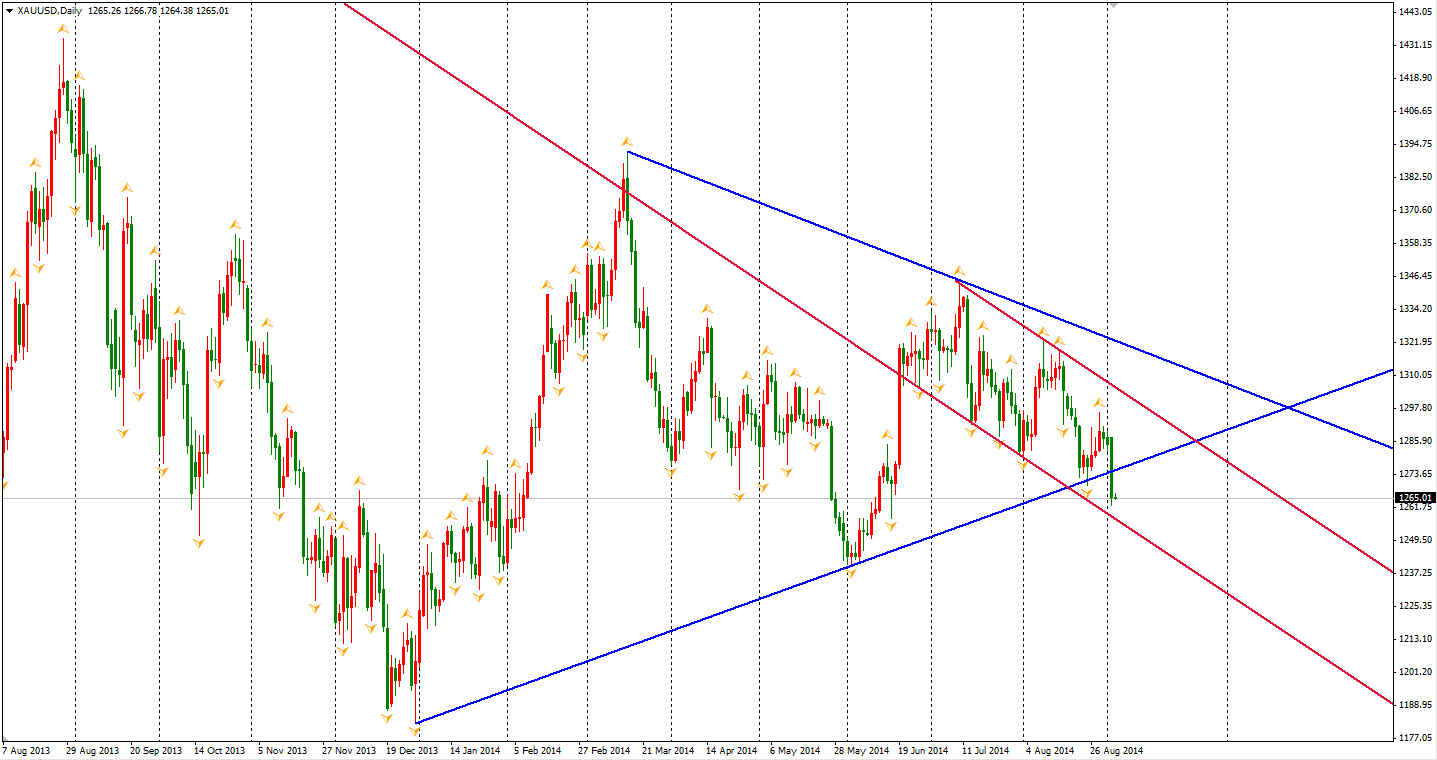

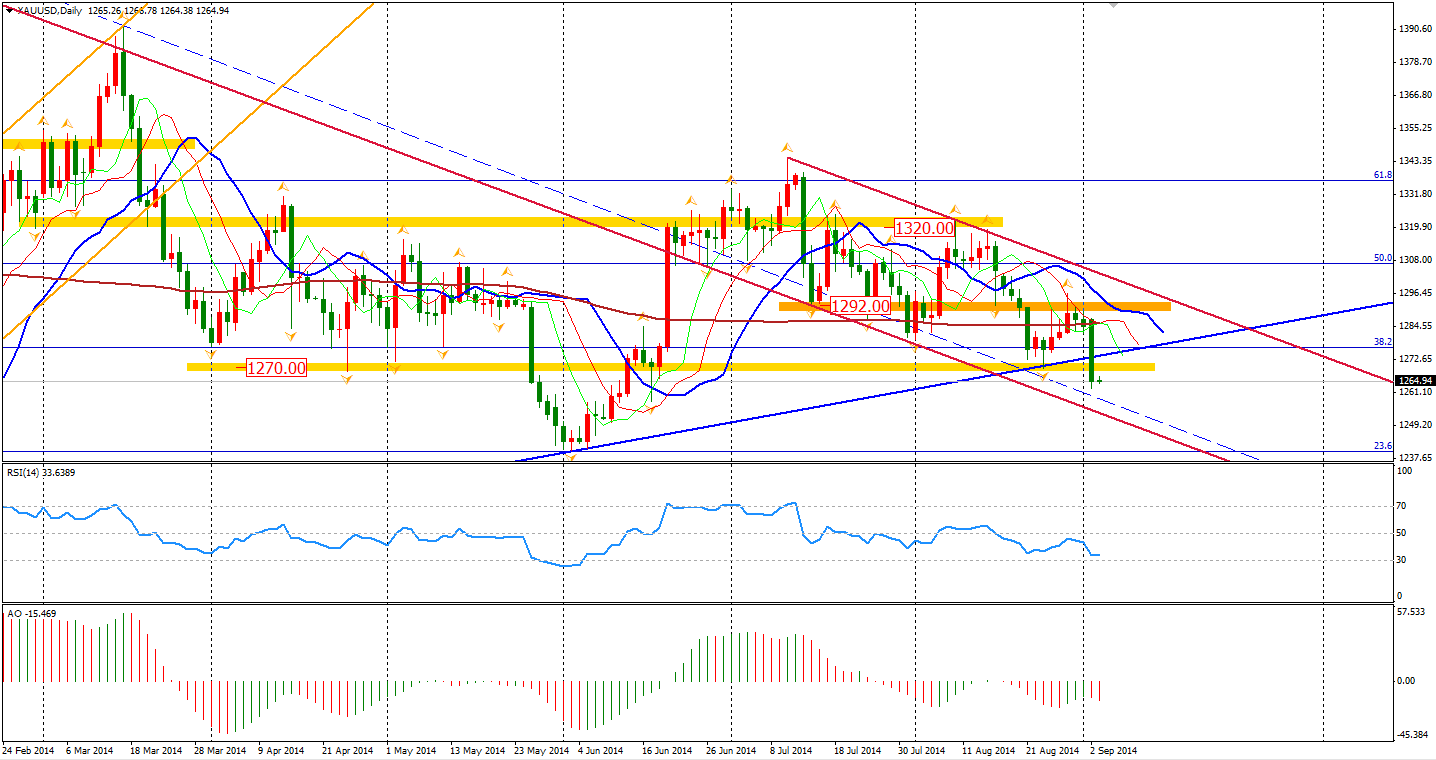

We have witnessed most major currencies depreciating against the Dollar, and now, Gold has joined the party. Gold yesterday plunged by over $23 per ounce to $1265, breaking several key supporting levels, including level $1270 and the uptrend line from the low of last December. The large triangle pattern that Gold has been forming since this year began has now finished and a new bearish trend is under way.

Yesterday’s fall is reminding me of what happened to the Gold price back in April 2013 when it lost over $270 just in one week. Maybe I was too sensitive and that history will never repeat. The break in this triangle continuation pattern still implies Gold may fell below $1180, the double bottom of 2013.

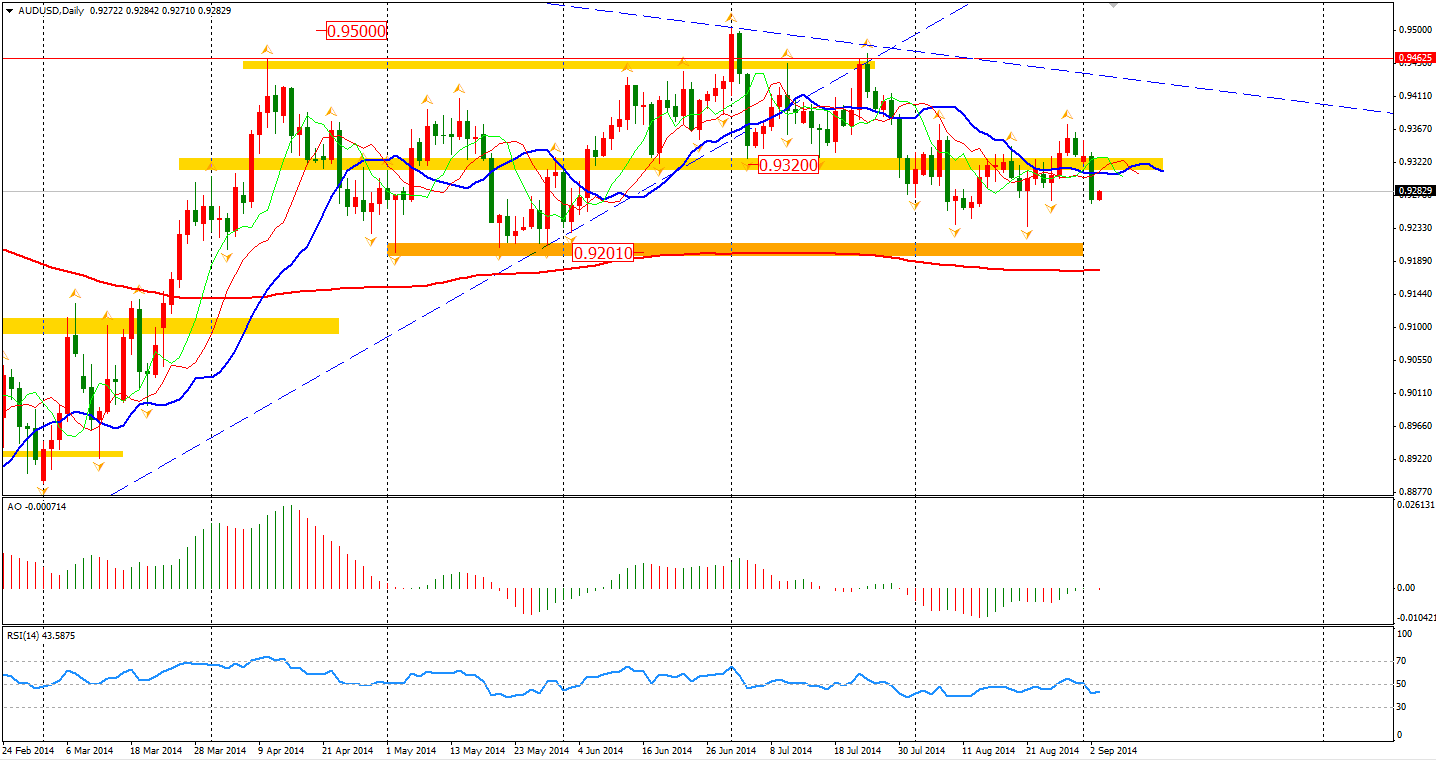

Aussie/Dollar, probably the last one of major currency pairs that defied gravity, fell back below 0.9320 again on Tuesday. Will this time be the one to break the 5-month-length sideway?

The RBA has decided to extend its longest pause in rate adjustments in eight years and its statement did not change much for September, stating that the “exchange rate remains above most estimates of its fundamental value”. Impacted by the background where the Chinese economy is slowing down, Australia’s expansion will be ‘a little below trend’.

The Q2 GDP today and Retail sales tomorrow may decide whether the Aussie will keep falling. The weak job market and contracting company profits have dampened the economic outlook – a clear negative sign of the future price movement.

Asian stocks markets performed quite strongly yesterday. The Shanghai Composite surged up 1.37% to 2266, 15-month high. The Nikkei Stock Average gained 1.24% on the weaker Yen. The Australian ASX 200 was up 0.51% to 5658. In European stock markets, the UK FTSE was up 0.06%, the German DAX gained 0.3% and the French CAC Index lost 0.03%. U.S. stocks closed with little changes after the long weekend. The S&P 500 closed flat at 2002. The Dows lost 0.18% to 17068, while the Nasdaq Composite Index was up 0.39% to 4598.

On the data front, Australia Q2 GDP will be released at 11:30 AEST. The RBA Gov Stevens speech will begin from 13:20 AEST. Several Service PMI will be released during the European session, including the UK one at 18:30 AEST. Canada Central Bank’s decision will be at midnight.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.