The market was significantly impacted by the news of the Malaysia Airline plane that was shot down in East Ukraine last Thursday. The White House tied Pro-Russia separatists with this accident on Friday with Russia responding that the Ukraine government should take the full responsibility. Although, the West and Russia are still arguing who should be blamed for this tragedy, the market has digested the news and the surging price of safe-haven assets like Gold retreated on Friday.

In other news, conflicts continued in Gaza with more civilians being killed, as the Israeli army expanded its ground operation. This event may not largely affect the market now but things will change if the tension in Middle East escalates.

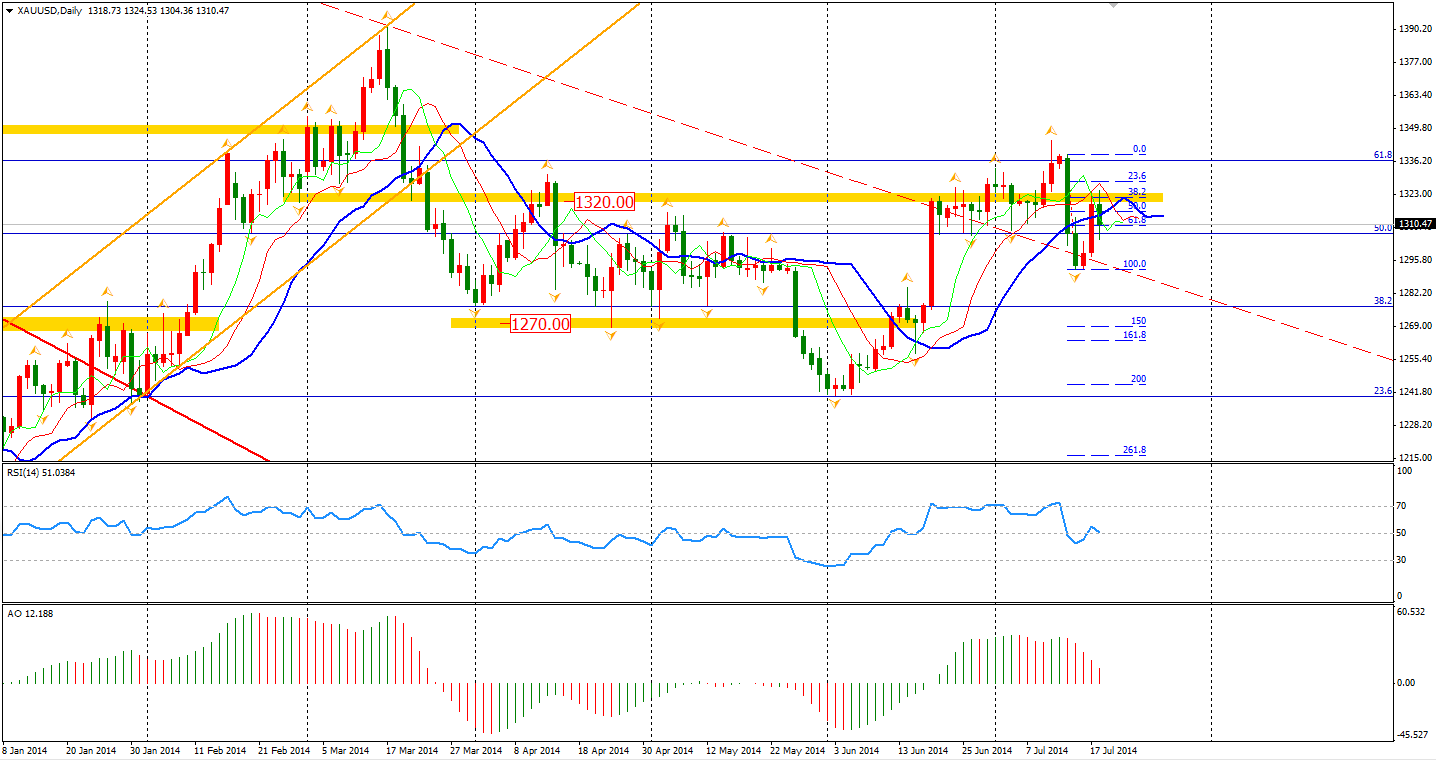

Gold prices fell from the $1320 resistance level on Friday. This level is also the 38.2% retracement level of the slump in the first two trading days of last week. Gold prices are still under pressure in mid-term, as the Fed will probably quit their QE program this October with more affirming signs of a U.S. economic recovery. Those items will most likely strengthen the Dollar over the next few months.

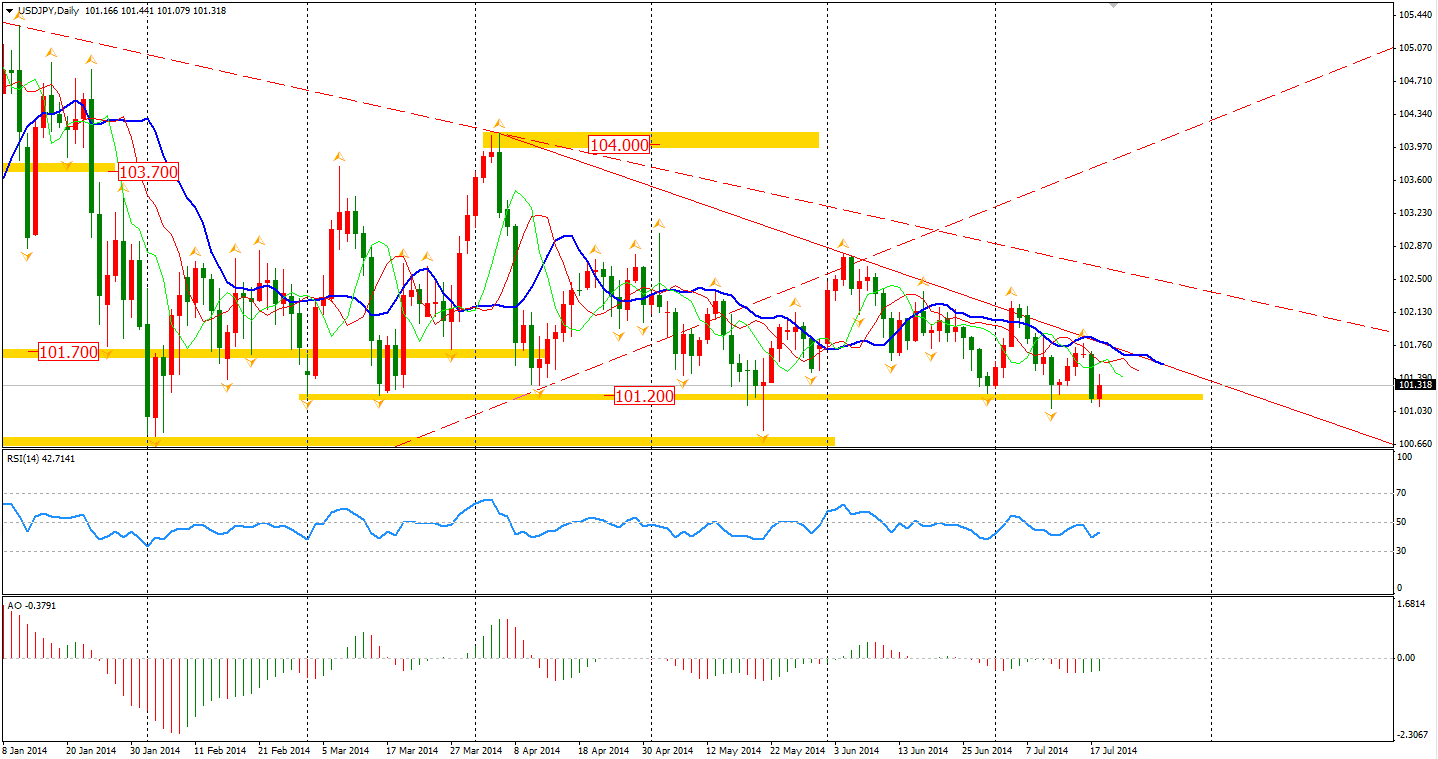

Similarly, Dollar Yen rebounded again from support levels near 101.20. The triangle consolidation is near the breakout.

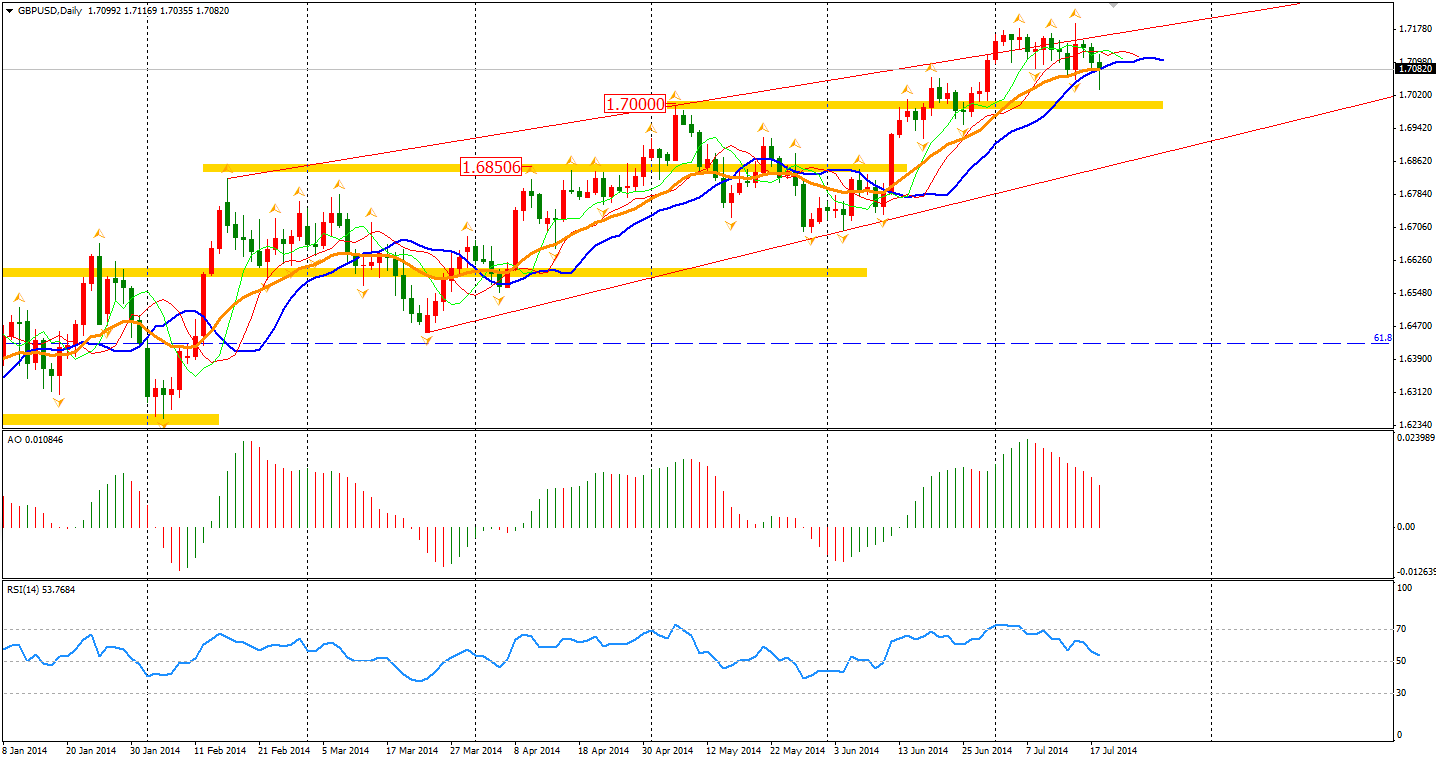

The Sterling fell to 1.7035 against the Dollar during the European trading session, but rebounded shortly from this level finally closing at 1.7082 – just above the 20-day MA.

Most Asian markets performed weakly on Friday. The Nikkei Stock Average suffered from a stronger Yen, losing 1.01%. The Shanghai Composite closed 0.17% higher to 2059. The Australian ASX 200 rose 0.17% at 5532. In European stock markets, the FTSE closed 0.17% higher, the DAX lost 0.35%, and the CAC was up 0.44%. U.S. stocks closed higher on Friday as the fear of geopolitics woes faded and the Dow Jones Industrial Average and S&P 500 closed on a record high. The Dows gained 0.73% to 17100. The S&P 500 edged 1.03% higher to 1978, while the Nasdaq Composite Index surged 1.57% to 4432.

No big data releases for today, but this week, we will see the BOE’s interest rate decision on Wednesday and New Zealand’s one on Thursday. Also UK’s Q2 GDP will the impact sterling and PMI data from China, Eurozone and U.S. shoud be watched closely.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.