EUR/USD is showing little movement on Wednesday, as the pair trades slightly above the 1.36 line. Int the US the highlight is the release of the FOMC minutes. In the Eurozone the sole event is a speech by ECB head Mario Draghi at an event in London.

The Federal Reserve returns to the spotlight on Wednesday, as the FOMC releases the minutes of its June policy meeting. The markets would love some clarity as to when the Fed is looking to raise interest rates. Any hints in this regard could send the currency markets scrambling. Based on updated Fed forecasts for inflation and unemployment, it's safe to say that the Fed is cautiously optimistic about the pace of the US recovery.

The week started with some positive news out of Germany, after a rash of weak data from the Eurozone's largest economy. Trade Balance improved last month, posting a surplus of EUR 18 billion, the highest reading since last October. This easily surpassed the estimate of EUR 15.7 billion. German retail sales, employment and manufacturing data softened in May, raising concerns that a weakening German economy could dash hopes of growth in the Eurozone and hurt the euro.

EUR/USD for Wednesday, July 9, 2014

EUR/USD July 9 at 10:40 GMT

EUR/USD 1.3614 H: 1.3631 L: 1.3609

EUR/USD Technical

- EUR/USD has show little activity in the Asian and European sessions.

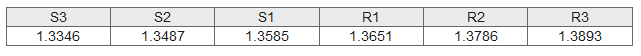

- On the downside, the pair is testing support at 1.3585. Will this line fall? 1.3487 is stronger.

- 1.3651 is the next line of resistance. 1.3786 is next.

- Current range: 1.3585 to 1.3651

Further levels in both directions:

- Below: 1.3585, 1.3487, 1.3346 and 1.3295

- Above: 1.3651, 1.3786, 1.3893 and 1.40

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.