Outlook:

We get the start of Q2 earnings today with Pepsi, and JPMorgan, Citi and Wells Fargo tomorrow. Goldman reports on Wednesday and BofA and Morgan Stanley on Thursday. Everyone will be watching for loan losses and loan loss provisions for the third quarter. If outcomes are worse than expected, a backlash could ensue, but CEO’s are expected to talk fast and overcome data.

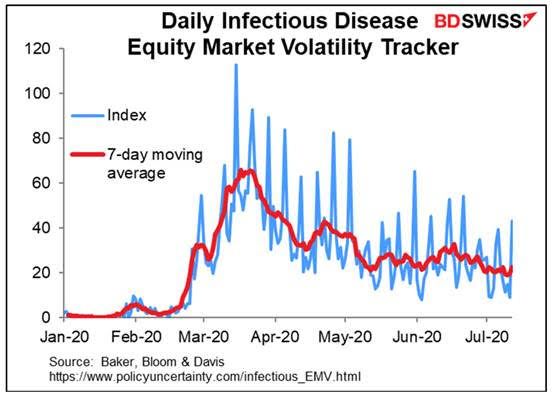

Gittler at BDSwiss found a clever correlation of disease reports with stock market performance. It seems to show a trend (and we like trendedness) of falling influence of pandemic news on equity markets. See the BDSwiss chart. Note that the study is measuring volatility, not price change. We are not sure we can put much faith in the falling line, if only because other measures would be directly relevant, like “bankruptcies above the norm,” but it’s still fun. A different point is that economists are not all pie-in-the-sky and can actually be useful sometimes.

We also get some focus on China this week, starting with trade tonight and moving on to the usual flood of data on Thursday: retail sales, industrial production and GDP. So far the consensus is that China is recovering nicely. See Tidbit 2 below.

Of all the data about to overwhelm us, we wonder if one small item might not prove to be critical—retail sales in Europe. There isn’t any such thing at “EMU retail sales” and we have to go country-by-country, but the FT put together some data that is quite encouraging. And no less an authority that Capital Economics says it sees “further evidence that the early stages of the eurozone’s economic recovery looked remarkably V-shaped… Restrictions have been lifted faster and spending has recovered more quickly than we anticipated.” All this goes down the drain if a second wave emerges. The FT notes “Retail sales volumes expanded by 18 per cent month on month in May as outlets reopened and consumers proved willing to put to work some of the savings they had accumulated during lockdown. The rebound in sales was larger than expected and brought spending back to near last year’s levels.”

Here's the thing—why is the FT presenting, on the front page, a story about data that is already a month old? The FT notes the usual stuff—industrial production is good but not all that good, exports (except Germany’s) are not that good, and the two-speed Europe is still very much in evidence. Not to go crazy over-interpreting, but there is some small sense that a better recovery in Europe than in the US justifies a firmer euro. Maybe stretching too far, but better pandemic management is leading to better economic performance and that’s something the FX market recognizes, lousy yield differential notwithstanding. A key factor in that better performance is a wider and stronger safety net for workers, something the US does not have. It’s a core, structural difference.

Looking ahead, we get a bunch of speeches by Feds, but Congress is away until next week, so no new recovery initiatives can be expected. Institutional news, if there is going to be any, will come from the central banks in Canada and Japan on Wednesday and the ECB on Thursday. Nobody expects much but you never know. The drip-drip-drip of anti-Trump and anti-US and anti-dollar stories continues. Be careful what you read—if all you read is the NYT and Bloomberg, you get a bias by osmosis. If earnings are not as bad as imagined (down less than 40-60%) and the stock market thrives this week, the dollar can dip without any reference to Trump, the economy or the pandemic.

Tidbit: The states now getting the worst-hit by Covid-19 are polling increasingly less in favor of Trump in the November election. That’s Arizona, Texas and Florida. Is it a true cause-and-effect correlation or a coincidence? In Texas, a new poll has Biden 46% to Trump 41%. Other polls show Biden at 48%-42% in Florida. As we all learned in 2016, beware extrapolation.

Tidbit 2: Bloomberg is continuing to beat the drum about the Chinese yuan but the tune has changed over the past few months from “threat to US dollar” to a more sensible and realistic “watch point.” Various officials are making the effort to get the yuan more widely accepted as a global currency, but the yuan is still only about 2% of total reserves. Plus, Chinese companies (and their banks) need the dollar. To get where it wants to go, China recognizes it would have to get rid of capital controls, something it’s not yet willing to do. But at the same time, Bloomberg reports “’Yuan globalization is largely hinged on convertibility under capital account -- which China is not yet ready for,’ said Yu Yongding, a former adviser to the People’s Bank of China. ‘China is facing a severe challenge of a series of potential U.S. financial sanctions and we can’t even rule out the possibility that they may freeze China financial assets one day. I believe regulators have a contingency plan.’”

Freezing China’s dollar assets sounds exactly like something Trump would do, and so does defaulting on the US debt held by China (but only China). But he has to get re-elected first.

Meanwhile, foreign investors are rushing to buy Chinese bonds as a new yield haven, according to the WSJ, flowing into China in Q2 at the fastest pace since late 2018 at ¥4.3 trillion. The yield has gyrated but at 3.118%, is better than any other big government and most companies, too. It may be worth noting that all of the analysts quoted in the WSJ favoring Chinese bonds are European.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.