Global developments

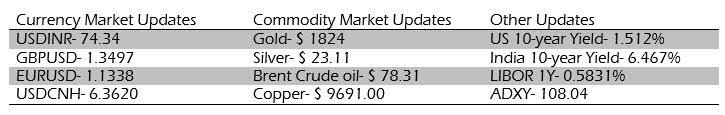

2022 seems to be kicking off with global risk sentiment holding up despite a flare-up in COVID cases across the globe. Though US nominal yields have risen at the shorter end, real rates continue to remain deeply in negative territory. This is weighing on the dollar which has weakened across the board except against JPY which is more sensitive to US nominal yields. JPY was the worst-performing G10 currency in 2021. Euro is trading close to the upper end of its recent 1.1260-1.1360 trading range. Sterling has retraced to 1.35 from around 1.1340 levels in the Asia session. Commodity currencies, the Canadian Dollar in particular are exhibiting strength. CAD was the only G10 currency that appreciated against the Dollar in 2021.

Domestic developments

Core sector output grew 3.1% in November, a sign that domestic growth is under pressure. However, GST collections for December came in at 129000crs, just a tad below collections in November. Given the robust direct and indirect tax collections, the April-November fiscal deficit was just 46% of that budgeted for the entire fiscal. FX Reserves held steady at USD 635bn as of the week ended 24th December.

Equities

The Nifty gained 0.9% on Friday to close at 17354. US equities ended modestly in the red on Friday. Asian equities too are trading mixed.

Bonds and Rates

The auction of the benchmark and the Floating Rate bond was canceled on Friday. The yield on the benchmark dropped 4bps from day highs to end at 6.45%. The 14d VRRR saw a poor uptake as banking system liquidity is still low on account of higher government cash balances with the RBI.

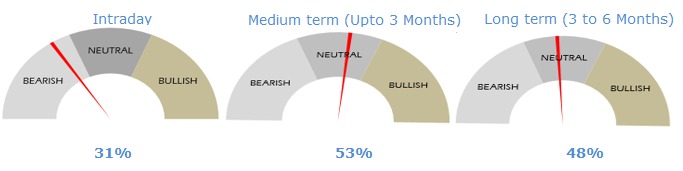

USD/INR

The Rupee had strengthened to 74.10 against the dollar on month-end exporter selling and cash Dollar selling by foreign banks on Friday. USD/INR however saw aggressive short-covering towards the end of the session as a result of which the pair closed at 74.34. 73.90-74.10 zone is a strong technical support.

Strategy: Exporters are advised to cover on upticks towards 75.50 levels. Importers are advised to cover on dips towards 74.30 level. The 3M range for USDINR is 73.80 – 76.00 and the 6M range is 73.50 – 76.50.

This report has been prepared by IFA Global. IFA Global shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. IFA Global nor any of directors, employees, agents or representatives shall be held liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. No liability whatsoever is accepted for any loss arising (whether direct or consequential) from any use of the information contained in this report. This statement, prepared specifically at the addressee(s) request is for information contained in this statement. All market prices, service taxes and other levies are subject to change without notice. Also the value, income, appreciation, returns, yield of any of the securities or any other financial instruments mentioned in this statement are based on current market conditions and as per the last details available with us and subject to change. The levels and bases of, and reliefs from, taxation can change. The securities / units / other instruments mentioned in this report may or may not be live at the time of statement generation. Please note, however, that some data has been derived from sources that we believe to be reliable but is not guaranteed. Please review this information for accuracy as IFA Global cannot be responsible for omitted or misstated data. IFA Global is not liable for any delay in the receipt of this statement. This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject IFA Global to any registration or licensing requirements within such jurisdiction. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. IFA Global reserves the right to make modifications and alterations to this statement as may be required from time to time. However, IFA Global is under no obligation to update or keep the information current. Nevertheless, IFA Global is committed to providing independent and transparent information to its client and would be happy to provide any information in response to specific client queries. Neither IFA Global nor any of its directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The information provided in these report remains, unless otherwise stated, the copyright of IFA Global. All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and copyright IFA Global and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.