1. JULY MARKETS

2. UP STARS/DOWN STARS

3. GOLDEN OPPORTUNITIES

4. QUOTES

5. ON THE WEB

6. LETTERS

1.WHITHER STOCK MARKETS? Backtracking Fed Puts an End to Market Celebration

We continue our fundamental downward bias for the July earnings season, despite widely expected FED accommodation.

Our initial Trading Target is the April 30 Market Close:

DJIA 26,592 SPX 2945

Seasonal weakness in world equity indices appeared on schedule last week. Most equity markets are intermediate overbought and have started to roll over. At this time of year, equity markets have a history of entering into a period of increased volatility with a downward bias into mid-October. Events trigger seasonal weakness this year include lower year-over-year second quarter earnings reports by major corporations (including two consecutive year-over-year quarterly earnings declines), increasing political uncertainty… growing Middle East tensions and unsettled trade negotiations.

Mark Leibovit, Editor, VRTRADER PLATINUM LETTER

OUR VIEWS

- Unless/until there is REAL US/China Trade deal progress, the current Market rally has gone TOO FAR, TOO FAST.

- We repeat our major July Trade Long Copper (Astrology + Fundamental + Technical)

- Swing Trade is Short Markets. We are playing for SP 2950/2900 before 3050.

Proper Valuations:

US$ 96-98

OIL 53-60

SILVER 16-16.50

IMHO “Improper” Valuations

SP > 2910

DJIA > 26827

NASDAQ > 8000

US 10 Year Bond <2.18

TIPS > 114

COPPER < 3.20

BITCOIN > 4000

GOLD > 1425

FIRST EPISODE OF YOU BETCHA YOUR LIFE (SAVINGS):

Sell SP 2954, Sell 2945 KACHING: Both Covered 2840!

SECOND EPISODE OF YOU BETCHA YOUR LIFE (SAVINGS):

Sell SP 2888, Sell 2880 KACHING: 2812 & 2750 Buy Gold 1286, 1280 KACHING 1400, 1410

THIRD EPISODE OF YOU BETCHA YOUR LIFE (SAVINGS)

Sell SP 2954, Sell 2964, & 3000; Buy Copper 270, 266 & 1 TBA > 275

H2 2019 POSITIONAL TRADING:

Copper 274, 266 & [292 Copper open from H1 2019]

HYDE PARK SOAPBOX:

Crypto is an unregulated casino, where criminality runs riot

KEY DATES: July 30/31

DJIA: 27000 SUPPORT? R1 27500 or 28000 RESISTANCE?

SPX: 3000 PIVOT S1 2980 S2 2958 S3 2900 RESISTANCE

NASDAQ: 8200 PIVOT 8000 SUPPORT? 8350 Resistance

GOLD: 1425 PIVOT S1 1400 S2 1390 R1 1425 R2 1444 R3 1458

SILVER: 16 PIVOT 15.50 SUPPORT 16.40 RESISTANCE

OIL: 55 PIVOT 52 SUPPORT 62 RESISTANCE

COPPER: STEADY ACCUMULATE : 2020 à 3.50+

US 10 year WATCH

BITCOIN: S1 10000 S2 9200 S3 8000 14000 RESISTANCE

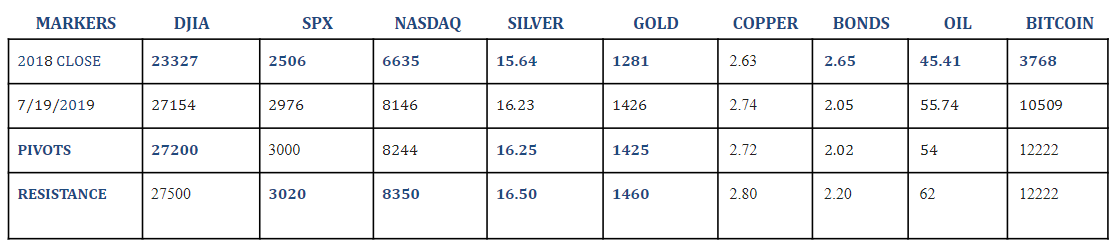

2018 CLOSE: DJIA 23327 SPX 2506 & NASDAQ 6635

2017 CLOSE: DJIA 24719 SPX 2673 & NASDAQ 6903

2016 CLOSE: DJIA 19762 SPX 2238 & NASDAQ 5383

AFUND Fair Value: GOLD $1390

THINK TRADITIONAL SWISS AND PRESERVE CAPITAL: HEDGE AND PROTECT AGAINST DOWNSIDE RISK.

2. Business & Banquets:

We obviously think companies that presented at our July 17 XXVII Triple Gold Conference are worth researching.

Those that are small and microcap, can easily provide outsized returns, however, they are best bought in a basket of higher risk/high reward portfolio allocation.

We continue to hold Maximum Allocation precious and base metal investments for the intermediate and long term.

Stock selection remains important. Elsewhere we recommend buying stocks sporting strong cash flows, sound balance sheets and growing dividends.

Actively managed portfolios will continue to deservedly outperform index funds in current bifurcated markets.

3. "Demand is quite weak, especially with prices over $1,400 an ounce."

Dick Poon, general manager, Heraeus Precious Metals.

"When prices dipped below $1,400, we saw some clients coming in. But increasingly, more customers have been switching to (cheaper) silver."

Brian Lan, managing director, GoldSilver Central

Gold bugs are finally happy as generalist investors are beginning to join the party: Forecasts for $1500 & $1600 gold become more frequent (even if wrong).

However, we believe, gold valuations will largely sport above Fair Value into the Year of the Earth Rat (2020).

Just as it was undervalued for a long time, it CAN and is likely to be overvalued for a LONG time. While fundamentally gold is currently overvalued, in August and in much of the Fall, the astro is positive for gold.

Silver 15 Support 15.50 Resistance weakening

We advise precious metal investors to pay attention to stock selection and only selectively add SUMMER 2019.

- Gold remains cheap geopolitical crisis insurance.

- For investors who cannot or will not buy the $US currency as well as investors who wish to safely and cheaply hedge their US$ exposure, ONLY GOLD IS AS GOOD AS GOLD!

Gold FV $1390 = Commodity FV: 1359 + Currency FV: 1376 + Inflation Metal FV: 1367 + Crisis FV: 1458.

Gold/Silver ratio à 88- Silver FV $16.50+.

INVESTORS: We plan to stay LONG in H2 2019 (recommending a precious metal sector buy/hold rating and only occasional hedging, selling or profit taking).

However as traders we will again likely periodically short gold $1428-1458. For silver our first selling numbers was $20+, but currently is being recalculated lower.

4. Clearly the biggest risk to the most recent rally is the earnings season."

Ryan Felsman, senior economist, CommSec

HW: Duh!

“We think earnings are going to be generally positive this season. We’ve been on a tear this year, but we still have some room to go.”

Lamar Villere, portfolio manager, The Villere Balanced Fund

HW: Yes but not sufficient to FUNDEMENTALLY justify many current valuations.

“We’re not looking for the bottom to fallout like last year, but I do expect a 10% correction in the next three months.”

Mike Wilson, chief investment officer, Morgan Stanley

HW: Certainly if markets drop to 2750-2700, there will be plenty of eager buyers.

5. What A Time To Be Alive And Trading

An Unprecedented Market Divergence: Robots Are All In As Humans Flee

Investors Risk Getting Tangled Up In Fed-Markets Feedback Loop

The Astrologers Fund (AFUND) is not a registered broker dealer, CTA or a registered investment advisor. Past performance does not ensure future results, and there is no assurance that any of the Astrologers Fund's recommendations achieve their investment objectives. The Astrologers Fund Inc. makes no claims concerning the validity of the information provided herein, and will not be held liable for any use thereof. If you are dissatisfied with the information found on this website, your sole and exclusive remedy is to discontinue use of the information. No information or opinion expressed here is a solicitation to buy or sell securities, bonds, futures or options. Opinions expressed are not recommendations for any particular investor to purchase or sell any particular security or financial instrument, or that any security or financial instrument is suitable for any particular investor. Each investor should determine whether a particular security or financial instrument is suitable based on the investor's individual investment objectives, other security holdings, financial situation and needs, and tax status. Past performance is not indicative of future results. Contact The Astrologers Fund, Inc. 310 Lexington Avenue Suite #3G, New York, N.Y. 10016 Email [email protected] 212 949 7275 Twitter@tafund

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.