Outlook:

The Big Story yesterday went unreported—the TICS report showed China raised its holdings of US Treasuries by $4.2 billion and Japan, by $2.2 billion. So much for diversifying out of dollars because of the deficit or Trump or any other reason. Nobody even bothers anymore to take the old-timey Excel files published by the Treasury and make a pretty chart.

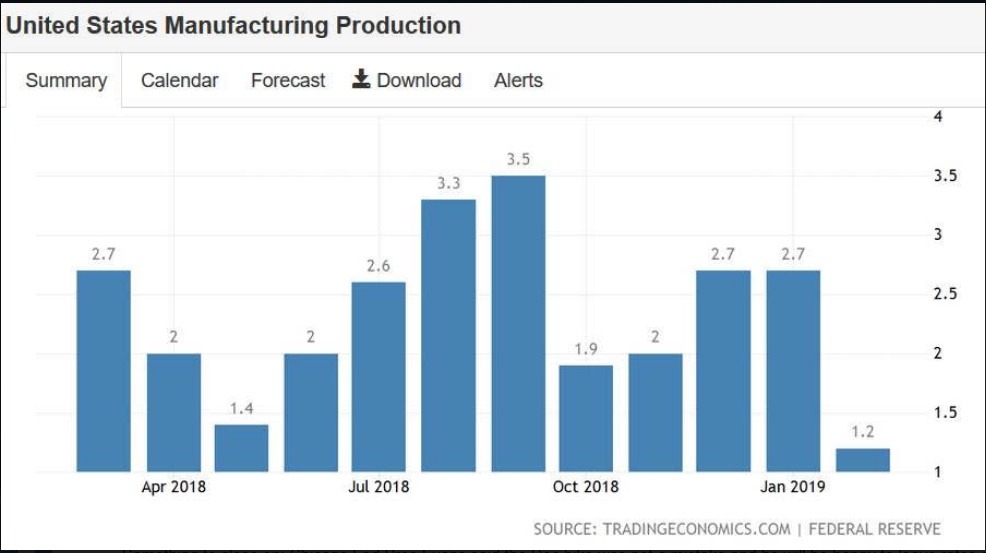

Today we get March industrial production, including manufacturing, which was lousy in Feb. Tomorrow is Feb trade numbers and the Beige Book, with retail sales on Thursday when everyone will be eyeing the door.

Something to close on: Chicago Fed Pres Evans said the Dec hike was not a mistake and he will be happy to leave rates alone until fall of 2020 (which is when we hold the next presidential election). We say this looks a lot like an offer to Trump—shut up about the Fed being wrong and bad and we will give you something you want—no more hikes. To help that outlook along, the Fed is newly investigating whether it somehow got the employment mandate wrong. The scope of the new study is not clear. It may end up changing the percentages or something. We have long argued the data is bad in several ways. From an economist’s perspective, a fresh look into the Phillips curve is a good thing and (obviously) overdue. From a voter’s perspective, it’s as though the Fed is climbing into bed with the Orange Menace to save tis skin.

Bottom line, we got nothing. We have no fresh news or perspectives today, however hard the analysts strive to make hay out of straw and old straw, at that. Trust the charts but draw plenty of them to avoid pre-judging and suffering from the consequences of confirmation bias.

Note to Readers: We will not publish any reports on Thursday or Friday. Publication resumes the following Monday, April 22.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.