The decline in Norwegian interest rates this week appears to be a delayed effect of lower international rates, i.e. not related to any domestic news. The volatility and steepness of the fall illustrate the limited risk capacity of market makers at present and the general illiquidity of NOK-related markets. We believe the recent market reaction is exaggerated, as only a major international downturn might make Norges Bank refrain from the strategy of a gradual normalisation of interest rates.

The short-end of the curve now discounts only one hike in 2019 and a flat curve thereafter. Long-end swap and NGB yield spreads have tightened somewhat relative to peers. ASW spreads have widened (see charts overleaf).

The decrease was not triggered by domestic news. As we discussed in Reading the Markets Norway – Norwegian recovery vs stronger international headwinds, 27 May, we moved our steepening strategy to the short-end of the FRA curve due to the imminent risk of spillovers from the US curve. The steepness of the fall appears to be linked largely to the illiquidity of the Norwegian markets. The decrease seems to have been triggered by a few major international accounts adjusting their exposure in short-end swaps and FRAs. Somewhat lower oil prices may have motivated the adjustments.

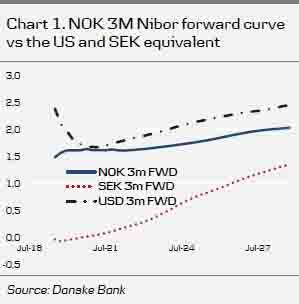

The US forward curve currently appears to be creating a ceiling to the upside for the Norwegian forward curve (see Chart 1). A further inversion of the short-end US curve could put more downward pressure on green NOK FRAs. At present, the FRA curve is perfectly flat. NOK FRA 3M DEC19 is 1.65%, DEC20 is 1.645% and DEC21 is 1.64%. We believe this is excessively flat. Given the risk of further spillover from the US market, we reiterate the recommendation of focusing any steepening strategy to the short end of the curve. Despite a poor performance of these strategies this week, we still recommend buying NOK FRA 3M DEC20 and selling NOK FRA DEC19. We also still think buying NOK FRA 3M DEC19 outright appears attractive, as we expect Norges Bank to hike the sight deposit rate to 1.25% at the board meeting on 20 June. We believe Norges Bank will stay with the basic strategy of a gradual normalisation of the target rate but that the fall in international interest rates and the changes in the risk environment will affect Norges Bank's 20 June interest rate projections compared with the 8 March Monetary Policy Report 1/19.

Purely based on our call of a 20 June hike, we recommend buying NOK FRA 3M SEP19. The current level is 1.535%. We suggest a target of 1.65 and stop-loss of 1.40%.

The decline and volatility in long end rates has been marked. However, the spread is still somewhat high versus international peers. NOK SWAP 5Y/5Y is still above the range of 2018 and Q1 19. Given the current geopolitical risks, we may see renewed interest in Norwegian government bonds, as yields are still high relative to peers. Norway has not enjoyed a safe haven status in recent years, probably due partly to low oil prices and dovish Scandinavian central banks. However, high relative yield levels, high oil investment and somewhat high inflation (suggesting a potential for a stronger NOK) could trigger a Norwegian relative bond rally in the case of an international downturn.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.