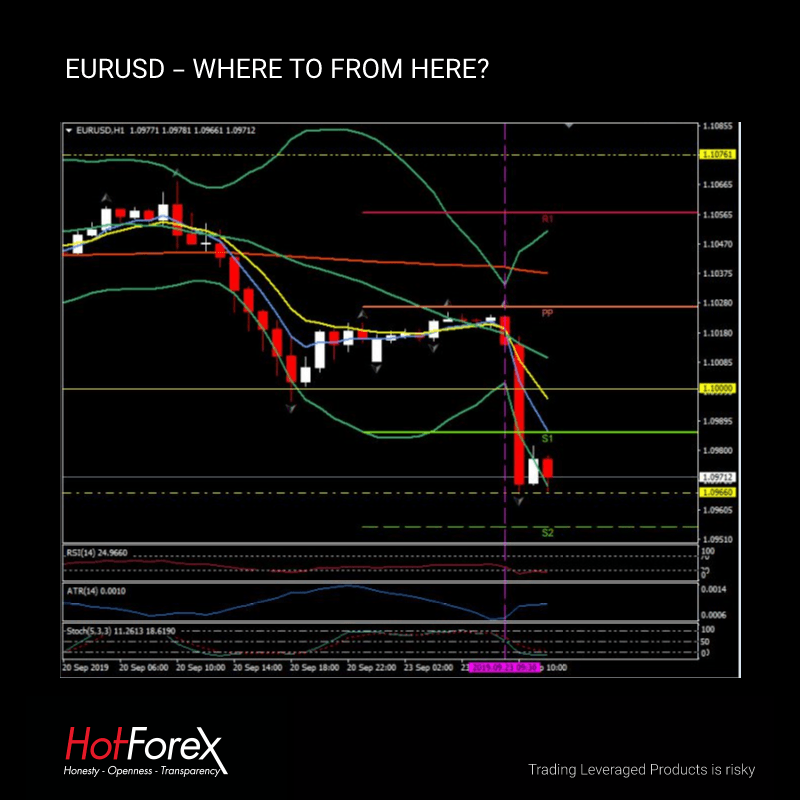

EURUSD, H1

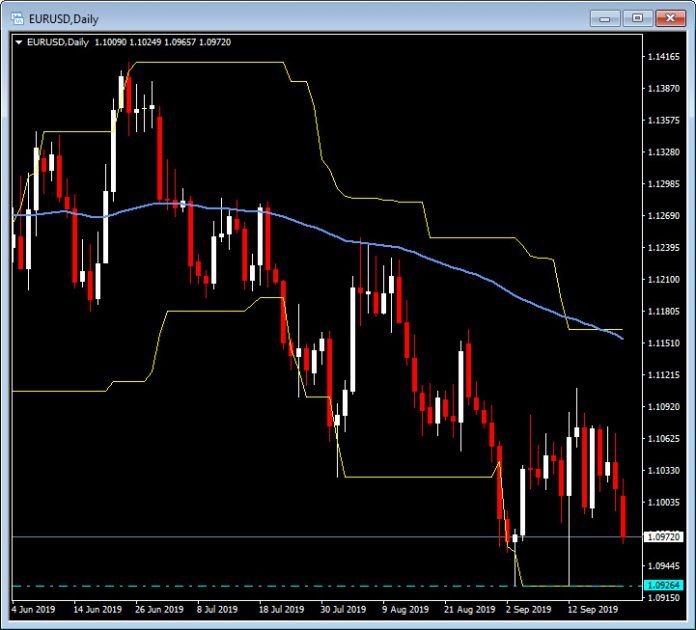

The Euro has dropped along with Bund yields following disappointing preliminary PMI data out of the Eurozone. EURUSD, EURJPY and EURCHF have all hit 11-day lows. Eurozone PMI readings for September failed to show the expected improvement and instead showed a marked contraction in manufacturing activity and a sharp slowdown in services sector growth that left the composite at just 50.4, barely above the 50 point no change mark. In the bigger picture, EURUSD is amid a long-term moderate downtrend, the latest leg of which has been in play since the late June highs above 1.1400. The favourable yield carry of the Dollar — 1.76% (approx.) for the 10-year US T-note vs nearly -0.5% for the benchmark Bund and -0.15% for the 10-year JGB — along with the fact that the Treasury market stands as the most liquid risk-free asset market in the world, and relative strength of the US economy, suggests that the US currency is likely to remain underpinned.

EURUSD’s low today is 1.0966, and the pair’s recent major-trend low is at 1.0926, which has been tested twice in September. Today, S1 sits at 1.0985, below the psychological 1.1000 and daily pivot point at 1.1026. S2 is at 1.0955 with both RSI and the Stochastic currently oversold following the aggressive move down today. Some consolidation at 1.0970 could be likely ahead of the US PMIs and Draghi speech later today.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.