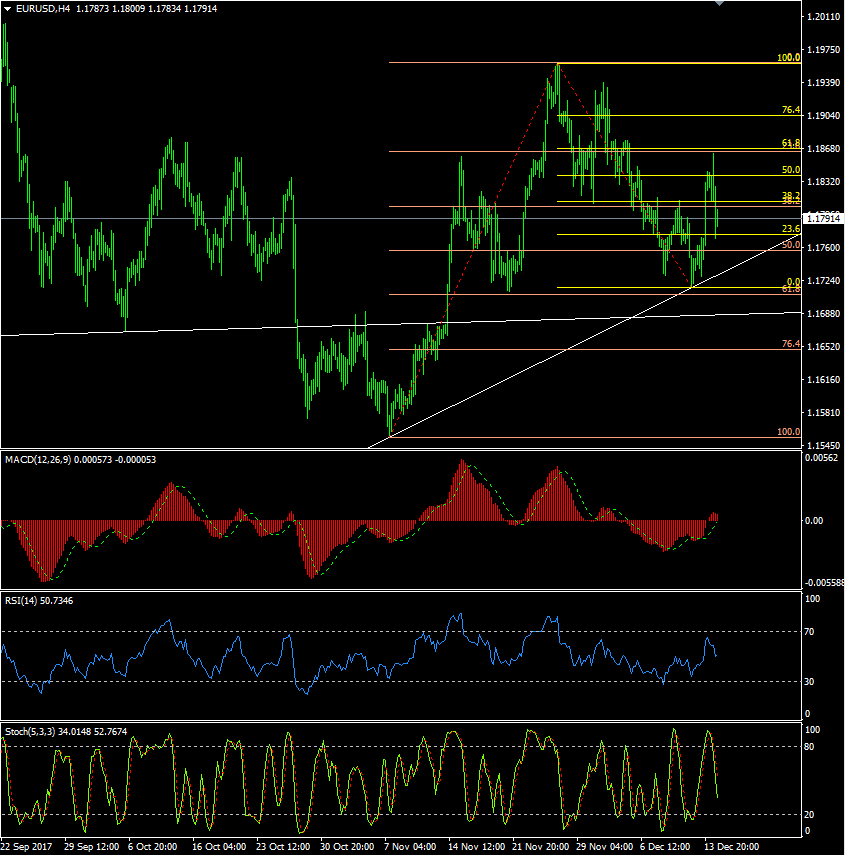

EURUSD: 1.1792

€/Usd has traded a choppy range of 1.1860/1.1770 on Thursday, after the ECB left rates on hold, with Draghi’s upbeat Press Conference sending the Euro briefly to its highs before the dollar strengthened after the strong RS/jobs data, closing at familiar territory, just under 1.1800.

1 hour/4 hour indicators: Turning higher

Daily Indicators: Turning lower

Weekly Indicators: Neutral

Preferred Strategy: With little data due today, and with the momentum indicators offering little help in either direction, a rangebound session seems most likely. Use 1.1740/1.1830 as a guide. Further out, the weeklies still suggest we could see a stronger dollar at some stage, but don’t get too excited yet.

| Resistance | Support | ||

| 1.1939 | 1 Dec high | 1.1770 | 100 DMA/Session low |

| 1.1903 | (76.4% of 1.1960/1.1717) | 1.1760 | 55 DMA |

| 1.1865 | (61.8% of 1.1960/1.1717)/Session high | 1.1729 | 13 Dec low / Rising trend support |

| 1.1845 | Minor | 1.1716 | 12 Dec low |

| 1.1825 | Minor | 1.1707 | (61.8% of 1.1553/1.1943) |

Economic data highlights will include:

German Wage Price Index, EU Trade Balance, US New York State Empire Mfg Index, Capacity Utilisation, Industrial Production.

Interested in EURUSD technicals? Check out the key levels

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.