EURUSD: 1.1807

EurUsd set a new trend low on concerns that the 5 Star/League Parties are about to form an Italian Government with a proposal that the ECB write off the Italian government debt, sending shudders through the markets, but having fallen to 1.1762 it then bounced and has since consolidated near 1.1800. We may chop around here for now but Italian politics, ECB & Fed speakers will be the risks today.

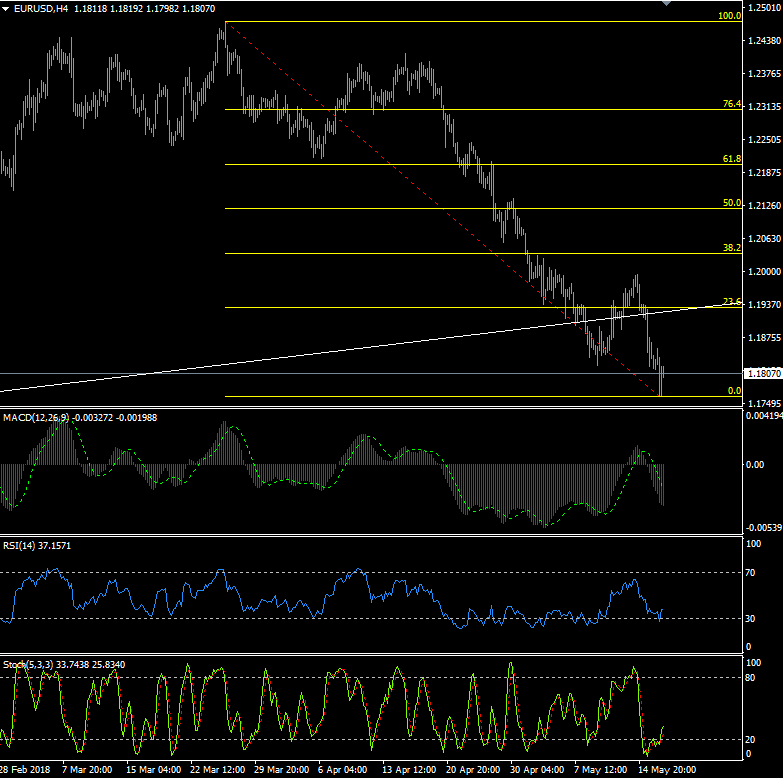

1 hour/4 hour indicators: Mixed- Bullish Divergence

Daily Indicators: Down -Becoming Oversold

Weekly Indicators: Turning lower.

Preferred Strategy: The bounce off the trend low at 1.1762 now sees the hourlies pointing higher, and with the 4 hour charts showing some bearish divergence, this may be a hint that a correction higher is due within the overall downtrend.

If so, on the topside, resistance will be seen at minor levels up to the 1.1853 session high and then again up to 1.1900. If 1.1900 can be overcome, then look for a possible return to the Fibo level at 1.1930 although this looks doubtful today.

On the downside, below 1.1760 there is little support to be seen ahead of 1.1700/10 although I don’t think we are going there today, and buying dips may be a play right now, looking for a squeeze back to 1.1900.

Short term: Buy EurUsd @ 1.1750. SL @ 1.1695, TP @ 1.1850

Medium Term: Sell EurUsd @ 1.1925. SL @ 1.2005, TP @ 1.1785

| Resistance | Support | ||

| 1.1930 | (23.6% of 1.2475/1.1762) | 1.1787 | (76.4% of 1.1553/1.2555) |

| 1.1900 | Minor | 1.1762 | Session low |

| 1.1875 | Minor | 1.1750 | Minor |

| 1.1853 | Session high | 1.1737 | 18 Dec low |

| 1.1820 | Minor | 1.1716 | 12 Dec low |

Economic data highlights will include:

EU Trade Balance – Mar, Construction Output – Mar, Philadelphia Fed Mfg Survey – May

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.