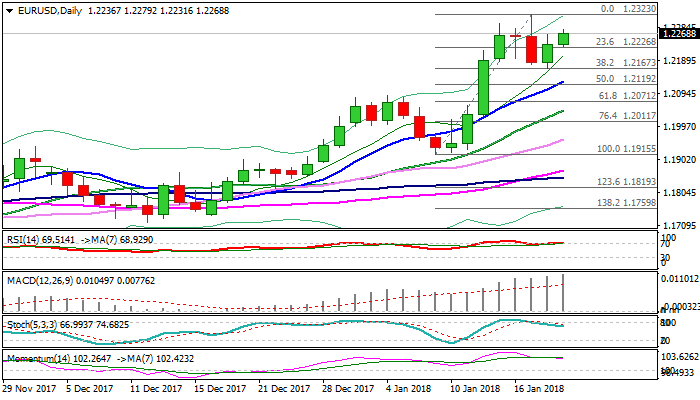

The Euro remains firm on Friday and extends recovery from 1.2165 (Fibo support / Thursday’s low) where corrective dip off 1.2323 peak found support.

The single currency was boosted by fresh weakness of the dollar, pressured by fears about potential shutdown of the US government, as lawmakers failed to reach an agreement on a federal budget.

Fresh near-term bullish sentiment is building up and turning focus towards 1.2323 (17 Jan peak).

Full retracement of shallow correction from 1.2323 to 1.2165 would signal continuation of broader uptrend and expose projected targets at 1.2383 (Fibo 138.2%) and (1.2420 (Fibo 161.8%).

Hourly Tenkan-sen marks initial support at 1.2255, followed by top of hourly Ichimoku cloud (1.2244) and hourly trough (1.2219), which is expected to hold corrective dips and keep fresh near-term bulls intact.

Key near-term support lies at 1.2165 and break here will be bearish.

Res: 1.2288; 1.2296; 1.2323; 1.2383

Sup: 1.2244; 1.2219; 1.2200; 1.2165

Interested in EURUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.