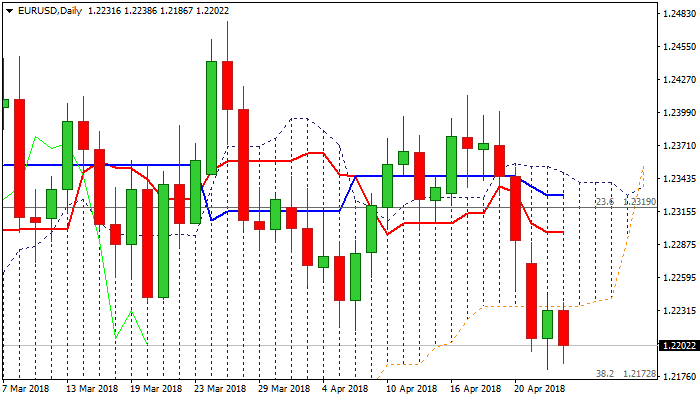

The Euro holds firmly in red in early European trading on Wednesday after recovery attempts in Asia were repeatedly capped by daily cloud base.

Hopes of forming a base above key Fibo support at 1.2172 after Tuesday’s action was rejected at 1.2181 and subsequent bounce left long-tailed bullish daily candle, are fading.

Thick daily cloud continues to weigh, along with strong dollar and expectations for dovish stance from the ECB tomorrow, which could further weaken the structure.

Firm break below key supports at 1.2172 (Fibo 38.2% of 1.1553/1.2555 / low of multi-month 1.2153/1.2555 consolidation of larger rally from 1.0340), would generate strong bearish signal for deeper correction of 1.0340/1.2555 advance and expose psychological 1.2000 support (also 200SMA).

Meanwhile, the pair may hold in extended congestion between 1.2172 and daily cloud base, awaiting fresh signals from the ECB.

Res: 1.2210; 1.2245; 1.2290; 1.2305

Sup: 1.2172; 1.2153; 1.2092; 1.2054

Interested in EURUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'