EURUSD, H1

The first release on Q2 GDP is out later and could reveal a 3.0% (median consensus is 2.5%) headline for the quarter following a 1.4% pace in Q1. Consumption looks poised for stronger growth during the quarter and we expect a 3.0% clip, up from 1.1% in Q1 and inventories should help lift the headline after a $47.0 bln subtraction last quarter. This release will also include annual revisions to previously reported figures. USD has weakened again this morning and the data at 12:30 GMT will be critical for closing positons this week.

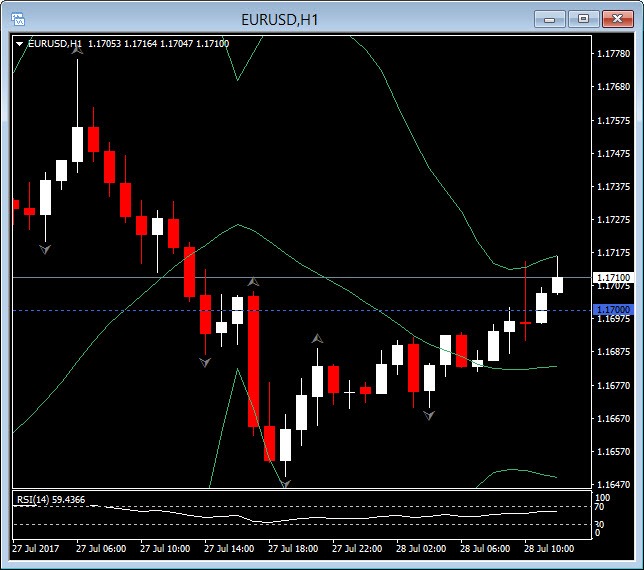

EURUSD has regained and held 1.1700 this morning helped by positive Eurozone ESI economic confidence that unexpectedly improved to 111.2 in July from 111.1 in the previous month and a raft of positive German state inflation data. Two of the heavyweights among the German states, Bavaria and NRW reported an unexpected uptick in the annual rate of 0.2% points, while headline rates were broadly steady in the other states. The data points to an upside surprise in the German HICP rate, which was expected to remain steady at 1.5% y/y, but could nudge higher to 1.6% y/y. The Spanish HICP rate already nudged higher unexpectedly, while the French reading remained unchanged, so on balance this could also mean an uptick in the overall Eurozone number, out next week. Today’s data adds to pressure on the ECB to discuss tapering when the QE schedule for next year is being discussed in (as we now expect) September.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.