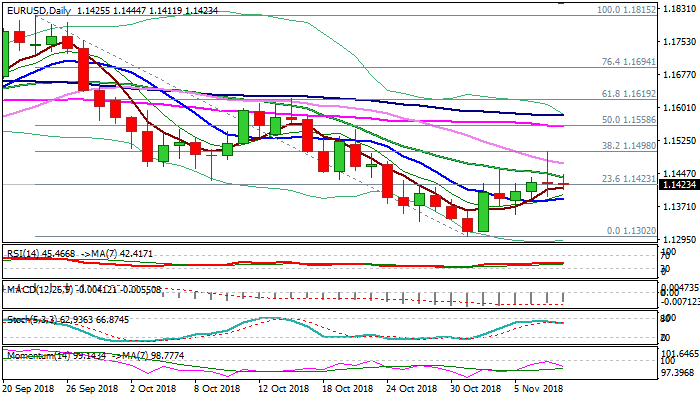

The Euro stands at the back foot on Thursday after bulls were strongly rejected on Wednesday and the day ended in Doji with very long upper shadow. Another negative signal comes from pair's inability to register close above initial barrier at 1.1423 (Fibo 23.6% of 1.1815/1.1302/Fibo 38.2% of 1.1621/1.1302) which limited the action in past week, despite strong spikes higher.

The greenback regains traction after initial negative impact from US midterm election, which keeps the single currency under pressure.

Hawkish tone from Fed after of two-day policy meeting would add to Euro's negative outlook, but near-term action is still underpinned by 10SMA (1.1390) and sustained break here is needed to signal reversal and re-expose key supports at 1.1300 zone.

Res: 1.1439; 1.1470; 1.1499; 1.1550

Sup: 1.1411; 1.1390; 1.1353; 1.1302

Interested in EURUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.