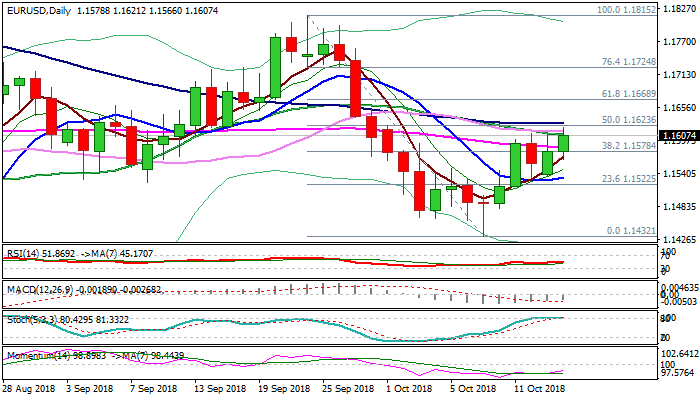

EURUSD

The Euro rose to two-week high at 1.1621 in early US trading, as dollar fell across the board on upbeat US earnings reports which inflated stocks. Stronger than expected US industrial production in Sep (0.3% m/m vs 0.2% f/c) did little to help greenback, which stands at the back foot. Choppy trading in European session managed to stay above daily cloud and keep bullish stance in extension of Monday's rally, as fresh bullish acceleration cracks a cluster of daily MA's at1.1608/27 zone. Daily momentum turns up but overbought slow stochastic warns, with close above 1.1627 (100SMA) to generate bullish signal for continuation of recovery leg from 1.1432. Today's close above cloud top is minimum requirement to keep bullish bias, with consolidation between cloud top and 100 SMA expected if bulls fail to clear 1.1627 pivot.

Res: 1.1627; 1.1668; 1.1724; 1.1757

Sup: 1.1587; 1.1569; 1.1545; 1.1534

Interested in EURUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.