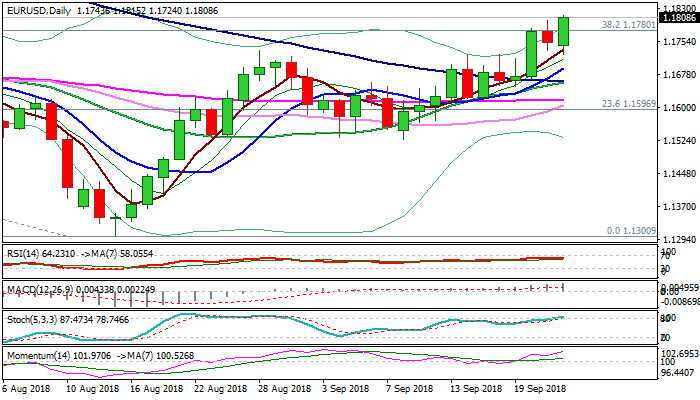

EURUSD

The Euro retested 1.1800 barrier on fresh acceleration higher after hawkish remarks from ECB President Draghi. Bounce from session low at 1.1724, posted in early Europe, cracked Friday's high at 1.1802 (the highest since 14 June) sidelining risk of deeper pullback and returning near-term focus to the upside. Fresh bulls eye target at 1.1848 (14 June high) but require daily close above 1.1780 (broken Fibo 38.2% of 1.2555/1.1300 fall) for confirmation of bullish signal. Completion of asymmetric inverse Head and Shoulders pattern on daily chart adds to positive signals, as growing bullish momentum underpins the action. Violation of 1.1848 target could open way for extension towards 1.1928 (50% of 1.2555/1.1300) and bring psychological 1.20 barrier in focus (1.1996 is 14 May high). Dip-buying above rising 5SMA (1.1734) remains favored near-term scenario.

Res: 1.1848; 1.1900; 1.1928; 1.1996

Sup: 1.1780; 1.1750; 1.1734; 1.1689

Interested in EURUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.