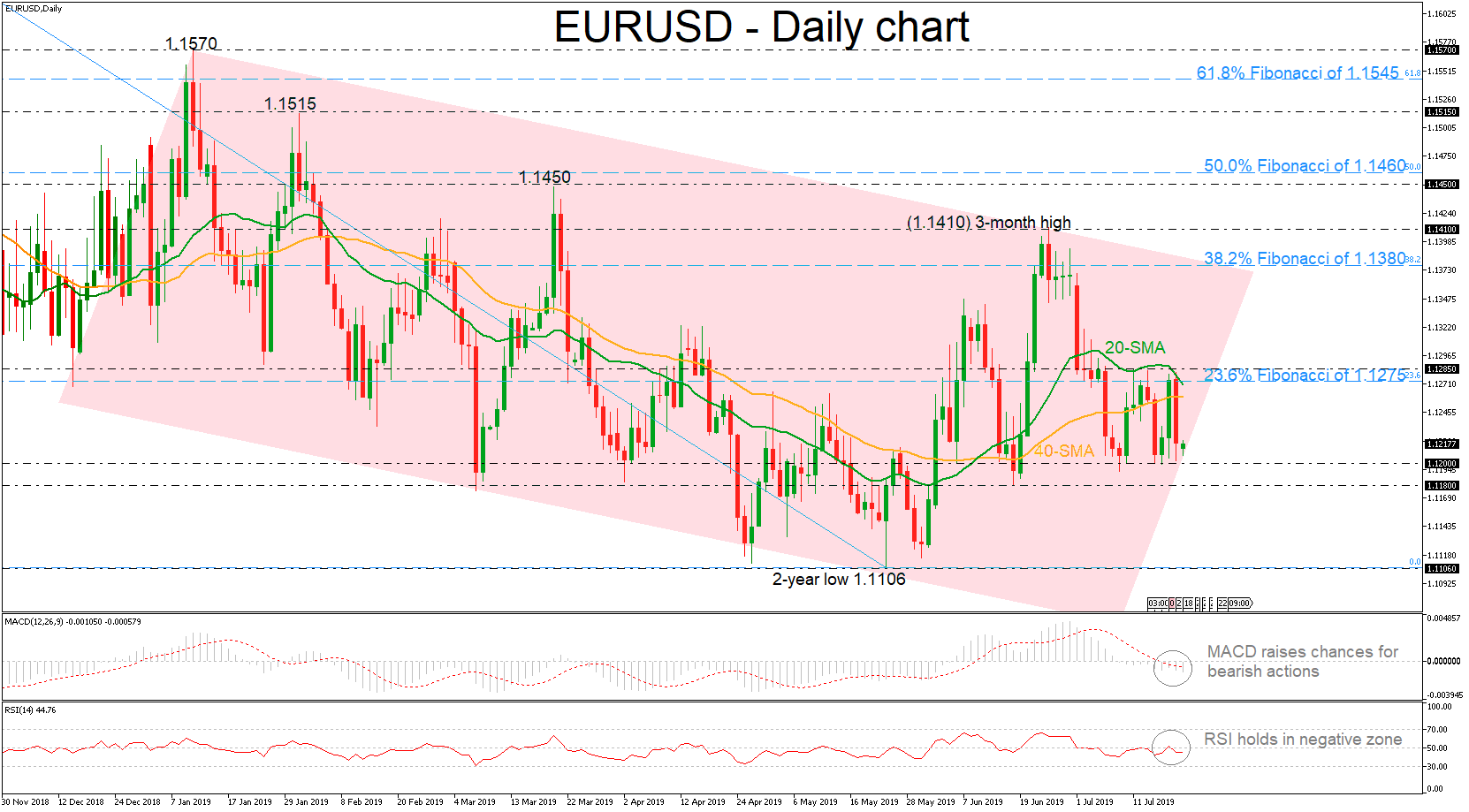

EURUSD has been under pressure over the last three weeks as it failed several times to jump above the short-term simple moving averages (SMAs) and the 23.6% Fibonacci retracement level of the downleg from 1.1815 to 1.1106 near 1.1275.

Short-term momentum indicators are pointing to a continuation of the bearish bias. The RSI bounced off the neutral threshold of 50 and is edging lower, while the MACD oscillator is strengthening its movement to the downside below trigger and zero lines.

On the way down, the bears would likely pause near the 1.1200 handle again before meeting the 1.1180 support area. Traders could increase selling sentiment below the latter level, testing the two-year low of 1.1106, achieved on May 23.

On the other side, if the pair successfully surpasses the 1.1275 – 1.1285 resistance zone, it would take the market towards the 38.2% Fibonacci of 1.1380. A decisive close above this line could open the door for the 1.1410 high, penetrating the long-term descending channel.

In the bigger picture, this channel has been developing since January and only a significant jump above the 61.8% Fibonacci region of 1.1545 could shift the bearish outlook to bullish. However, in the very short-term, EURUSD is trading sideways within 1.1200 – 1.1285.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.