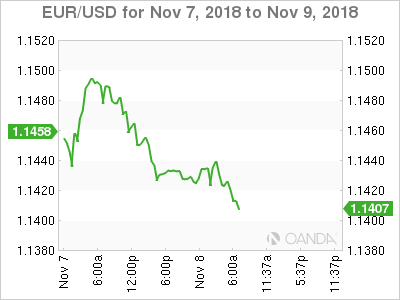

EUR/USD has ticked lower in the Thursday session. Currently, the pair is trading at 1.1421, down 0.05% on the day. On the release front, Germany’s trade surplus dropped to 17.6 billion, shy of the estimate of 18.2 billion. On Friday, the U.S releases Producer Price Index reports and UoM Consumer Sentiment.

The crisis over the Italian budget shows no signs of easing anytime soon. The EU’s Economic Commissioner, Pierre Moscovici, has demanded that Rome revise its budget, which it says increases Italy’s debt and is in breach of EU rules. Moscovici has demanded a response from Rome by November 13 and has even threatened sanctions if the Italian government does not comply. On Wednesday, Italian Prime Minister Giuseppe Conte said that he had no intention of backing down over the budget. Italy is the third largest economy in the eurozone, and the financial markets and the euro could react negatively if Rome and Brussels cannot resolve the crisis.

After digesting the results of the U.S. midterm elections, investors will be focusing on the Federal Reserve, which will hold its monthly policy meeting. The Fed is widely expected to maintain interest rates, after raising rates by 25 basis points in September. The markets will be combing through the rate statement, as the tone of the statement could move the U.S dollar. The Fed has sounded hawkish in the September statement, acknowledging the booming U.S economy and reiterating that it planned to continue its stance of gradually raising rates. The Fed is expected to raise rates in December, which would mark a fourth hike in 2018, and continue with at least three rate hikes in 2019.

ECB’s Draghi told Italy’s Tria to stick to fiscal discipline beyond EU rules

Commodities Weekly: Oil near 7-month lows on Iran waivers

As the election dust settles

EUR/USD Fundamentals

-

2:00 German Trade Balance. Estimate 18.2B. Actual 17.6B

-

2:45 French Trade Balance. Estimate -6.1B. Actual -5.7B

-

4:00 ECB Economic Bulletin

-

5:00 EU Economic Forecasts

-

Tentative – French 10-year Bond Auction

-

8:30 US Unemployment Claims. Estimate 214K

-

10:30 US Natural Gas Storage. Estimate 56B

-

14:00 US FOMC Statement

-

14:00 US Federal Funds Rate. Estimate <2.25%

-

8:30 US PPI. Estimate 0.2%

-

8:30 US Core PPI. Estimate 0.2%

-

10:00 US Preliminary UoM Consumer Sentiment. Estimate 98.0

Open: 1.1426 High: 1.1445 Low: 1.1412 Close: 1.1422

EUR/USD Technical

|

S1 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.1120 |

1.1212 |

1.1300 |

1.1434 |

1.1553 |

1.1685 |

EUR/USD inched lower in the Asian session and is showing little movement in European trade

-

1.1300 is providing support

-

1.1434 is fluid. Currently it is a weak resistance line

-

Current range: 1.1434 to 1.1553

Further levels in both directions:

-

Below: 1.1300, 1.1212 and 1.1120

-

Above: 1.1434, 1.1553, 1.1685 and 1.1800

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.