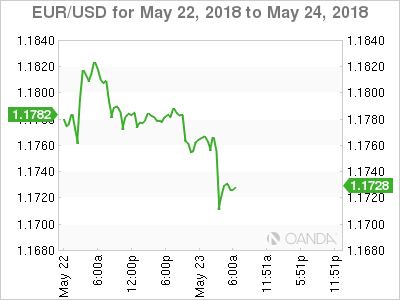

After a quiet start to the week, EUR/USD has posted considerable losses in the Wednesday session. Currently, the pair is trading at 1.1726, down 0.45% on the day. On the release front, German and eurozone PMIs missed expectations in the manufacturing and services sectors. In the US, the key event is the release of the Federal Reserve minutes from the May policy meeting. On Thursday, Germany releases Final GDP and GfK Consumer Climate, and the ECB will publish the minutes of its April policy meeting. The US will release unemployment claims and Existing Home Sales.

Weak PMI data in May has sent the euro lower in the Wednesday session, as the currency dipped below the 1.17 line for the first time since mid-November. Investors are particularly concerned that both German and eurozone manufacturing PMIs dropped for a fifth straight month. German Manufacturing PMI posted its weakest gain in 16 months, while the eurozone indicator posted its worst reading in 18 months. These numbers, while certainly disappointing, should not cause any alarm, as the PMIs continue to indicate expansion in the services and manufacturing sectors. Still, the fact that growth was softer than expected could give ECB policymakers reason to re-evaluate the planned wind-up of its stimulus program in September.

The Federal Reserve will be in the spotlight on Wednesday, as analysts pore over the minutes of the May policy meeting. The Fed did not raise rates at the meeting, but a strong US economy has raised expectations that the Fed will press the rate trigger in June – according to the CME Group, the odds of a June hike stand at 100%. The markets will be looking for some guidance from the May minutes, and if the message from Fed policymakers is hawkish, traders can expect the dollar to post gains against the euro and other major rivals.

Fed Minutes to Drive Market as Trade Concerns Recede

Another Turkish Lira flash crash

EUR/USD Fundamentals

-

3:00 French Flash Manufacturing PMI. Estimate 53.6. Actual 55.1

-

3:00 French Flash Services PMI. Estimate 57.1. Actual 54.3

-

3:30 German Flash Manufacturing PMI. Estimate 57.9. Actual 56.8

-

3:30 German Flash Services PMI. Estimate 53.1. Actual 52.1

-

4:00 Eurozone Flash Manufacturing PMI. Estimate 56.1. Actual 55.5

-

4:00 Eurozone Flash Services PMI. Estimate 54.7. Actual 53.9

-

9:45 US Flash Manufacturing PMI. Estimate 56.6

-

9:45 US Flash Services PMI. Estimate 54.9

-

10:00 Eurozone Consumer Confidence. Estimate 0

-

10:00 US Crude Oil Inventories. Estimate -2.5M

-

14:00 US FOMC Meeting Minutes

-

2:00 German Final GDP. Estimate 0.3%

-

2:00 German GfK Consumer Climate. Estimate 10.8

-

4:00 ECB Financial Stability Review

-

7:30 ECB Monetary Policy Meeting Accounts

-

8:30 US Unemployment Claims. Estimate 220K

-

10:00 US Existing Home Sales. Estimate 5.56M

Open: 1.1778 High: 1.1790 Low: 1.1699 Close: 1.1726

EUR/USD Technical

|

S1 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.1448 |

1.1613 |

1.1718 |

1.1809 |

1.1915 |

1.2025 |

EUR/USD ticked lower in the Asian session and has posted stronger losses in European trade

-

1.1718 is fluid. Currently, it is providing weak support

-

1.1809 is the next resistance line

Further levels in both directions:

-

Below: 1.1718, 1.1613, 1.1448 and 1.1313

-

Above: 1.18o9, 1.1915 and 1.2025

-

Current range: 1.1718 to 1.1809

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.