The world markets fell today as investors feared that the financial crisis in Turkey would affect the developed markets. The Turkish economy has faced a major challenge in the past few months with inflation expected to move above 15%. The country’s central bank has rejected the recommend measures to raise interest rates. The problem has been compounded by the recently announced sanctions by the Trump administration following the continued jailing of an American pastor. Today, Donald Trump announced that the US would double the tariffs on steel and aluminium from Turkey. Europe’s markets were the most affected because of their proximity to Turkey. The Stoxx, DAX, and CAC declined by 1.60%, 1.80% and 1.32%. The euro fell sharply against the dollar and reached the lowest level since July last year.

The Japanese Yen was little moved against the dollar after the country’s statistics office released the first reading of Q2’s GDP. In the quarter, the economy rose by an annualized rate of 1.9%, which was higher than the expected 1.4%. On a quarterly basis, the economy rose by 0.5% after contracting by 0.2% in the first quarter. The growth in the economy was mostly because of the growth in capital expenditure, which increased by 1.3%. This was higher than the expected 0.6% growth. Still, the impact of the ongoing trade issues was seen in the external demand which contracted by negative 0.1%. Traders were expecting a 0.1% growth.

The Office of National Statistics (ONS) released the first reading of UK’s Q2 GDP reading. The data showed that in the quarter, the economy expanded by an annual rate of 1.3% and a quarterly rate of 0.4%. This was in line with the expectations and higher than the first quarter’s growth of 1.2%. The growth was attributed to the good weather in the quarter. The manufacturing production rose by an annualized rate of 1.5%, which was higher than the expected 1.0%. The industrial production in June rose by an annualized rate of 1.1%, which was lower than the expected 0.7%. The positive economic data was received with a grain of salt by investors who cautioned that it was still lower than that of other global peers. The FTSE fell by 70 basis points while the pound continued to slide to the lowest level since June last year.

The dollar rose after the BLS released the CPI numbers for July. In the month, the CPI rose by an annual rate of 2.9%, which was unchanged from June but lower than the expected 3.0%. The core CPI, which excludes the volatile food and energy products rose by an annual rate of 2.4%, which was higher than the expected 2.3%. This was the biggest jump since 2008. Other than the CPI data, the dollar’s rise was mostly because of its little exposure to the Turkish market unlike its other peers like pound and euro.

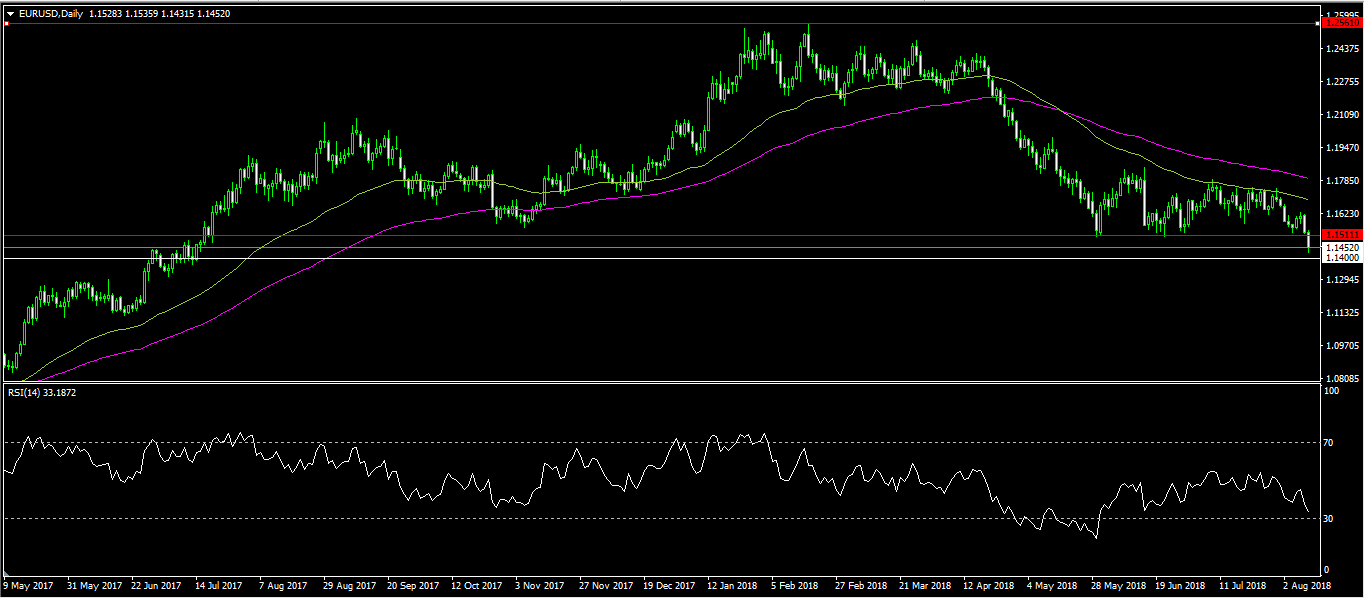

The EUR/USD pair is now trading at 1.1450, which is the lowest level since June last year. This price is below the 50, 100, and 200-day moving average, with the RSI on the daily chart approaching the oversold level of 30. As the crisis in Turkey continues, and as the data from the US continues being supportive of the dollar, there is a likelihood that the pair will test the 1.1400 level.

GBP/USD

In April, the GBP/USD pair started falling from a high of 1.4374. Today, the pair fell to an intraday low of 1.2730. During the decline, the pair tested and passed multiple support levels and today, it crossed the support of 1.2765. Its RSI is currently at 24, which is the lowest level since May this year, while the MACD is showing signs of further downward risks. As the impasse on Brexit continues, the pair is likely to continue being under pressure.

EUR/GBP

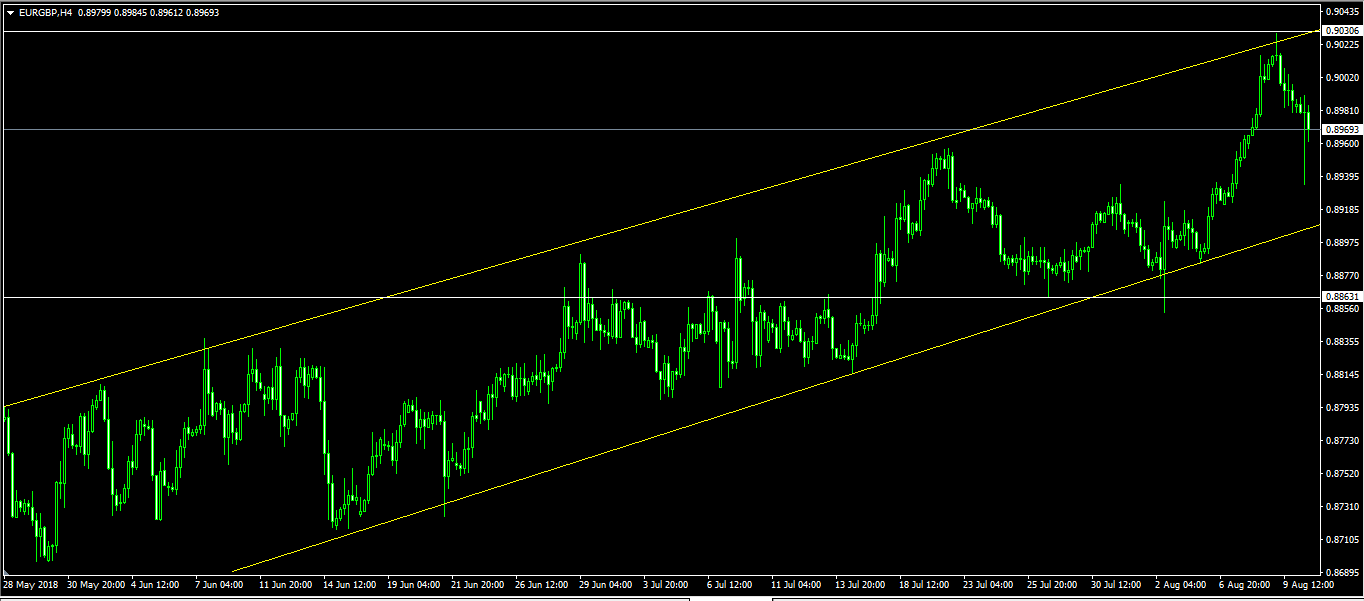

The EUR/GBP pair rose today in a cautious trade to reach a high of 0.9030. This was a continuation of the gains that started in May when the pair reached a low of 0.8622. During the pair’s climb, it has created equidistance support and resistance levels as shown on the 4-hour chart below. If the pattern holds, the pair is likely to test the 0.8920 support.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.