The US dollar is still rising. When will that stop?

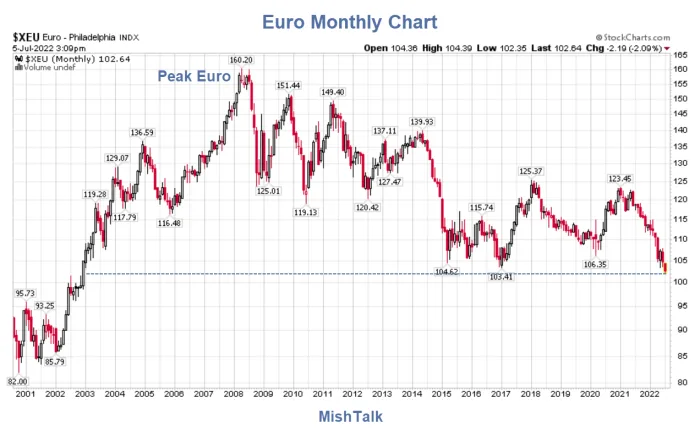

Euro chart courtesy of StockCharts.Com annotations by Mish

Peak euro

The Euro continues it's plunge towards parity with the US dollar.

In 2008, it took 1.60 dollars to buy one Euro. Now it takes 1.03 dollars.

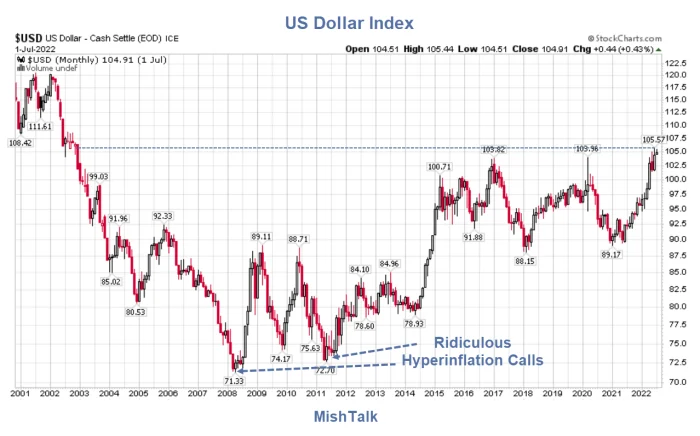

US Dollar Index

Dollar chart courtesy of StockCharts.Com annotations by Mish

Unsurprisingly, if the euro is weak, the US dollar rates to be strong.

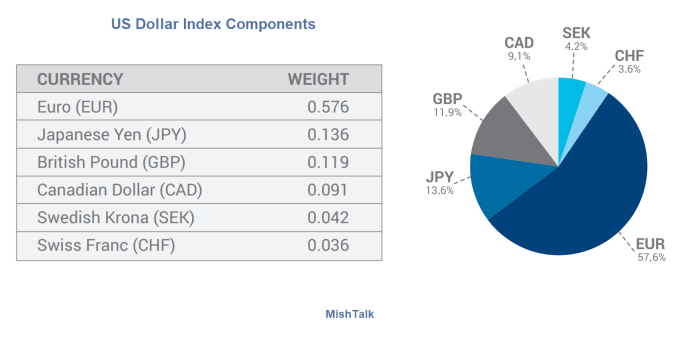

The Euro is 57.6 percent of the US Dollar Index

US Dollar Index components

For the first time since 1991, Germany's trade surplus vanishes

Also note For the First Time Since 1991, Germany's Trade Surplus Vanishes

The US has the strongest economy and is moving the fastest on rate hikes and QT.

Question of the day

Q: When does the dollar rise stop?

A: When the Fed stops tightening as much as expected (hikes and/or QT) or the ECB starts tightening more than expected.

But with Powell's repeated insistence on bringing down inflation, a strong US dollar aids that purpose.

There's your strong dollar. One of my readers put it this way "Prettiest gal in the whorehouse."

Meanwhile, Rent is Still Rising, Compounding the Fed's Recession Woes

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.