The Euro rose 0.7% against the US dollar, or 75 pips, during a choppy week that finally gave way to a rally last Friday. The market had heard rumours, at the beginning of the week, that ECB governor Draghi would be announcing a reduction in the central bank’s asset buying program. The Euro gained 65 pips on Tuesday, to lose them through Wednesday and Thursday, with price regaining lost ground again on Friday, completing the helter-skelter ride.

The Euro may see more volatility this week as the second round of negotiations for Brexit started yesterday and the ECB holds a monetary policy meeting this Thursday. The monetary policy meeting will issue an announcement on interest rates at 12:45 pm, and Draghi will hold a press conference at 01:30 pm. This will be the last before the summer break, and the central bank will be holding its next meeting in September.

There are no expectations for changes in interest rates, but the market will be watching very carefully for any hints as to the timing of the reduction in bond purchases. There has been a lot of talk of cutting back the QE programme, which may lead to a spike in volatility, as Draghi answers questions from the press, and the markets react to new interpretations of policy.

The main advantages of using an option compared to opening a Spot position comes in the reduction and mitigation of risk. Buying an option may be cheaper than the cost of your stop loss if it is reached. Bear in mind that after big events, like ECB monetary policy meetings, the market may experience extreme increases in volatility therefore stop losses must be very wide and can be expensive. Stop losses may not always be closed at the price you placed as a stop. In a Fast market, typical after a surprise in important data releases, the price you are stopped at may differ considerably. With options that simply cannot happen, the cost of the option is your total risk when buying.

If you feel that the Euro will rise against the US dollar then all you need to do is buy a Call option, which gives you the right to buy EURUSD at a set price (strike), set date (expiry), and for an amount of your choice.

The screenshot below shows that a EURUSD Call option with a 1.14786 strike, 7-day expiry, and for €10,000 would cost $53.94, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above option, just click the Scenarios button.

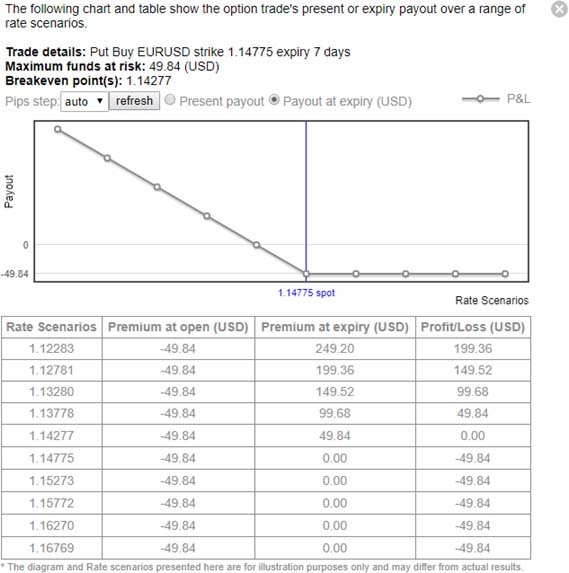

On the other hand, if you feel that the Euro will fall against the US dollar then all you need to do is buy a Put option, which gives you the right to sell EURUSD at a set strike, expiry, and amount.

The screenshot below shows a EURUSD Put option with a 1.1478 strike, 7-day expiry, and for €10,000 would cost $49.85, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.