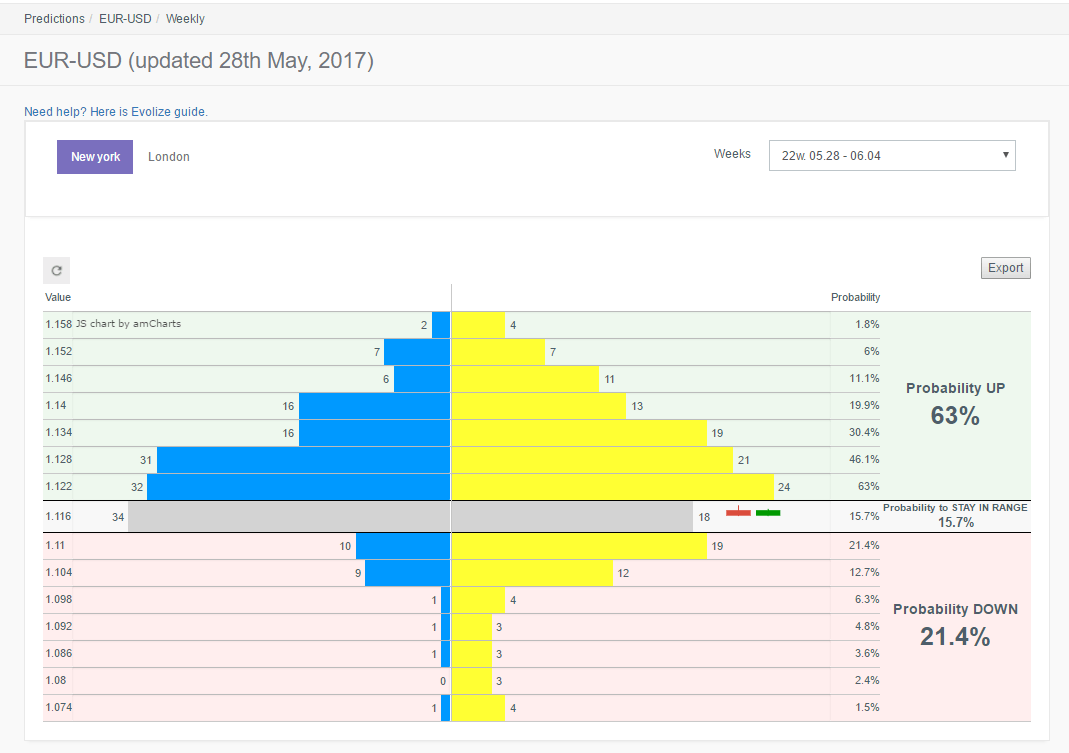

According to our weekly Euro and US dollar prediction we are looking to Buy EURUSD with a target price 1.120 and a probability of 63%

Evolize graph is made by doing more than 300 predictions using Long-Short term memory networks using different data sources. All of these predictions are divided by the type of data we use as an input and placed into two different histograms. We constantly look for three qualities in the graph so that we could safely believe what it predicts:

-

Normality - the closer the histogram is to normal distribution, the better.

-

Modes - they mostly are the points algorithm believes most certainly be reached, so modes need to be in a normal weekly range for specified currency, otherwise we see that there might be something wrong with prediction.

-

Difference between rows or standard deviation - the more widely the predictions distributed - the more uncertain the algorithm is. So are we.

The probabilities are calculated simply by counting how many predictions are below and above current price.

We publish at least one prediction per week out of 16 we currently have and one daily prediction out of 8, so than our users can see the reasoning we do before trading according to Evolize graphs.

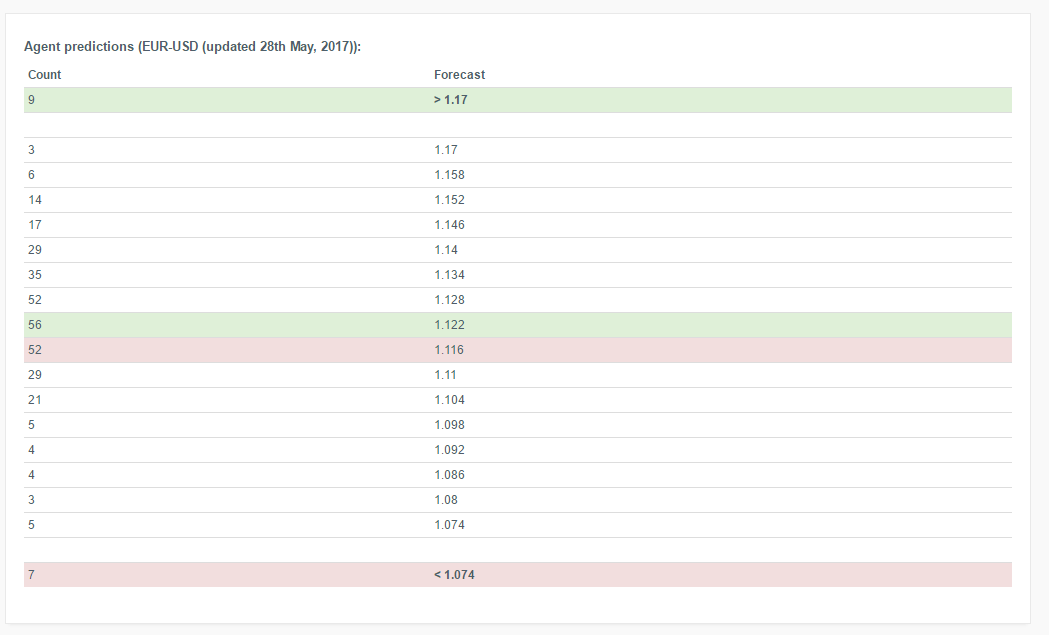

Now let’s look at the predictions. This week EURUSD graph looks quite normal on the both sides. We can see that the Yellow one is more widely distributed but it is still close to normal. Yellow mode is right above current price and it’s great, but the blue mode is already reached. Both distributions are a bit skewed upwards and the probability the the price will reach points above current price is bigger. The question is where to place take profit. Since the difference between rows is 60 pips which is quite big, we decided to lower our take profit and place it on 1.120 with 40 pips at stake.

One needs to know that our algorithm doesn’t use fundamental data as an input, meaning that fundamentals can have a negative impact on this trade. If you believe that some of the economic or political events are able to turn around price trajectory - rethink this trade accordingly.

Detail guide of how to use Evolize predictions to your advantage is here.

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve considerable exposure to risk of substantial losses and are ideally

made based on the advice of qualified financial advisors. “Day Trading” also involves particularly high levels of risk and can cause you to sustain loss of

some or all of your initial investment, before engaging in any trading venture, prospective investors are encouraged to consult investment strategy experts.

Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no

circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone

else engages in based on any information or material you receive through evolize.com

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.