EURGBP is currently down from the day’s open after hitting an eight-day high yesterday.

The RSI indicator is hinting to a neutral short-term bias as it is currently at 50.

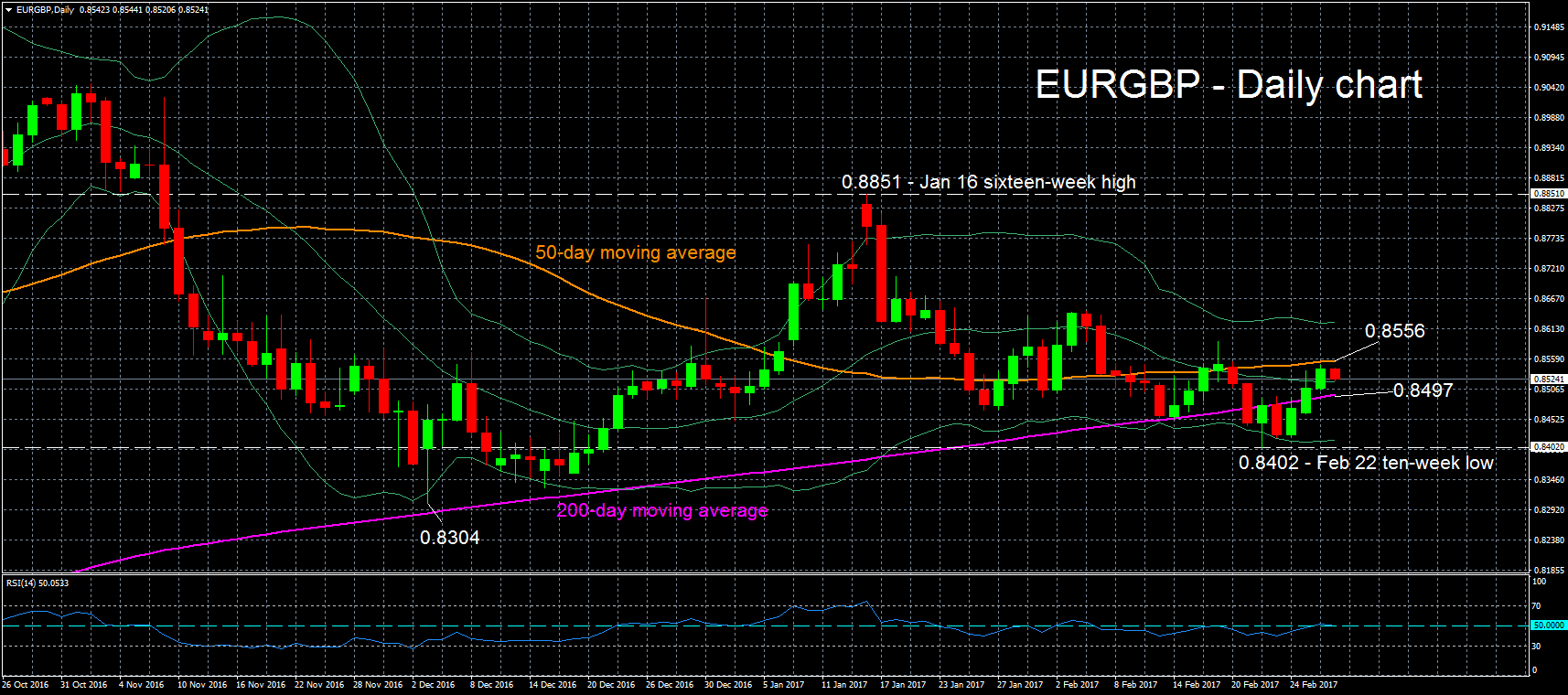

The 50-day moving-average (MA), currently at 0.8556, is expected to provide resistance to upside moves. Should it fail to hold, the upper Bollinger band at 0.8624 is likely to provide additional resistance. An important mark beyond this level is the January 16 sixteen-week high of 0.8851.

On the downside, the middle Bollinger line (a 20-day MA) at 0.8519 could contest a daily close below it – note that the price is close to this level at the moment. The 200-day MA at 0.8497 comes into view as next immediate support should the price continue to head down. If this fails to hold as well, the lower Bollinger band at 0.8415 and the February 22 ten-week low of 0.8402 could form an additional support area thereafter.

The medium-term outlook is looking neutral at the moment as the price is in between the 50- and 200-day MAs.

Overall, the pair looks neutral in both the short- and medium-term.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.