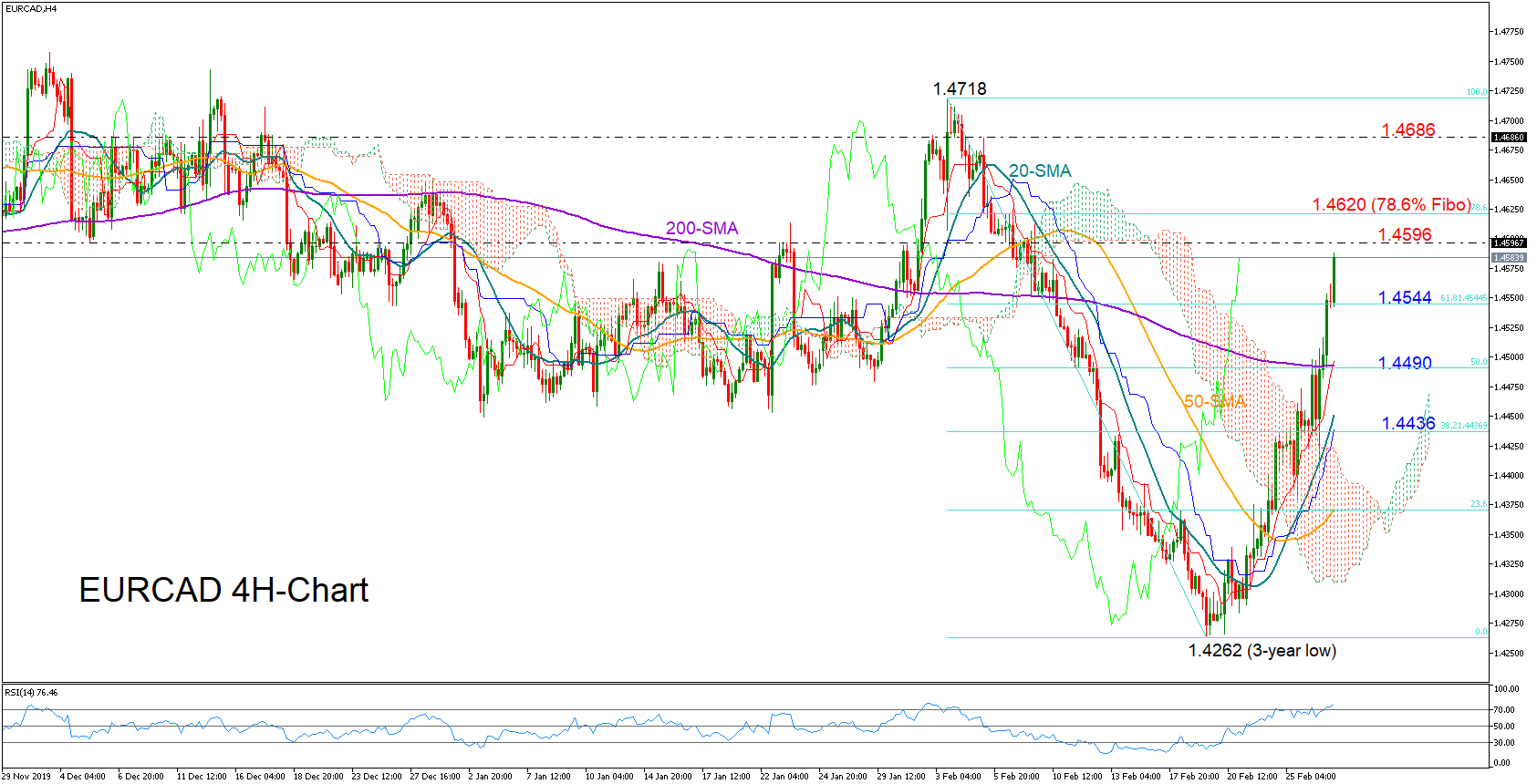

EURCAD is set to close strongly bullish after three consecutive negative weeks, with the pair accelerating from a three-year low of 1.4262 to three-week highs.

Looking at the four-hour chart, the RSI’s position provides some cautious signals as the indicator is already above its 70 overbought mark, though it has yet to show signs of weakness, suggesting that there might be some extra room for improvement in the market.

Moving higher, the bulls should overcome the former 1.4596 resistance level to reach the 78.6% Fibonacci of 1.4620 of the 1.4718-1.4262 downleg. Beyond the latter, the next target could be the 1.4686 barrier.

Should sellers return to the game, the 61.8% Fibonacci at 1.4544 could act as immediate support before attention shifts back to the 200-period simple moving average (SMA), which has flattened around the 50% Fibonacci of 1.4490. Breaching the latter, the area between the 20-period SMA and the 38.2% Fibonacci of 1.4436 could next take control as it did earlier in the week.

In short, EURCAD could experience more upside pressure, though not for long as the market is already trading in overbought waters.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.