The EUR/USD was creeping higher during the second week of April gaining more than 1% over the week as the US-China trade disputes took a diplomatic turn shifting away from one-side communication tweets and unilateral actions. Euro was supported at the beginning of last week by comments from Austria’s central bank governor Ewald Nowotny claiming that the asset purchasing program will likely end this year with following step being the deposit rate increase from current -0.40% to -0.20%. Nowotny, who is also ECB Governing Council member is an active communicator but was not followed by his colleagues from the ECB Governing Council, even as the ECB President Mario Draghi and the Executive board members Praet and Coeure were speaking last week as well. The ECB actually did not confirm the communication shift towards more neural policy bias in minutes from the March meeting as well.

While EUR/USD was rising from 1.2270 to 1.2397 peak of the last week, the ECB accounts nailed the EUR/USD lower with the currency pair falling towards 1,2300 level by the end of the second week of April.

The risk-on mood dominated the first half of the last week and the rise of geopolitical risk re-emerged with the US administration threatening Syria with military intervention against Russia-supported President Assad suspicious of poison attacks against rebels and civilians in the civil-war stricken country. Although military interventions traditionally tend to help the US Dollar war aggression in Syria might encounter Russia, a conflict that if spread further, smells bad for everyone.

Fundamentally, there was no reason to get excited for the Euro with Sentix investors sentiment indicator falling to 19.6 in April while the Eurozone industrial production fell -0,8% m/m in February, falling for the second month in a row. On the top of the story the ECB meeting accounts, or minutes, did not prove any sign of the Governing Council turning hawkish or even contemplating about what would come after the asset purchasing will end. The EUR/USD actually proven very resilient to negative surprises stemming from the macroeconomic data flowing in.

At the other side of the Atlantic, the US inflation in March together with the Federal Reserve Bank’s March meeting minutes headlined the second week of April. While US inflation data met the market expectation with core inflation accelerating to 2.1% y/y in March from 1.8% y/y in February markets seeking clues for justifying the March interest rate hike in the FOMC minutes felt a bit disappointed as Fed policymakers did not hold a convincing hawkish stance and the US Dollar losing on the news.

Technically the EUR/USD is the long-term uptrend that would regain traction once the currency pair moves above 1.2400 level. In short-term though, the outlook for EUR/USD is rather bearish with targets of 1.2265-1.2215.

EUR/USD daily chart

Technical analysis

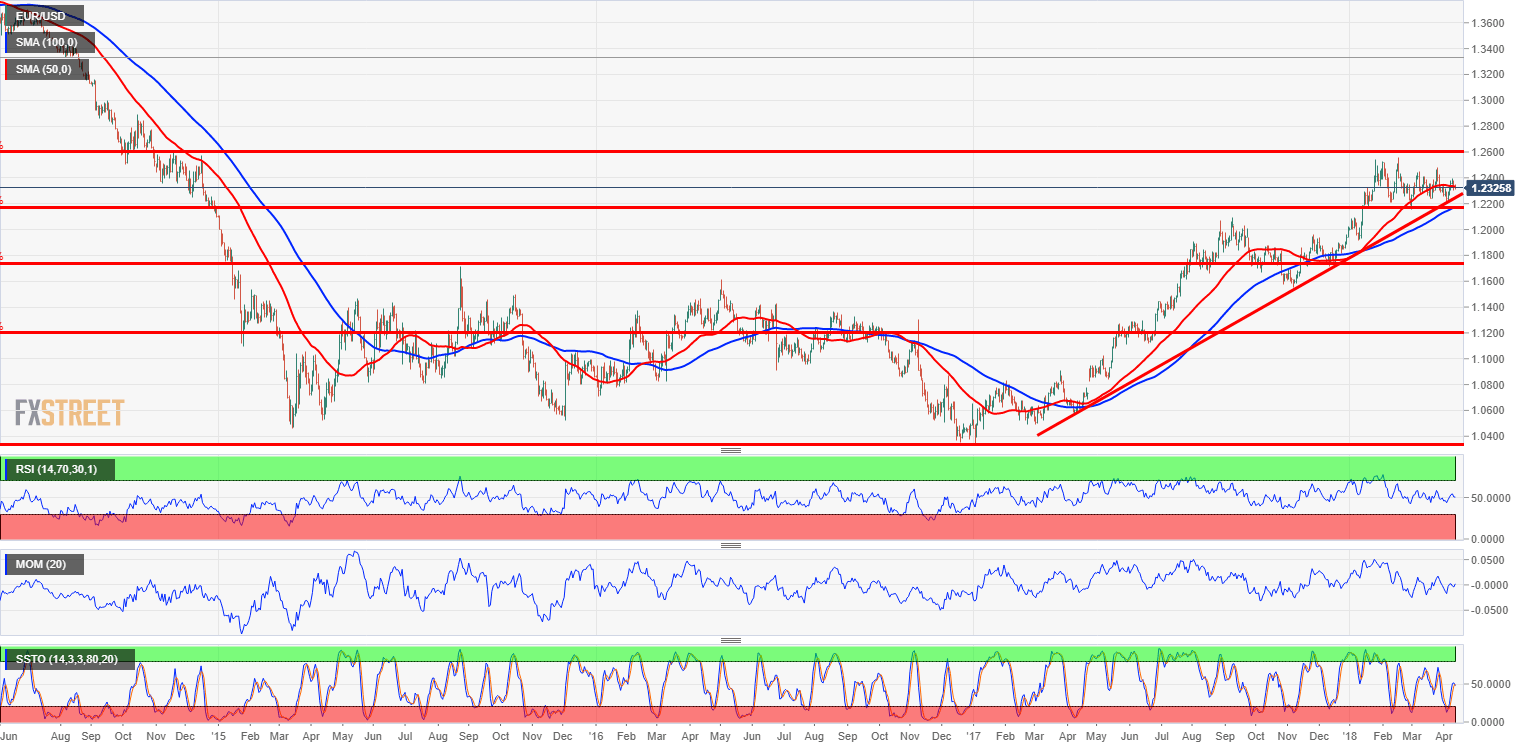

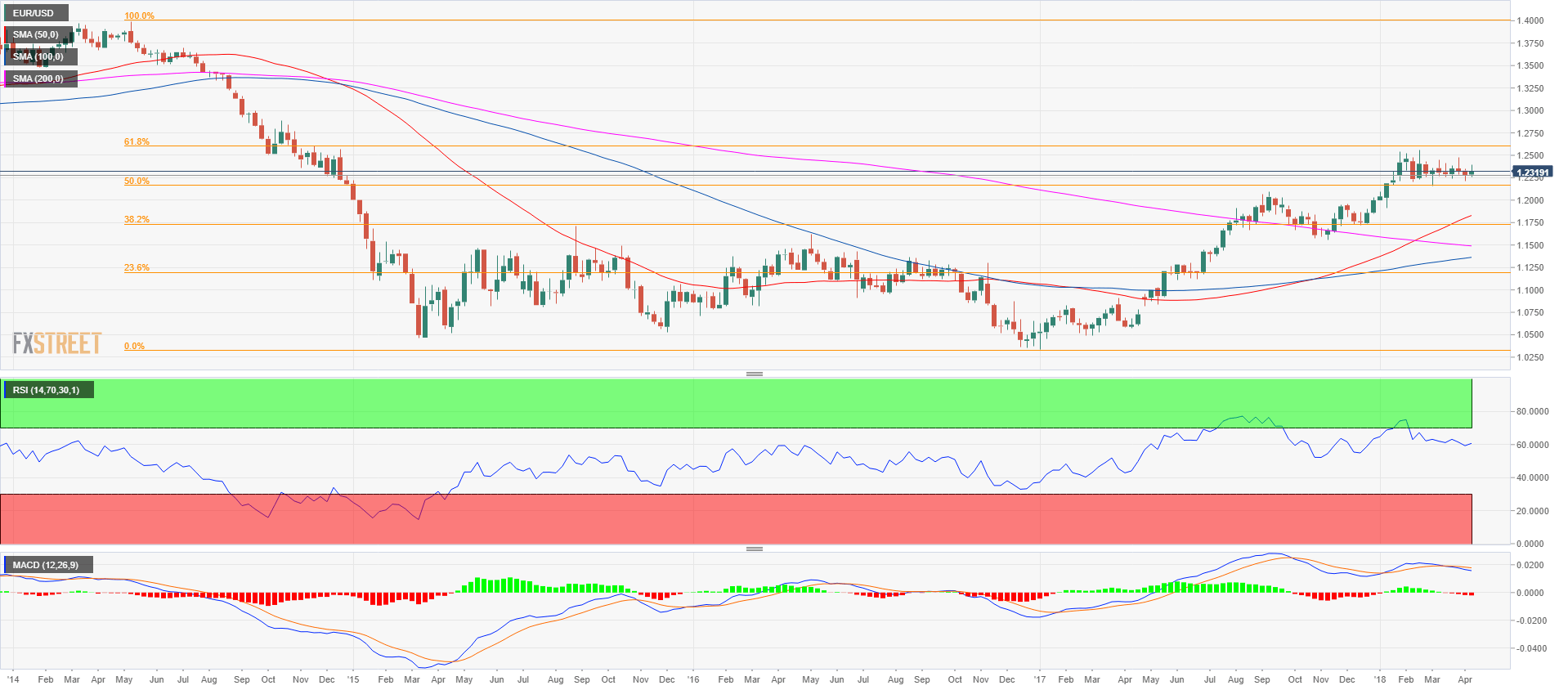

EUR/USD weekly chart

The EUR/USD is in a bull trend since December 2016. In mid-February, the 50-period SMA crossed above the 200-period SMA creating a golden cross, which is a strong bullish signal. Since mid-January of this year, the pair is consolidating in a bull flag above the 50, 100 and 200-period simple moving averages (SMA). The EUR/USD has therefore been trading in a tight trading range since mid-January and is trading between 1.2166 and 1.26 as calculated by the 50% and 61.8% Fibonacci retracement from the September 2014-June 2017 bear trend. This week (April 9-13) the bulls failed to bring the market above the 1.2400 psychological level and the bears on Friday are currently trying to close the day below the 1.2345 level (high of last week). The Relative Strength Index (RSI) indicator is above 60 and the Moving Average Convergence/Divergence (MACD) is showing a small and progressive waning bullish momentum.

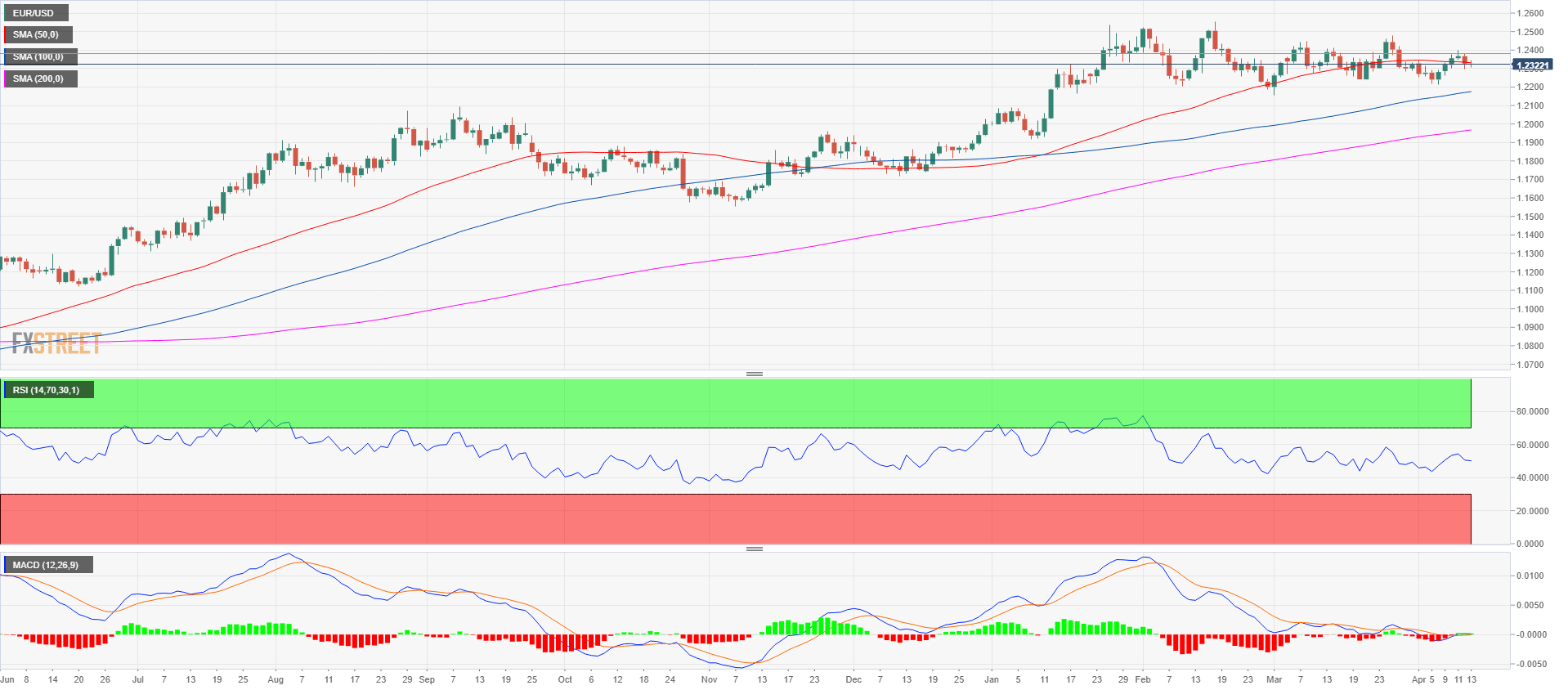

EUR/USD daily chart

This week the bulls brought the market as high as 1.2397 or 3 pips just off the 1.2400 psychological resistance. On Thursday, the bears made a statement by closing the daily candle below the 50-period simple moving average on the daily time frame at 1.2334. The RSI indicator is a little above 50 (seen as neutral) while the MACD indicator is showing a slowing bullish activity.

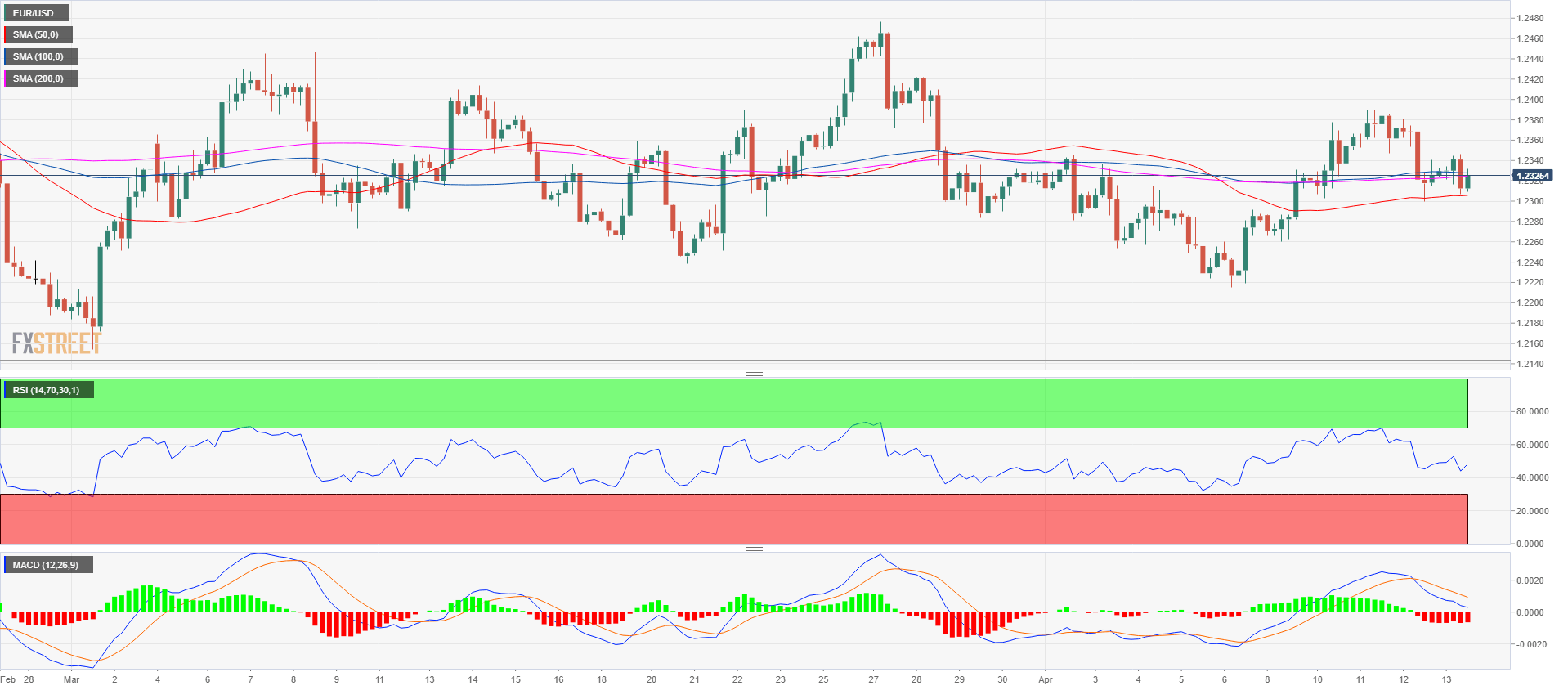

EUR/USD 4-hour chart

As long as the bears keep the market from spiking above the 1.2400 level, the pair keeps a bearish bias as confirmed by the RSI and MACD indicators. The key support to break for bears is the 1.2300 swing low and also psychological level. A break below can lead to 1.2260 swing low and to the 1.2215 cyclical low made on April 6. The first resistance bulls need to break is the 1.2346 swing high made on Friday, April 13. After which, higher up, the 1.2360 supply level and the 1.24 psychological level will be the next challenges for the euro bulls. A break above 1.2400 can open the gates to a retest of 1.2477 swing high made on March 27.

Upcoming macro data

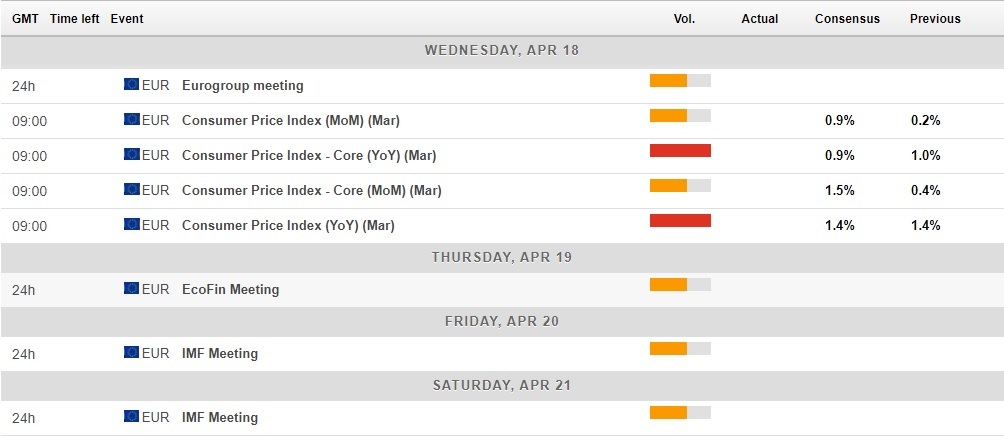

The Eurozone economic calendar is headlined by German ZEW indicator of investors sentiment that has surprised on the downside last month while it is expected to deteriorate further in April falling to -0.5 from a reading of 17.8 in February just within two months.

The Eurozone inflation data are also due next week, but inflation very rarely deviated from expectation and this time it is set to increase 1.4% over the year in March with core inflation stripped of food and energy prices rising only 0.9% y/y, unchanged from previous month and well below the ECB 2% inflation target.

The Eurozone economic calendar for April 16-20

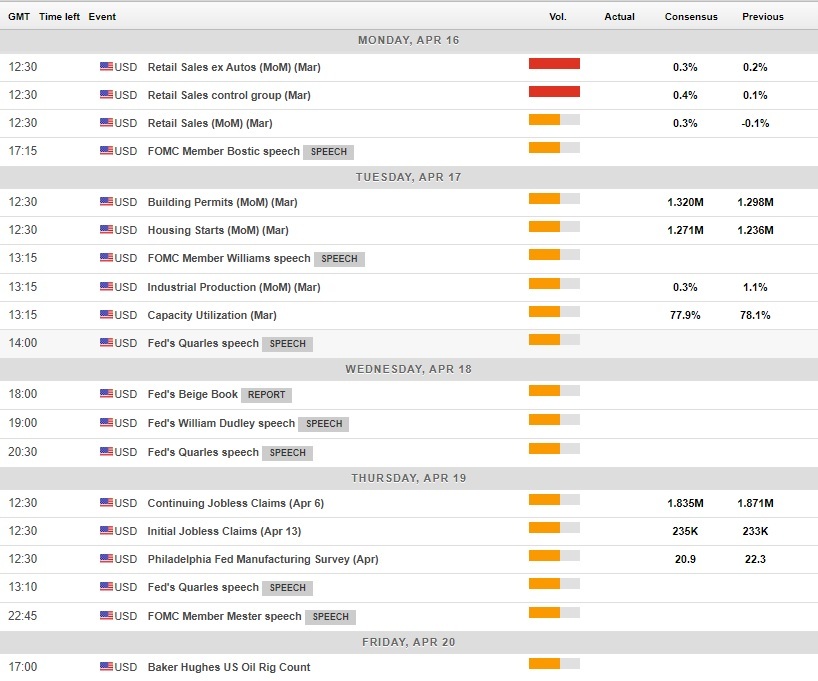

In the US the third week of April will be headlined by the US retail sales report for March, while housing starts and building permits and a whole set of Fed speakers are scheduled for the week ahead.

The US retail sales are expected to increase 0.3% m/m in March while the part of the retail sales called control group, that is included in the GDP is seen rising 0.4% m/m. In terms of the US labor market, weekly initial jobless claims are seen rising 235K during the week ending April 13.

Speeches from the Federal Reserve Bank official will include Atlanta Federal Reserve Bank President Raphael Bostic, San Francisco Federal Reserve Bank President John Williams, the New York Federal Reserve Bank President William Dudley, Chicago Federal Reserve Bank President Charles Evans, Cleveland Federal Reserve Bank President Loretta Mester and the Federal Reserve Governors Randal Quarles.

The US economic calendar for April 16-20

Forecast for next week

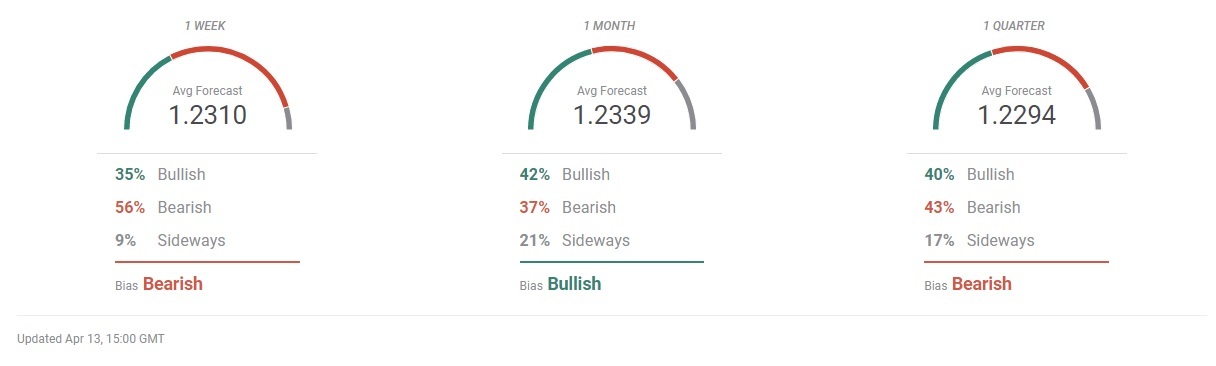

The economic analysts and forecasters participating in FXStreet Forecast Pool are slightly bearish on EUR/USD for the week ahead predicting it to fall some 20 pips lower from the spot rate of 1.2330 at the time of writing this Forecast. With 565 of participants predicting lower spot rate for EUR/USD in one week time while 355 expect bullish trend to prevail while the predicted value is within reach of current spot, the actual trend predicted is rather neutral-to-sideways.

Participating analysts expect EUR/USD to trade very near current spot price also in 1-month and 3-month time horizon from now, so although the trend predicted in 1-month from now is bullish and 3-months from now bearish, the actual trend is also neutral-to-sideways.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.