- US politics take centre stage with the covid-related stimulus package and spending plan.

- Growth in the EU likely to remain subdued amid coronavirus-related lockdowns.

- EUR/USD long-term bullish trend remains intact, but a slide is not out of the picture.

The EUR/USD pair recovered to reach 1.2149 but was unable to hold on to gains above the 1.2100 figure. The advance had little to do with the common currency, mainly related to the dollar self-weakness. The American currency fell off investors’ radar after the release of a tepid Nonfarm Payroll report, maintaining its sour tone throughout the week.

US government debt yields soared, a sign of mounting optimism mostly related to the passing of a US stimulus package. Long-term bond yields reached levels last seen in March 2020 but quickly retreated afterwards. Optimism faded as the week went by, but the greenback remained near its weekly low.

US politics stepping up

On the stimulus bill, US House Speaker Nancy Pelosi said on Thursday that she hopes to have US President Joe Biden's COVID-19 relief plan approved by the end of February, before unemployment benefits expire on March 14. Also, US President Joe Biden called for a meeting with a bipartisan group of senators to seek support for major infrastructure spending program. Biden outlined a bigger than $2 trillion infrastructure plan during the presidential campaign to keep pace with China.

“If we don’t get moving they’re going to eat our lunch,” the US President said, indicating that the rival country has invested billions in dealing with a “whole range of issues that relate to transportation, the environment and a whole range of other things.”

US Federal Reserve chief Jerome Powell hit the wires mid-week, adding a pitch of pessimism to financial markets. Among other things, he noted that the employment sector has a “long way” ahead in recovering, adding that the real unemployment rate is probably closer to 10% than the 6.3% reported last Friday. He said that rates with remain low as long as the employment sector remains subdued. Investors remained unmotivated, waiting for a fresh catalyst.

Sluggish economic growth in the spotlight

A scarce macroeconomic calendar exacerbated range-trading. Germany published the final version of January inflation figures, confirmed at 1.6% YoY. US CPI also came as previously estimated, at 1.4% YoY, missing the market’s expectations. On Friday, the US published the February preliminary estimate of the Michigan Consumer Sentiment Index, that contracted to 76.2 from 79, missing expectations.

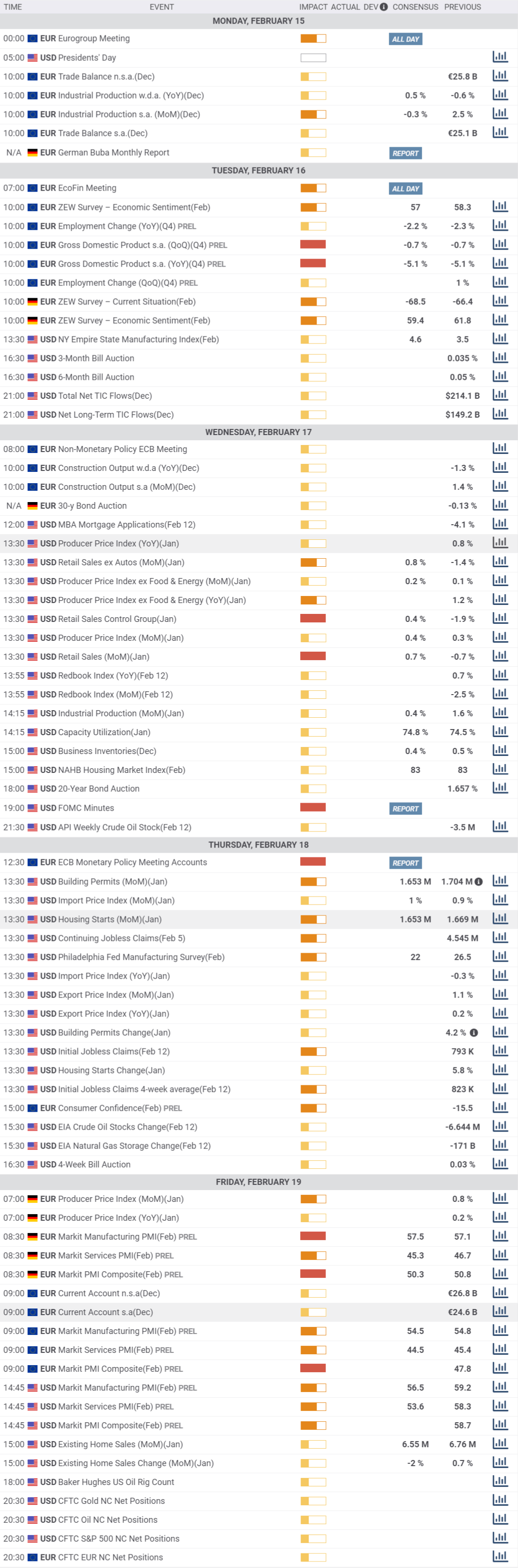

The US celebrates a holiday next Monday, anticipating a dull start to the week, as China is also on holidays until February 17. The macroeconomic calendar will include some interesting figures as next Tuesday the EU will publish the preliminary estimate of the Q4 Gross Domestic Product, foreseen at -0.7%, while Germany will release the February ZEW survey. On Wednesday, the US will publish January Retail Sales and the FOMC Minutes. At the end of the week, Markit will release the preliminary estimates of its February PMIs for the EU and the US.

It seems that it will be another week of uncertainty and choppy price action in the FX board, as data will likely confirm sluggish economic growth, directed linked to coronavirus-related lockdowns.

EUR/USD technical outlook

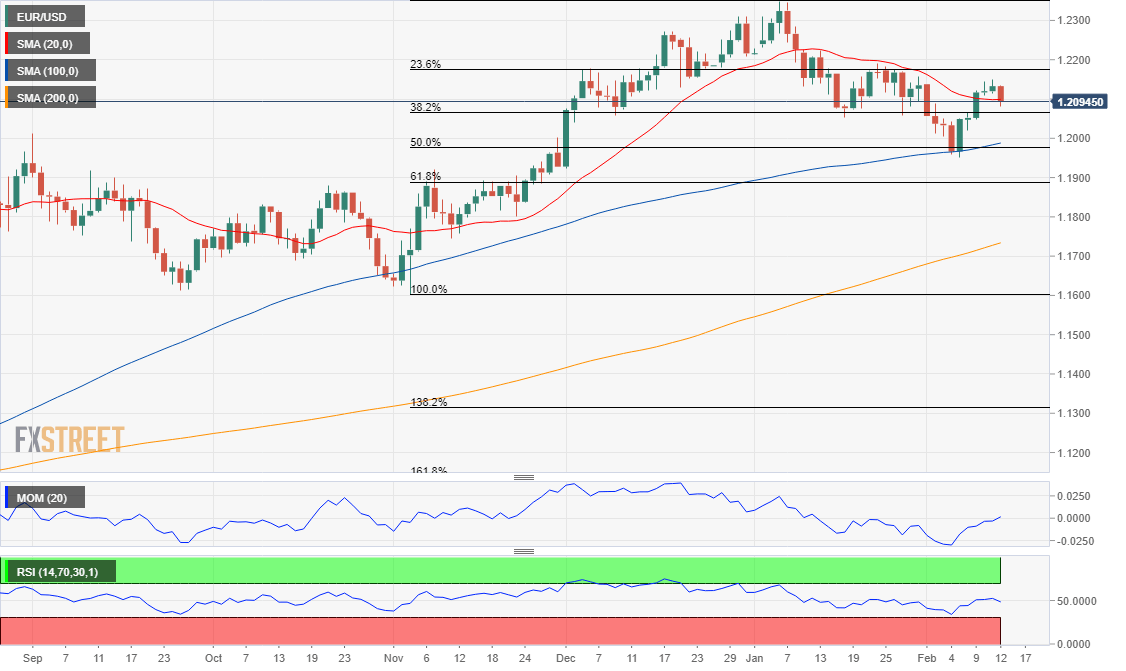

The EUR/USD has further recovered from around the 50% retracement of November/January rally to settle above the 38.2% retracement at 1.2070, an immediate support level. The weekly chart indicates that bulls remain in control, despite the lack of momentum. In the mentioned chart, the 20 SMA maintains its bullish slope converging with the mentioned 61.8% retracement around 1.1960, while the longer ones advance below there. Meanwhile, technical indicators hold within positive levels, but with divergent directional strength and confined to familiar levels.

In the daily chart, further gains are still unclear. The pair trades around a directionless 20 SMA and above the larger ones. Technical indicators, on the other hand, remain directionless around their midlines, indicating limited buying interest.

The pair has topped several times this year in the 1.2170/80 price zone, where it also has the next Fibonacci resistance. A clear break of the area could lead to a retest of the year’s high at 1.2349. The pair could turn bearish only once below 1.1970, with scope then to test the 1.1880 price zone.

EUR/USD sentiment poll

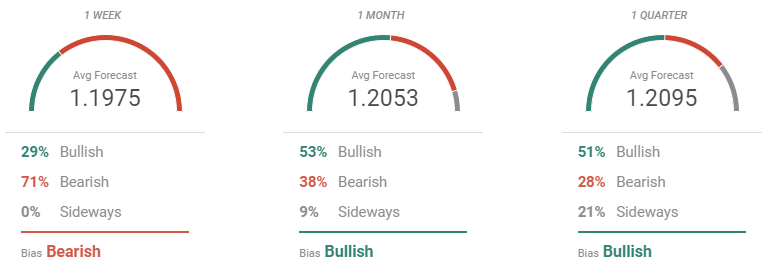

The FXStreet Forecast Poll shows that investors are betting on further dollar recoveries in the near-term. The pair is seen on average at 1.1975, with 71% of the polled experts betting on lower levels. The pressure recedes in the monthly and quarterly views, where buyers are around 50%, pushing the pair back above the 1.2000 level.

The Overview chart, on the other hand, says that bears keep building their case. The moving averages in the weekly and monthly views head firmly lower, although the negative momentum eases in the longer perspective. The number of those looking for a break below 1.2000 has increased when compared to the previous week.

Related Forecasts:

GBP/USD Weekly Forecast: Next stop 1.40? UK reopening expectations and US stimulus eyed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.