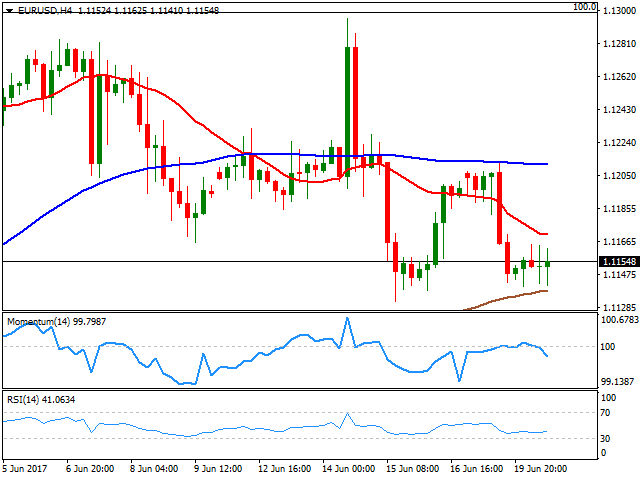

EUR/USD Current price: 1.1154

The EUR/USD pair can't find a catalyst this Tuesday, trading within a well limited 30 pips range ever since the day started. Minor EU macroeconomic releases seen today were mostly disappointing, as German PPI edged lower in May, down by 0.2% from a 0.4% advance in April, and up 2.8% yearly basis from previous 3.4%, with both numbers missing market's expectations. In the EU, the current account recorded a surplus of €22.2 billion in April, down from previous €35.57B. The US current account for the first quarter of this year came in better than expected, with a deficit of $116.8B, while previous quarter deficit was revised higher, to $114.0B. Fed's Kaplan will hit the wires later today, but there are no other news scheduled for today.

Technically, the pair is neutral, although near the lower end of the range that persisted for the last four weeks, somehow increasing chances of a bearish move, at least short term. In the 4 hours chart, the price holds above a bullish 200 SMA, but is also contained by a bearish 20 SMA, whilst technical indicators present modest downward slopes within negative territory, hardly enough to suggest a bearish extension. The immediate support comes at 1.1110, with a stronger one at 1.1075, the base of the mentioned range and the level to surpass to confirm additional declines ahead.

Support levels: 1.1110 1.1075 1.1030

Resistance levels: 1.1170 1.1220 1.1260

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.