The Euro reached new 7-week highs against the US dollar on Friday, lifted by optimism over a Brexit deal, a brighter outlook for US/China trade relations and high expectations for a Fed rate cut at the end of October.

Brexit Deal

On Thursday, UK and EU leaders in Brussels declared that a Brexit deal had been achieved. However, the deal still needs to be approved by the UK Parliament and a vote is set to take place on Saturday. The prospect of an orderly Brexit served to support the European currency, amid fears of the economic region slipping into recession. Recent PMI data showed that manufacturing sentiment in the eurozone fell in September to the worst level in nearly seven years.

US/China Trade

Last Friday, the US and China agreed on the outlines of a partial trade accord. US President Donald Trump stated: "We've come to a very substantial phase one deal" and the news was viewed as a major breakthrough in the trade war that began in January of 2018. With the trade war posing a threat to the Eurozone economy through diminished global investment, news of progress served to support the euro.

October Fed Meeting

The CME Fedwatch tool currently forecasts an 87% chance of a quarter point rate cut at the Fed meeting on October 30th, the probability of a cut having jumped after Wednesday’s disappointing retail sales data. Lower interest rates make the US dollar a less appealing investment.

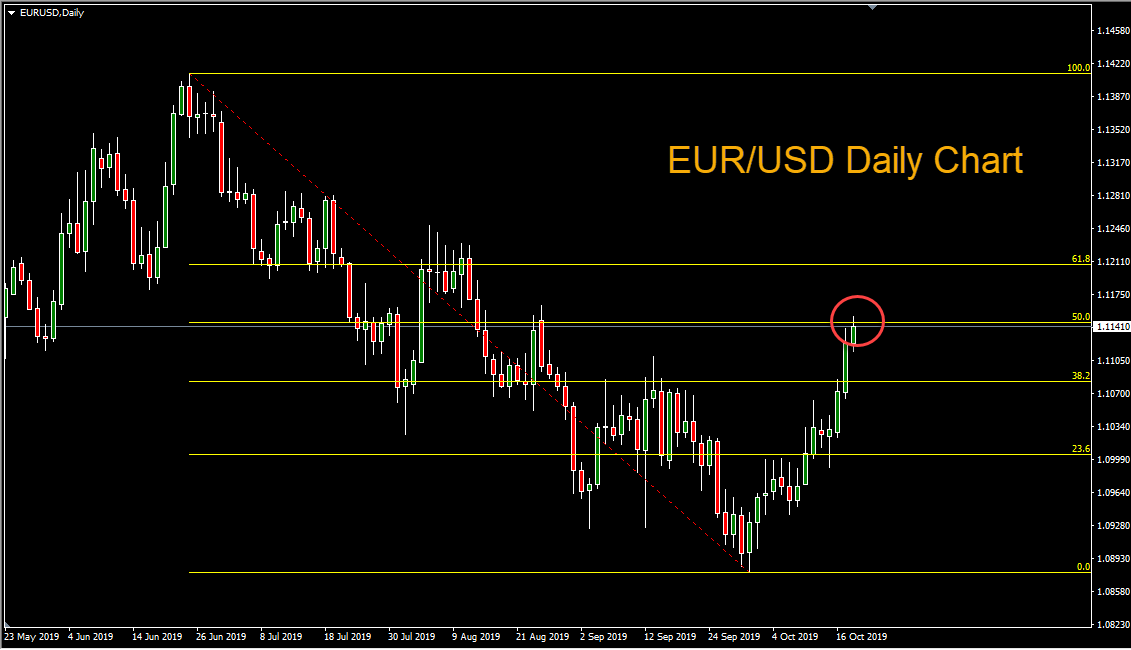

Technical Outlook

Looking at the daily chart we can see that EUR/USD has reached its highest levels since August 26th and has risen to a major 50% retracement level on the daily chart.

Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.