EUR/USD

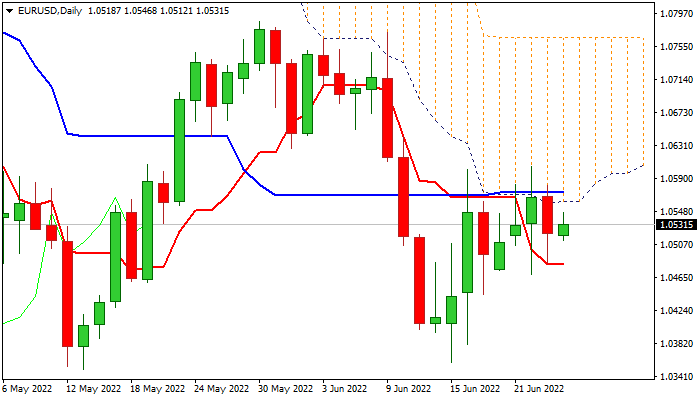

The Euro kept slightly positive stance in a quiet early Friday’s trading, as stocks edged higher, but lacking direction as near-term action holds within a range, defined by 10 and 20DMA’s, for the third straight day and capped by thick daily cloud.

Technical studies are bearishly aligned on a daily chart as momentum remains negative and stochastic turns south, though recovery from June 15 low at 1.0358 remains alive while the price stays above 10DMA (1.0495), but with limited upside prospects for now.

Traders eye German Ifo business climate data (June 92.9 f/c vs May 93.0) for fresh signals, if the figure significantly diverges from expectations, with end-of-week position liquidations to possibly further move the price.

Look for signals on break of 10DMA which could soften near-term tone and shift focus towards key supports at 1.0358/49/40, loss of which would signal bearish continuation.

This so far looks as preferred scenario as the action remains heavily weighed by a massive daily cloud ( 1.0560/1.0767) and negative fundamentals, driven by weak economic data that raise recession fears.

Only sustained penetration of daily cloud and close above 20DMA (1.0591) would ease downside pressure and allow for stronger rebound, although, overall bias is expected to remain with bears while the action stays below 1.0767/86 (daily cloud top/May 30 lower top).

Res: 1.0560; 1.0591; 1.0621; 1.0685.

Sup: 1.0495; 1.0459; 1.0380; 1.0358.

Interested in EUR/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.