- EUR/USD witnessed some follow-through selling for the second straight session on Tuesday.

- A strong pickup in the US bond yields underpinned the USD and exerted pressure on the pair.

- The risk-on mood capped gains for the safe-haven greenback and helped limit the downside.

The EUR/USD pair struggled to capitalize on its early uptick to the 1.2100 neighbourhood, instead met with some fresh supply and dropped to two-month lows on Tuesday. The shared currency was weighed down by concerns that the slow rollout of COVID-19 vaccines in Europe could hamper the economic recovery. On the economic data front, the prelim Eurozone GDP report showed that the economy contracted by 0.7% during the October-December period. The reading was less worse than the 0.9% drop anticipated but marked a sharp slowdown from the downwardly revised 12.5% growth recorded in the previous quarter and did little to impress bulls.

On the other hand, signs of progress towards additional US stimulus measures triggered a fresh leg up in the US Treasury bond yields and helped revive the US dollar demand. This, in turn, was seen as another factor that exerted some additional downward pressure on the major. Democrats in the US Congress took the first steps toward advancing President Joe Biden's proposed $1.9 trillion COVID-19 relief package without Republican support. Democrats opened debate on a fiscal 2021 budget resolution with coronavirus aid spending instructions, unlocking a legislative tool to pass stimulus spending amid Republican opposition.

Meanwhile, renewed optimism over a massive US economic stimulus lifted hopes for a strong global economic recovery. This, along with positive news related to the development of another COVID-19 vaccine, boosted investors' appetite for riskier assets. Reuters reported on Tuesday – citing the peer-reviewed trial data – that the Sputnik V coronavirus vaccine developed in Russia showed an effectiveness rate of 91.6% in the phase-3 trial. The risk-on flow was seen as the only factor that kept a lid on any further gains for the greenback and assisted the pair to find some support ahead of the key 1.2000 psychological mark.

The pair finally settled around 30 pips off daily lows, albeit lacked any follow-through buying and remained confined in a range through the Asian session on Wednesday. Market participants now look forward to the release of the final Eurozone Services PMI prints for a fresh impetus. Later during the early North American session, the release of the US ISM Services PMI will influence the USD price dynamics and further produce some trading opportunities. Apart from this, traders will also take cues from developments surrounding the coronavirus saga, US stimulus headlines and the broader market risk sentiment.

Short-term technical outlook

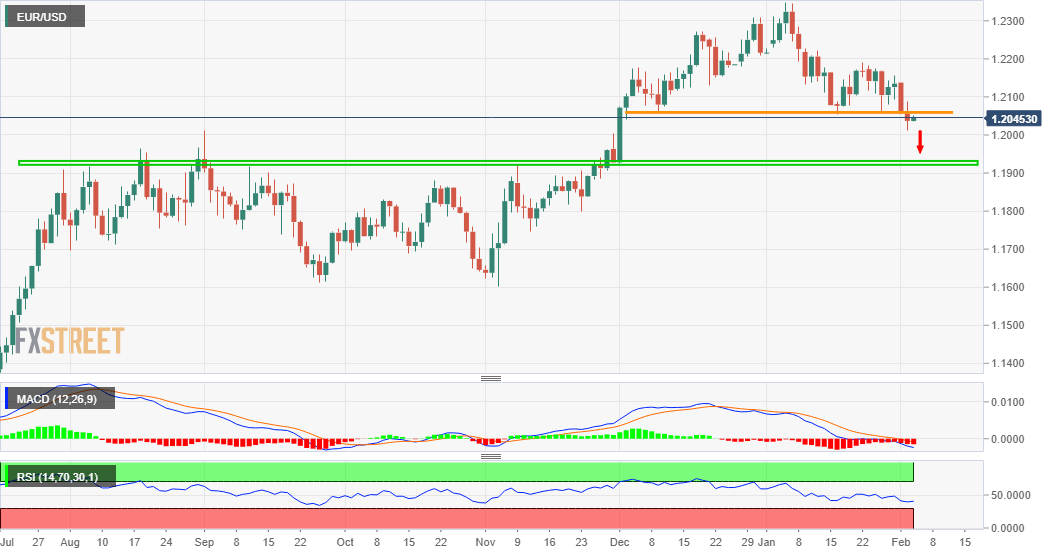

From a technical perspective, the overnight break through the 1.2060-55 strong horizontal support might have already set the stage for a further near-term depreciating move. Subsequent weakness below the 1.2000 mark will add credence the negative outlook and turn the pair vulnerable to accelerate the slide towards the 1.1930 resistance-turned-support zone.

On the flip side, attempted recovery move might now confront stiff resistance near the overnight swing highs, around the 1.2085-90 region. Any further positive move beyond the 1.2100 mark is more likely to be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the 1.2140-50 supply zone. Only a sustained breakthrough the mentioned resistance levels will negate the bearish bias and allow the pair to resume its prior/well-established near-term uptrend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.