Macroeconomic overview

-

U.S. Federal Reserve meeting minutes due later on Wednesday could either reinforce or undermine recent hawkish comments from central bank policy makers that have raised bets on a rise in rates as early as next month.

-

Cleveland Fed President Loretta Mester said on Monday that she would be comfortable raising rates at this point if the economy maintained its current performance. Philadelphia Fed President Patrick Harker said on Monday that he would support a rate increase at a mid-March policy meeting as long as inflation, output and other data continued to show the U.S. economy is growing. But as we wrote yesterday, their comments brought nothing new to market expectations.

-

We think that the likelihood of Fed hike in March is very low. Our baseline scenario is a hike in June.

-

Euro zone inflation rose to an annual rate of 1.8% in January, the European Union statistics agency said today confirming its earlier estimates. Stripped of the volatile components of energy and unprocessed food, an indicator closely watched by the European Central Bank, the annual inflation rate in January was 0.9%, confirming Eurostat's earlier estimate and the market consensus.

-

Ifo economic institute said its business climate index for Germany rose to 111.0 from a upwardly revised reading of 109.9 in January. The reading came in far stronger than market consensus forecast for a value of 109.6. This is another sign of bright recovery of Eurozone economy after yesterday’s PMI readings.

-

The EUR/USD fell below 1.0500 today. Investors keep shrugging off rising inflation and strong macroeconomic data from the Eurozone. We think that a corrective move is likely after today’s FOMC minutes, because we think they will not point to a hike next month and this may disappoint USD bulls.

Technical analysis

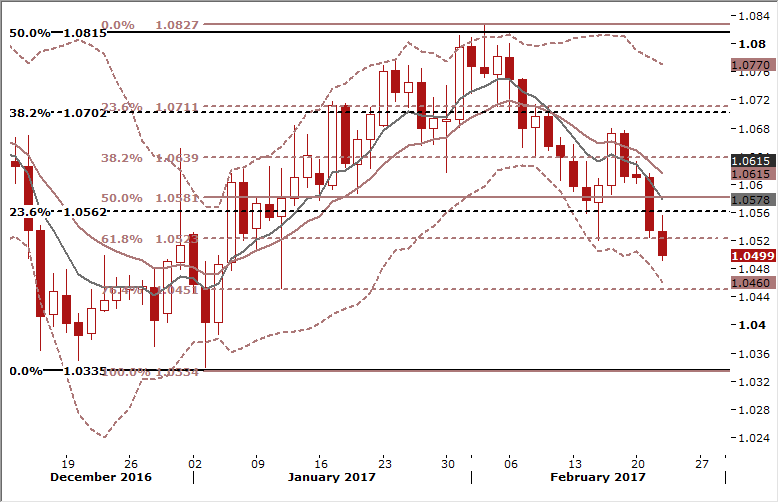

- The EUR/USD broke below the support at 1.0522. The next target of EUR/bears is 1.0451 (76.4% fibo of January-February rise) and then full retracement to the January 1.0340 base. Declining 14-day exponential moving average at 1.0616 weighs heavily on the market.

Trading strategy

- Our long was stopped below 1.0522 support. We stay sideways now, as the outlook is unclear for now. Fundamental factors suggest a recovery in the EUR/USD. But the EUR is weakening despite accelerating inflation and recent much-better-than-expected macroeconomic indicators from the Eurozone. What is more, FOMC roster in 2017 is more dovish than it was in 2016 and we had no hint on timing of next hike in the previous FOMC statement, so we think that the likelihood of March hike is very low. A comeback to fundamental trading may result in rapid EUR/USD recovery, but for now technical analysis suggests a continuation of bearish move to 1.0340.

GBP/USD: Short-lived reaction after better-than-expected UK GDP data

Macroeconomic overview

-

The British economy advanced 0.7% on quarter in the three months to December of 2016, following a 0.6% expansion in the previous period and above the preliminary estimate of 0.6%. It was the highest figure in one year, as exports and government spending rebounded while household expenditure rose at a slower pace and fixed investment showed no growth.

-

From the expenditure side, the largest positive contribution to GDP came from net trade, which contributed a positive 1.3 percentage points, and household final consumption expenditure, which contributed a positive 0.4 percentage points. The negative contributions to GDP came from gross capital formation, which contributed a negative 1.1 percentage points.

-

The trade balance deficit narrowed to GBP 11.0 billion from GBP 17.2 billion in the third quarter. Exports jumped by 4.1%, following a 2.6% drop in the previous period, while imports shrank 0.4% following a 1.3% gain.

Technical analysis

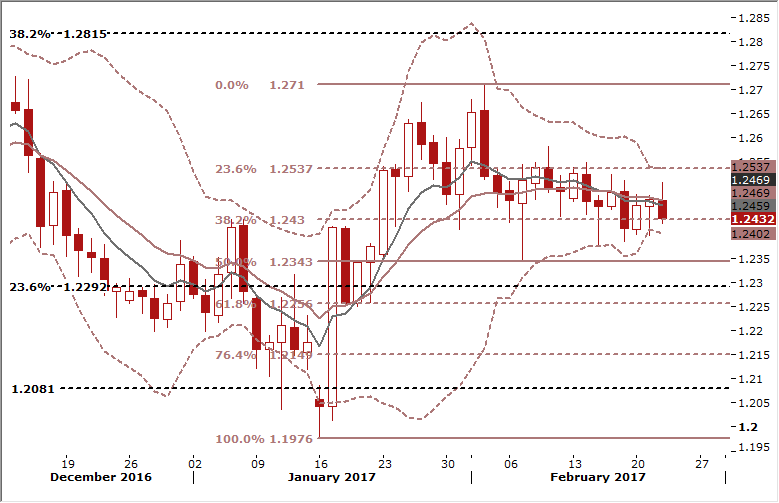

- The GBP initially climbed on a pick-up in UK growth, but quickly reversed course and is fluctuating near 14-day exponential moving average now. Long lower shadow on yesterday’s candlestick suggested the GBP/USD may be gaining momentum, but we need a confirmation of this signal today.

Trading strategy

- We stay GBP/USD long for 1.2700.

AUD/USD: RBA sees danger in high household debt

-

The head of Australia's central bank Philip Lowe gave the clearest signal yet on Wednesday that further cuts in interest rates would not be in the national interest as the danger of a debt-fuelled boom and bust was just too severe.

-

Lowe noted that high levels of debt combined with subdued wage growth were already making households wary of spending freely, a drag that was only set to get worse.

-

Data out on Wednesday showed annual pay rises were stuck at an all-time low of 1.9%, with ongoing weakness in private sector wages.

-

Lowe held out the hope that wage growth had finally bottomed, although the RBA's liaison with firms suggested an upturn was not imminent.

-

A high and rising unemployment rate might add to the case for more stimulus, Lowe said, yet the bank was satisfied that the labour market was heading in the right direction.

-

Lowe, who took over the reins at the RBA last September, has repeatedly stressed about the diminishing returns to the economy from lowering interest rates further, largely due to ballooning household indebtedness. The ratio of household debt to disposable income is at an all-time peak around 180%, while the saving rate has fallen. Mortgage debt stands at AUD 1.7 trillion, larger than the country's annual economic output.

-

"We have been seeking to balance the risks from having inflation low for a longer period against the risks from attempting to increase inflation more quickly, which would partly occur through encouraging more borrowing," said Lowe. While there was a danger that low inflation could lead to a self-fulfilling decline in inflation expectations, he did not see "a particularly high risk" of this in Australia. However, he did see danger in spurring more debt.

-

"At some point in the future, households having decided that they had borrowed too much, might cut back consumption sharply, hurting the overall economy and employment," he warned.

Technical analysis

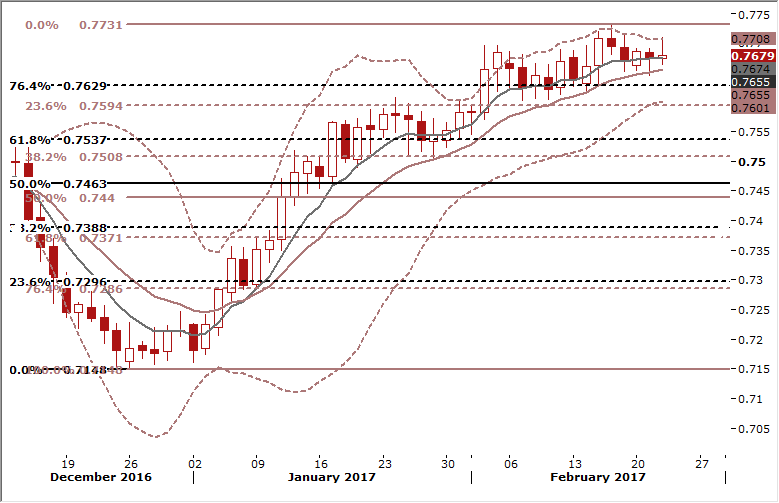

- A hawkish message from Philip Lowe supported the AUD. It is trying once again to break above the 0.7700 resistance against the USD. We think the AUD may succeed if today’s FOMC minutes are less hawkish than expected. The AUD/USD remains above the 14-day exponential moving average, which highlights the overall bullish structure.

Trading strategy

- Our short-term and long-term positions are getting closer to the 0.7750 target. We think it may be reached even today in case of less hawkish FOMC minutes.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.