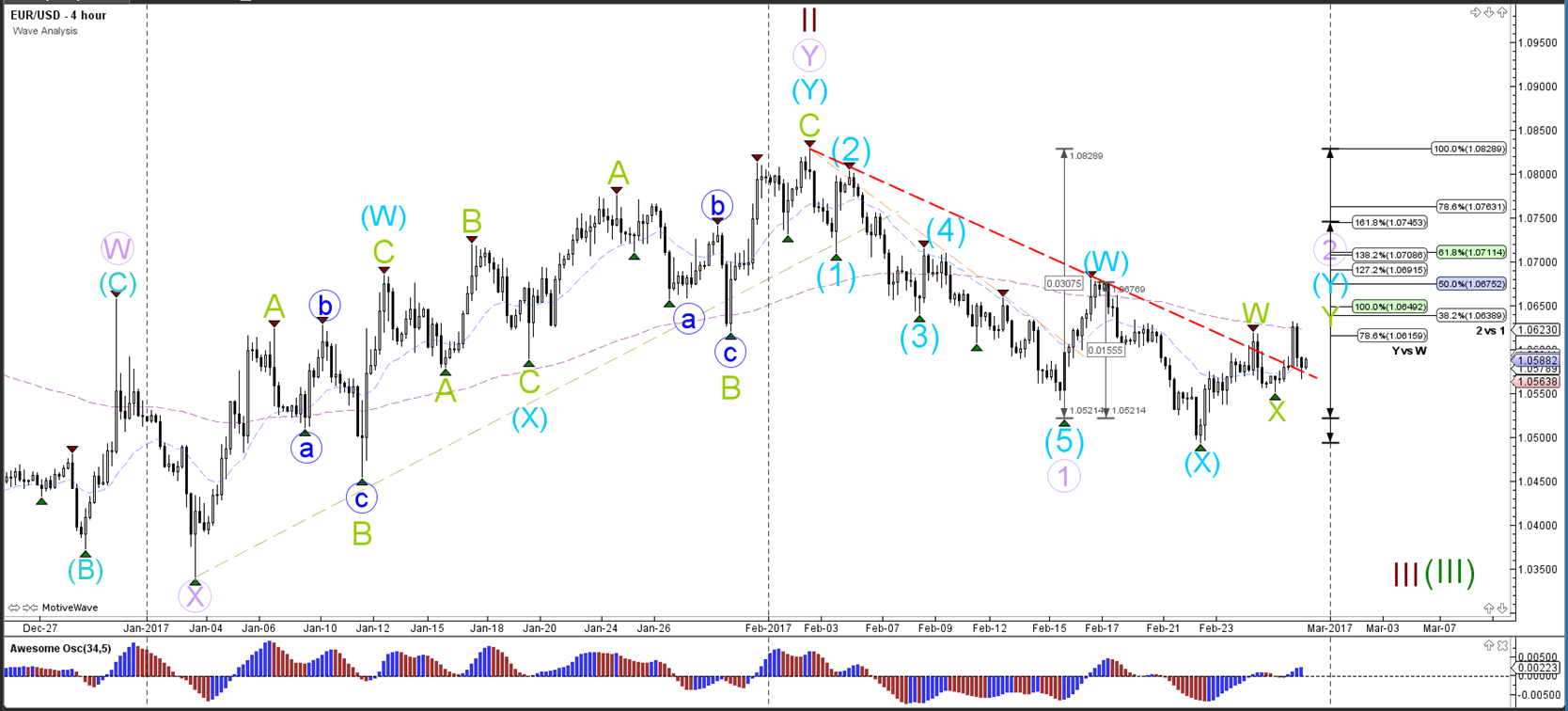

EUR/USD

4 hour

The EUR/USD is building a WXY correction (blue/green) within wave 2 (purple) unless price breaks above the 100% level of wave 2 vs 1 (purple) which invalidates the wave structure. The Fibonacci retracement (purple) levels are potential bouncing spot and reversal levels.

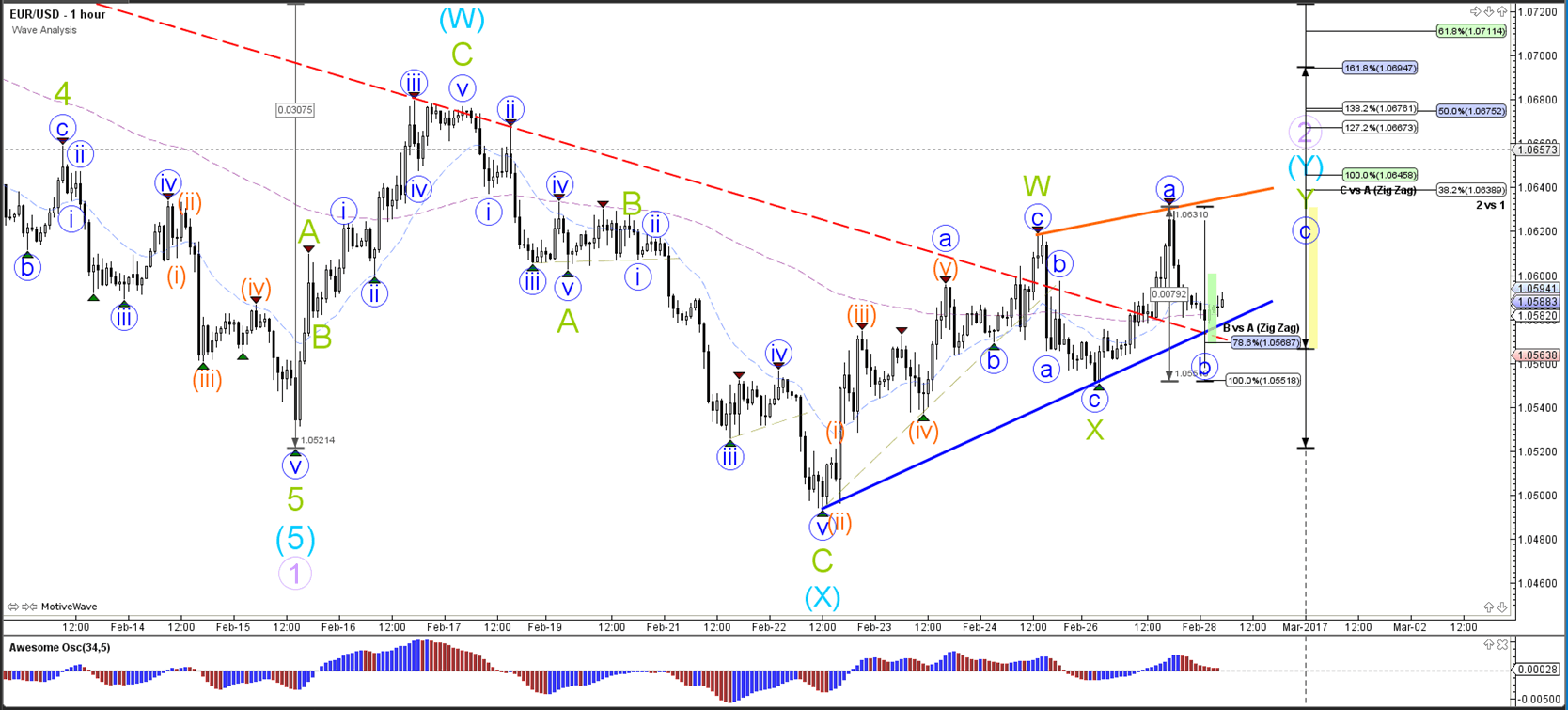

1 hour

The EUR/USD is building an ABC (blue) zigzag correction unless price breaks below the 100% level of wave B vs A (invalidation). The EUR/USD could head back to the 1.07-1.0775 resistance area.

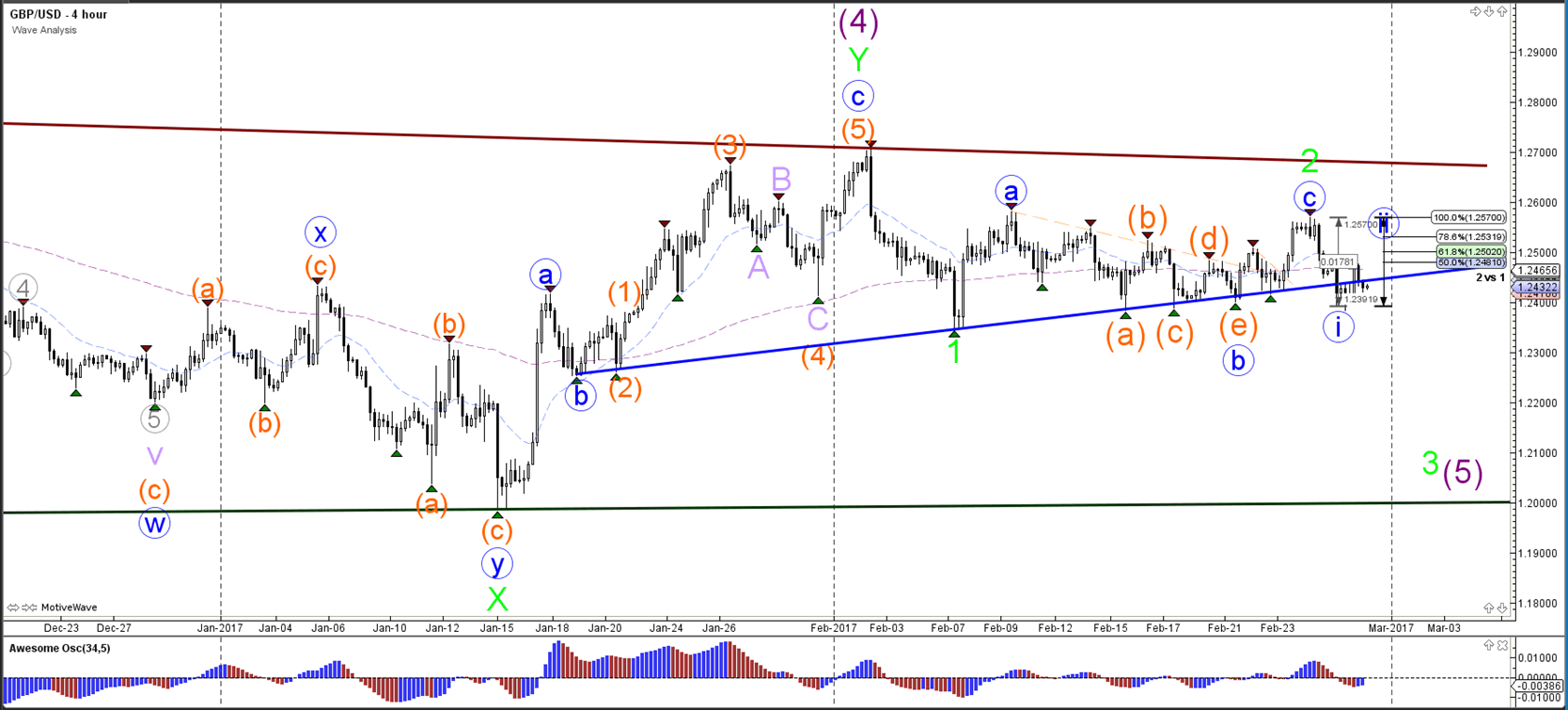

GBP/USD

4 hour

The GBP/USD is still stuck in a larger triangle pattern with support (blue) and resistance (dark red) nearby. A bearish breakout below support (blue) could see price start a wave 3 (green).

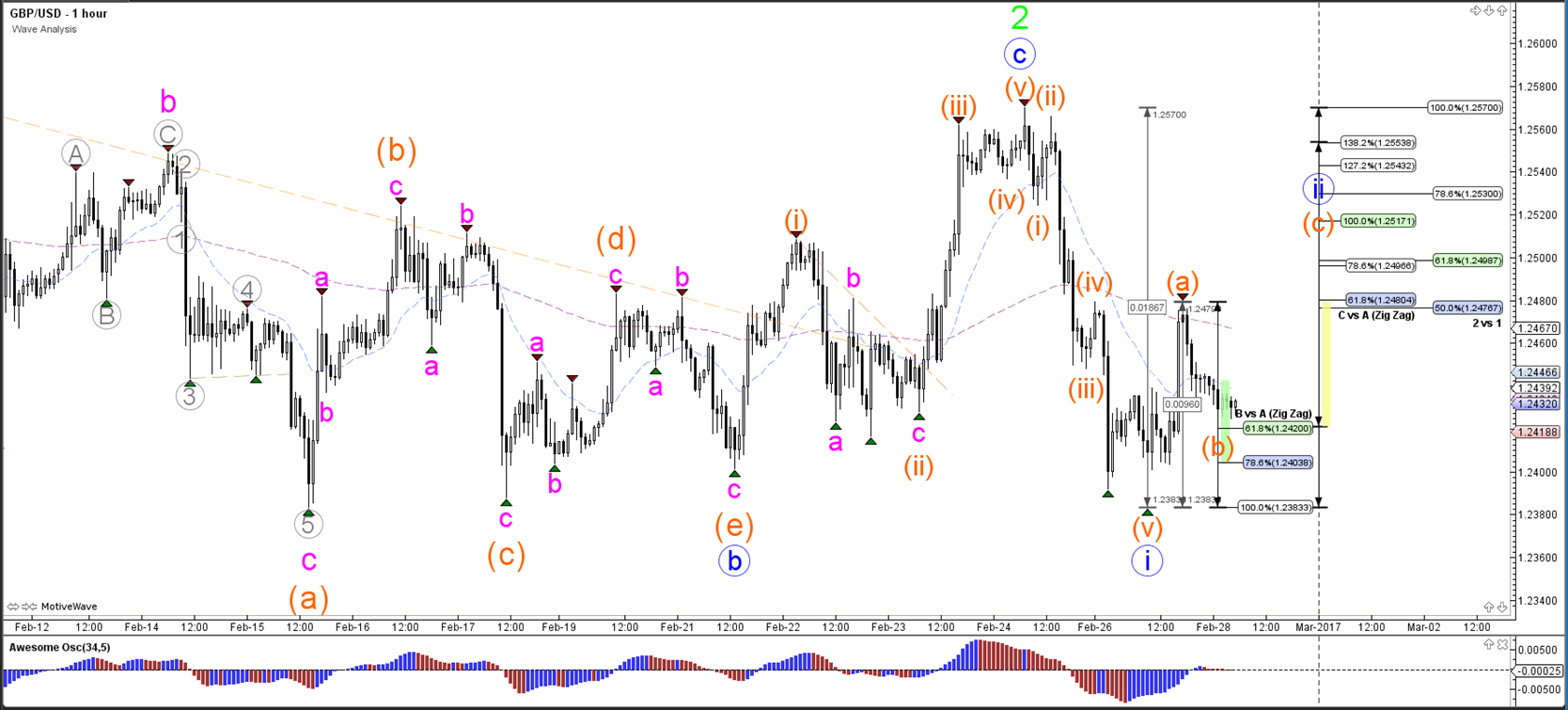

1 hour

The GBP/USD is building an ABC (orange) zigzag correction unless price breaks below the 100% level of wave B vs A (invalidation).

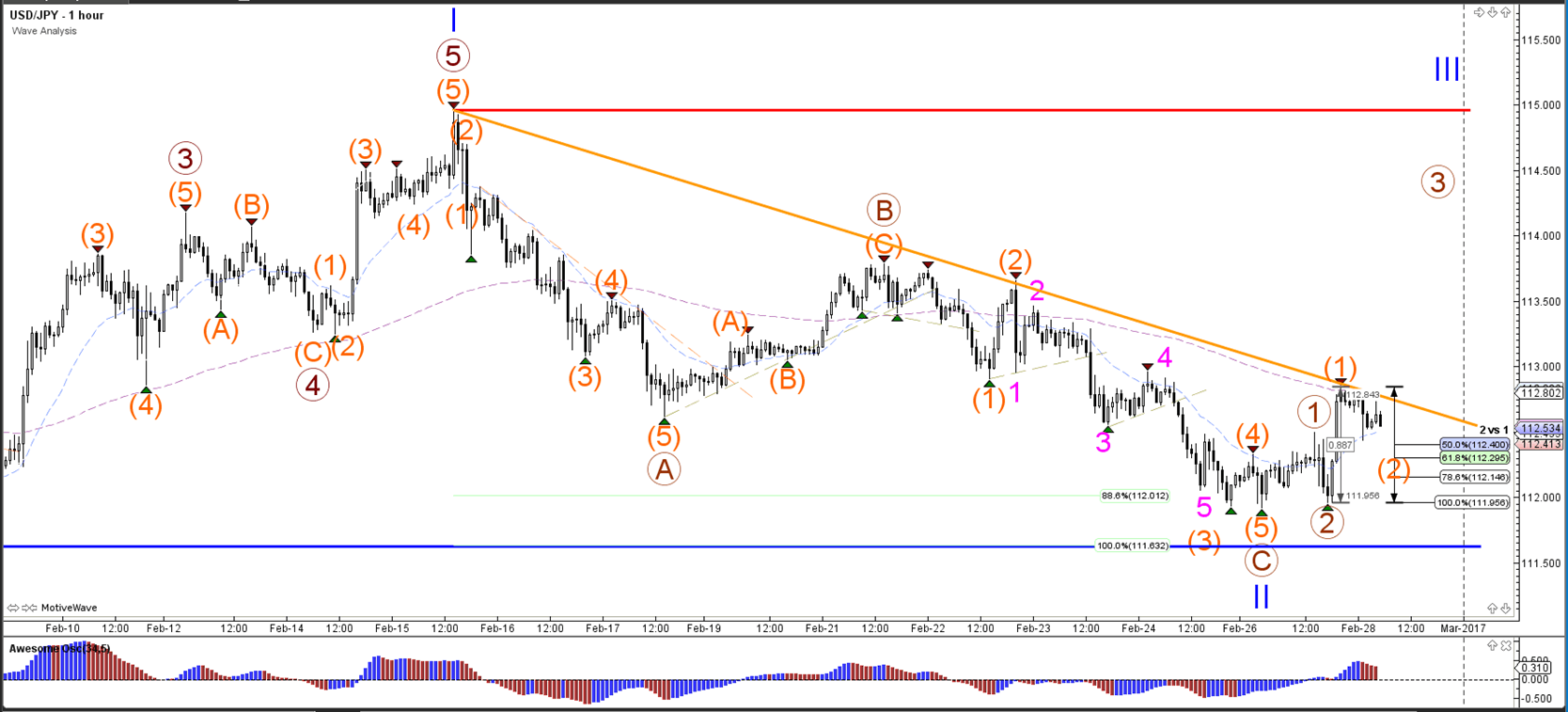

USD/JPY

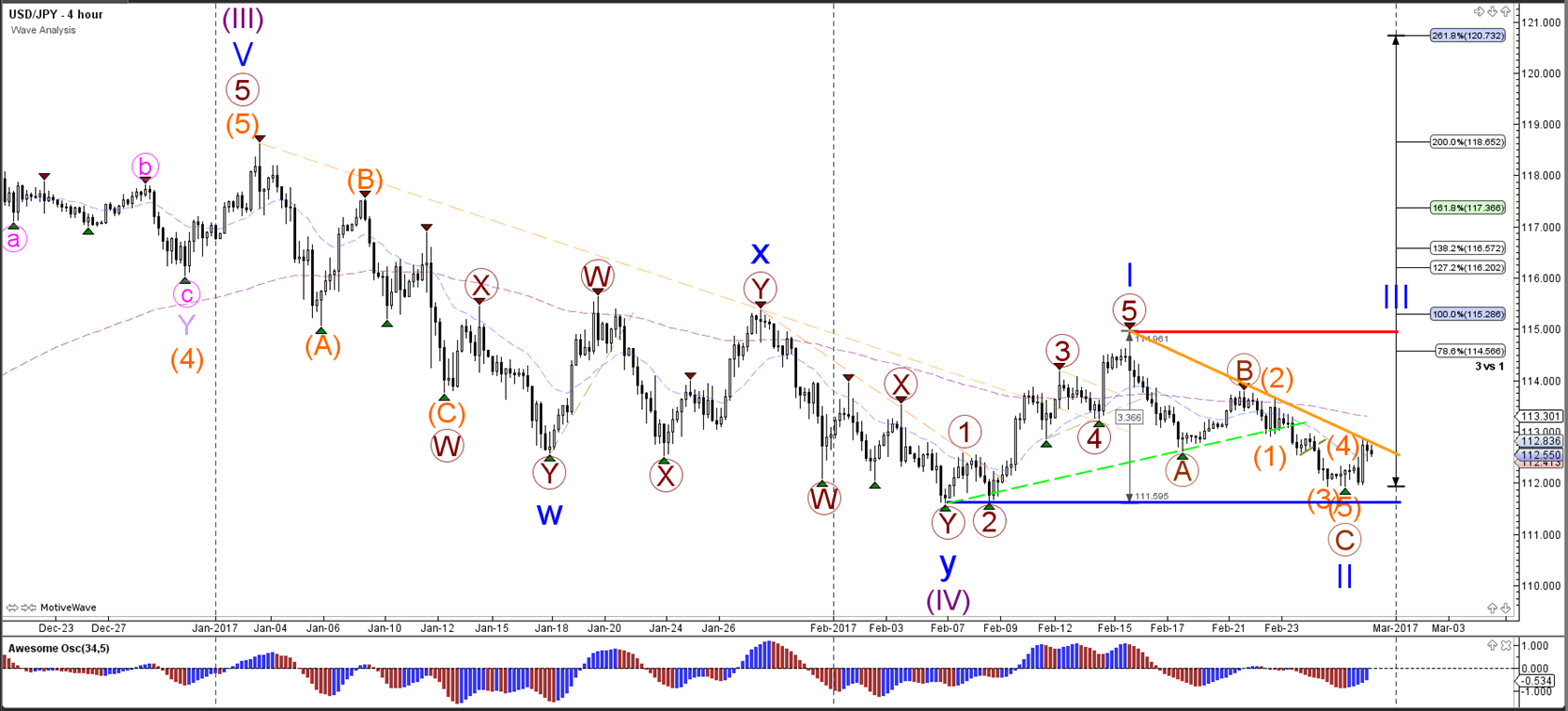

4 hour

The USD/JPY probably completed an ABC (brown) zigzag correction within a wave 2 (blue) pullback. A break below the bottom of wave 1 (blue line) invalidates the wave structure. A break above resistance (orange line) could indicate that the correction is finished.

1 hour

The USD/JPY respected the 88.6% Fibonacci retracement level of wave 2. A break above resistance (orange line) could indicate a potential bullish breakout as part of waves 3 (brown/blue).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.