- EUR/USD has been holding onto gains around 1.11 amid upbeat trade headlines.

- Weak German data and the US Non-Farm Payrolls may send it down.

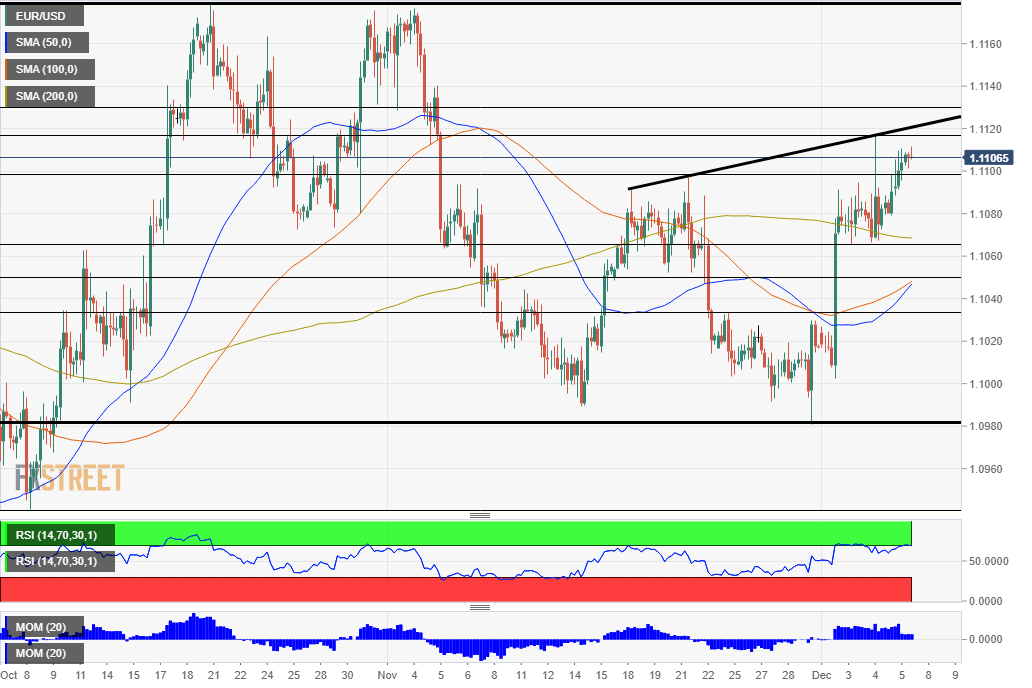

- Friday's four-hour chart is pointing to overbought conditions.

De-escalation in the Sino-American trade war? China has announced it will begin implementing tariff waivers for some purchases of US pork and soybeans. This gesture of goodwill has pushed markets higher, weighed on the safe-haven dollar – and kept EUR/USD bid.

However, by offering this olive branch, Beijing is averting a commitment on the exact amount of agrifood buying – a critical demand from Washington. Moreover, the clock continues ticking down toward December 15 – when the US is set to slap new tariffs on China. President Donald Trump has indicated that talks are proceeding – but markets have heard such optimism before. Moreover, the president said an agreement might wait for after the November 2020 elections earlier this week.

Trade headlines, coming from both countries, are set to continue whipsawing financial markets on Friday. However, the US jobs report is also due to have its share in moving currencies during the day.

Focus shifts to Non-Farm Payrolls

Non-Farm Payrolls figures are expected to show an increase of 180,000 positions in November, up from 128,000 in October. Average Hourly Earnings are forecast to remain at 3% yearly growth, while the Unemployment Rate is also predicted to hold its ground at 3.6% – close to the historic lows.

Indicators leading toward the publication have been mixed, with weak figures from ADP and an upbeat employment component in the ISM Non-Manufacturing Purchasing Managers' Index. The Federal Reserve is watching the data ahead of its December 11 decision.

See

- Nonfarm Payrolls Preview: Economic health vs. trade war, who will win the battle?

- US Non-Farm Payrolls November Preview: Labor market continues to defy concerns

Troubles in the core of Europe

The old continent's largest countries are both grappling with several issues. German Industrial Production plunged by 1.7% in October, far worse than a modest increase that was projected. While Europe's powerhouse averted a recession, its economy is still not out of the woods. Friday's figures join disappointing Factory Orders earlier this week.

Germany's government is under pressure as the new leadership of the SPD – the center-left junior coalition partner – is taking over. Norbert Walter-Borjans and Saskia Esken are expected to demand changes from Chancellor Angela Merkel's CDU/CSU bloc – but the center-right party has issues of its own and is unlikely to give in easily. Political analysts foresee no imminent danger to the government, but politics has its own dynamics.

France has been rocked by massive strikes and demonstrations on Thursday against a planned reform in the pensions system. Industrial action is set to continue for several days.

Overall, trade headlines and the Non-Farm Payrolls are set to dominate trading today.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is just above 70 – indicating overbought conditions – indicating a slide. Moreover, upside momentum has waned, and the currency pair is capped by uptrend resistance. On the other hand, it trades above the 50, 100, and 200 Simple Moving Averages.

Support awaits at 1.11, which held euro/dollar down last week. The next level to watch is 1.1065, a support line earlier this week, which converges with the 200 SMA. Next, we find 1.1050 – the confluence of the 50 and 100 SMAs, followed by 1.1030, which held the pair down last week. November's low of 1.0980 is next.

Resistance is at 1.1115, Thursday's high. Next, we find 1.1130, a support line from early November, and 1.1180 – a critical double top.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.