- EUR/USD witnessed some profit-taking on Monday amid a strong pickup in the USD demand.

- The risk-on mood-led rally in the US bond yields prompted some USD short-covering bounce.

- The pair showed resilience below the 1.1800 mark, warranting caution for bearish traders.

The EUR/USD pair kicked off the new week on a positive note and climbed to over two-month tops, around the 1.1920 region, albeit struggled to capitalize on the move. Joe Biden’s victory in a nail-biting US presidential election kept the US dollar bulls on the defensive, which was seen as a key factor behind the early uptick.

Adding to this, a promising development over a potential vaccine for the highly contagious coronavirus disease provided an additional boost to the already upbeat market mood. Pfizer and BioNTech announced that a large-scale clinical trial showed their experimental vaccine was more than 90% effective in preventing COVID-19.

This was seen as a major victory in the fight against the highly contagious disease and revived hopes for a swift global economic recovery. The strong risk-on flow triggered a massive rally in the US Treasury bond yields, which, in turn, prompted investors to unwind their bearish USD positions and exerted some pressure on the major.

The pair dived around 125 pips from daily swing highs and momentarily slipped back below the 1.1800 mark, though showed some resilience at lower levels. The latest optimism turned out to be short-lived and was evident from a pullback in the equity markets. Investors remain sceptic about the efficacy and the length of immunity provided by the vaccine.

The cautious mood was further reinforced by a fresh leg down in the US bond yields, which undermined the greenback and assisted the pair to regain some positive traction during the Asian session on Tuesday. Market participants now look forward to the release of the German ZEW Survey for some impetus. On the other hand, moves in the US bond market and the broader market risk sentiment will influence the USD price dynamics, which should further assist traders to grab some meaningful opportunities.

Short-term technical outlook

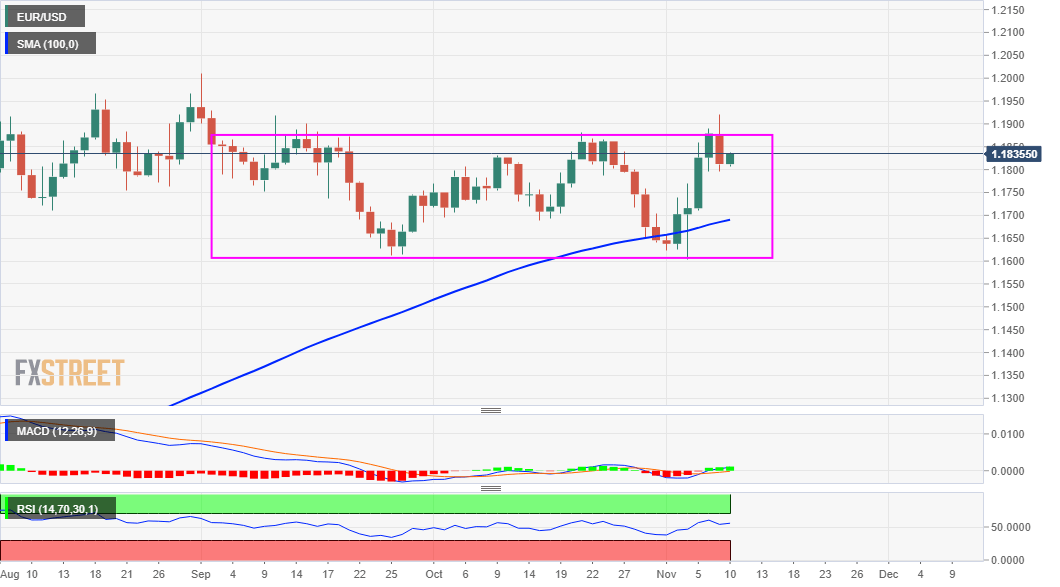

From a technical perspective, the overnight sharp retracement might have turned the recent move beyond a two-month-old trading range as a false breakout. That said, it will still be prudent to wait for some follow-through selling below the 1.1800-1.1795 region before confirming that the pair might have topped out in the near-term. The pair might then turn vulnerable to accelerate the slide back towards testing the 1.1700 mark. The downward trajectory could further get extended towards 100-day SMA support, currently near the 1.1650-45 region.

On the flip side, the 1.1855-60 region, which is closely followed by the 1.1880-85 support zone might now act as immediate resistance. A sustained strength beyond, leading to a subsequent move above the overnight swing high, around the 1.1920 region, has the potential lift the pair beyond the 1.1945-40 supply zone, towards reclaiming the key 1.2000 psychological mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.