- The USD rebounds sharply in reaction to Friday's upbeat US retail sales data.

- Escalating geopolitical tensions further benefitted the buck's safe-haven status.

- Traders eye Draghi's speech for some impetus ahead of FOMC on Wednesday.

The US Dollar rebounded sharply on Friday and exerted some heavy pressure on the EUR/USD pair after the latest US economic data suggested that the Fed might not be in a hurry to cut interest rates anytime soon. The headline US monthly retail sales came in slightly weaker-than-expected but the fact that ex-autos and control group sales surpassed market expectations, along with upward revisions of the previous month's readings weakened the case for an immediate rate cut move by the Fed and provided a strong boost to the greenback.

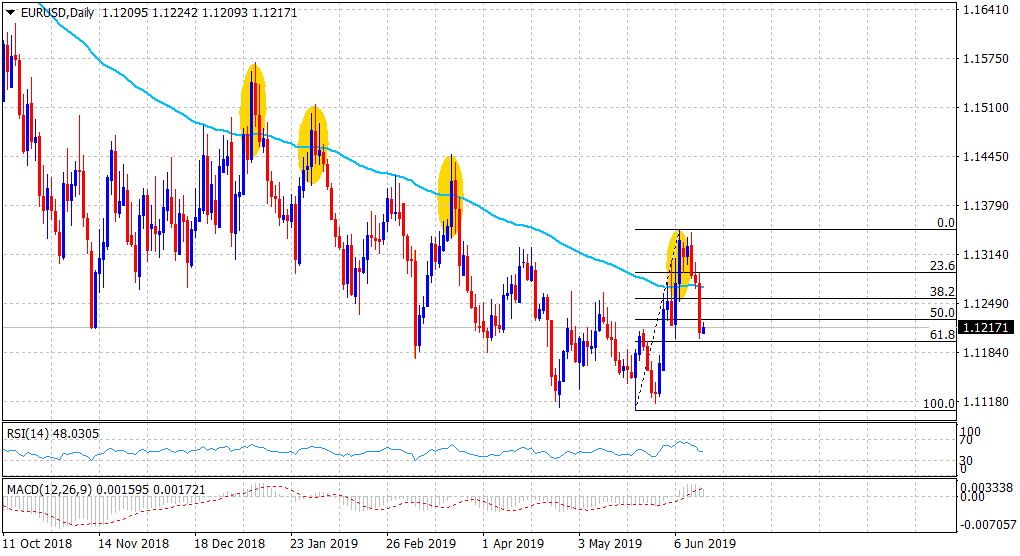

This was followed by better-than-expected Industrial Production and Capacity Utilization figures for May, which coupled with escalating geopolitical tensions, further benefitted the USD's relative safe-haven status and continued dragging the pair through the US trading session on Friday. The pair extended its retracement slide from the 1.1340-50 supply zone and tumbled to the 1.1200 neighbourhood, albeit managed to find some support near 61.8% Fibo. retracement of the 1.1107-1.1348 recent corrective bounce.

The pair held steady near the mentioned handle through the Asian session on Monday and remains at the mercy of USD price dynamics in absence of any major market moving economic releases from the Euro-zone. Later during the early North-American session, the release of Empire State Manufacturing Index for June might further collaborate towards producing some short-term trading opportunities. The key focus, however, will be on the ECB President Mario Draghi's scheduled speech, which might influence the near-term price dynamics ahead of the next event risk - the keenly awaited FOMC monetary policy update on Wednesday.

From a technical perspective, the pair's repeated failures to find acceptance above 100-day SMA clearly indicates that the near-term selling bias might still be far from over. A follow-through weakness below the 1.1200 handle will reinforce the bearish outlook and turn the pair vulnerable to aim back towards challenging yearly lows support near the 1.1100 round figure mark with some intermediate support around mid-1.1100s.

On the flip side, the 1.1255 region - marking 38.2% Fibo. retracement level now seems to act as an immediate resistance and is closely followed by 100-day SMA, around the 1.1270-75 zone and the 1.1300 round figure mark. Momentum above the mentioned hurdles could get extended towards the recent swing high, around the 1.1345-50 region, which if cleared decisively will negate the bearish set-up and prompt some aggressive short-covering move in the near-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.