What a way for the EUR/USD pair to close April! The common currency surged to fresh 2017, gapping around 200 pips on Sunday, amid the result of the first round of the French presidential election. Centrist Emmanuel Macron and populist candidate Marine Le Pen advanced to the second round of the French presidential election, with the first leading with 23.7 and Le Pen pulling in 21.7%. The two of them will now confront on the second round, next May 7, and polls show that Mr. Macron has solid chances of winning. The common currency rallied on relief as Le Pen is seen by investors as a synonym of "Frexit."

EUR's demand survived a not so optimistic ECB, which left its monetary policy unchanged last Thursday, indicating that economic growth is doing fine but inflation not that much and therefore that tapering QE is not yet an option. However, EU inflation released early Friday came in much better than expected, up to its highest in over three years and close to ECB's target. April preliminary CPI came in at 1.9% from 1.5% in March, whilst core inflation, which excludes food and energy volatile prices, rose by 1.2% yearly basis, up from previous 0.8%, the highest level since September 2013. Such figures put easing back on the table.

In the US things were not that bright, as data released all through the week missed expectations. On Friday, the preliminary Q1 GDP came in at 0.7%, below market's forecast, but in line with the negative figures seen lately, while the Michigan Consumer sentiment index for April retreated to 97 from previous 98. Overall, there's a general sense that Trump-promised boost to growth is not coming as fast as expected, although markets are not yet ready to give up on hopes.

Next week, FED's monetary policy meeting and US Nonfarm Payrolls will take center stage, with a holiday in Europe on Monday and the Golden Week in Japan anticipating some choppy trading ahead of the events. The FED is not actually expected to make a move, but investors will be looking for clues on what will happen in June and whether a rate hike is possible then. Payrolls will probably lose relevance being released a couple of days after the FED's meeting, although the US really needs a strong reading in there to regain some confidence.

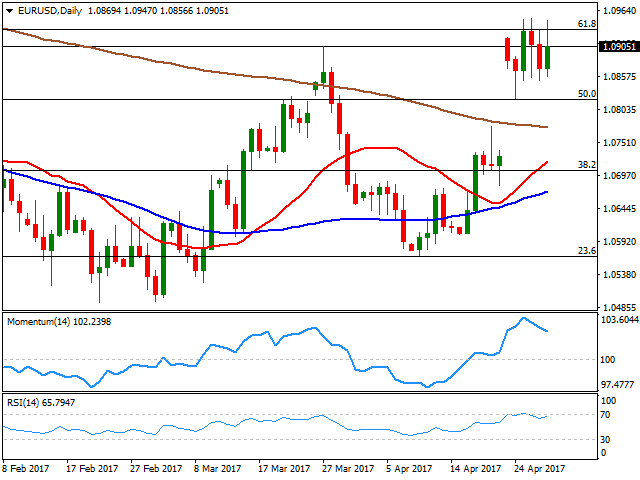

From a technical point of view, the EUR/USD rally stalled at a major resistance this week, as the 1.0930 region stands for the 61.8% retracement of the post US-election slump. Given however that the pair settled a few pips below it, and that the intraweek decline met buying interest around 1.0820, the 50% retracement of the same decline, the risk is clearly towards the upside. In the weekly chart, technical indicators lack directional strength, while a major resistance can be seen at 1.1100, the 100 SMA. Daily basis, the Momentum indicator lost upward steam within positive territory, pretty much because the pair has been consolidating all through the week, but the price is above all of its moving averages, whilst the RSI indicator consolidates near overbought readings, also favoring additional gains for next week.

Above 1.0950, the next short-term resistance comes at 1.1000, followed by 1.1045, although gains up to 1.1260 could be possible if the pair advances further beyond this last. The bullish trend will persist as long as the price holds above the mentioned Fibonacci support at 1.0820, although a break below the level should favor a downward move towards the 1.0730 level, where the pair will fill this week's opening gap.

Sentiment towards the American currency is clearly negative in the short term according to the FXStreet Forecast Poll, as most majors are seen gaining against the greenback next week, with the only exception of the Canadian dollar, seen sideways.

In the case of the EUR/USD pair, bullish led by little, representing a 38%, while those betting on further consolidation reach 37%. In the 1 and 3 months' perspectives, however, market favors the greenback, with 80% of the polled experts favoring the greenback to an average target of 1.0592. The poll converges with the overall sentiment towards Trump and his growth policies, seen delayed but not down yet. On a color note, the pair is hardly seen recovering beyond 1.1000 in the next three months.

Investors seem to believe that the GBP/USD has topped, or is about to, given that despite sentiment is bullish for this upcoming week, the average target is 1.2900, with some investors seeing it tops at 1.3150. For the monthly outlook, investors bet on a downward move towards 1.2670, while the number of bears increases to 80% in a three-month view, with the pair seen then at 1.2470. Much higher targets that a month ago, and with 1.2000 clearly out of the picture.

Bulls surpass the 50% when it comes to the USD/JPY pair, up to 72% for the three-month outlook, with bears representing a small portion of the polled experts. Nevertheless, the pair is average targeting 113.00/60 during the next few months, higher when compared to last week, but still indicating that risk is the main market leader, as in a risk-averse environment the JPY always stands victorious.

.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.