EUR/USD Current Price: 1.0954

- Mounting tensions between the US and China weighed on the market’s mood.

- Markit preliminary estimates for business output were better than anticipated but remained in contraction territory.

- EUR/USD continues to post higher highs daily basis, its bearish potential remains limited.

The EUR/USD surged 1.1008, a fresh three-week high, but closed the day in the red around 1.0950. The market’s sentiment remained sour throughout the day, although risk-aversion during US trading hours benefited the greenback. The dismal mood was triggered by comments from Chinese speaker for the National People’s Congress, Zhang Yesui, who said that China will firmly defend its interest if the US does something to undermine the country’s core interests.

In the data front, Markit released the preliminary estimates of May’s PMI for the Union and the US. In the EU, the manufacturing index improved from 33.4 to 39.5, while services output rose from 12 to 28.4. Despite upbeat figures, the European economy “remained stuck in its deepest downturn ever recorded,” according to Markit. In the US the manufacturing PMI recovered from 36.1 to 39.8, while the Services PMI recovered to 36.9 from 26.7. Initial Jobless Claims for the week ended May 15, which resulted at 2.43 million, slightly worse than the 2.4 million expected.

Friday is a quiet day in terms of data, as the ECB will publish the Minutes of its latest meeting, while the US won’t release relevant macroeconomic figures. The focus will remain on mounting tensions between Washington and Beijing and coronavirus-related headlines.

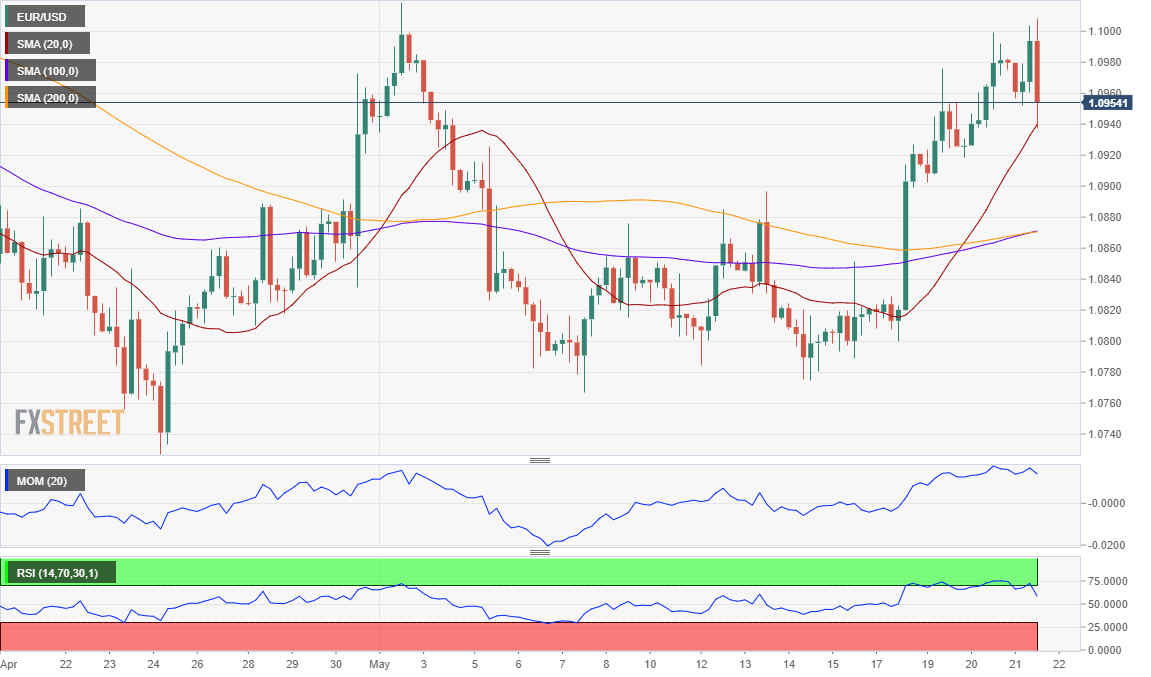

EUR/USD short-term technical outlook

The EUR/USD pair bottomed at 1.0936, above a static support level at 1.0920. The decline seems corrective after the test of the critical 1.1000 price zone. The 4-hour chart shows that the pair met buyers on a test of a sharply bullish 20 SMA, while technical indicators gyrated sharply lower, the Momentum now flat around its mid-line and the RSI at around 58. Overall, the bearish potential seems limited, but it could gather a firmer pace on a break below 1.0920 the immediate support level.

Support levels: 1.0920 1.0890 1.0850

Resistance levels: 1.0975 1.1010 1.1045

View Live Chart for the EUR/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD tests the major level of 1.0650; followed by the nine-day EMA

EUR/USD remains lackluster during the early Tuesday, hovering near 1.0650. From a technical perspective, analysis suggests a bearish sentiment for the pair as it struggles below the pullback resistance at the 1.0695 level.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.