- EUR/USD has been retreating from the highs amid concerns about the coronavirus.

- Manufacturing PMIs and further headlines about the virus are set to dominate trading.

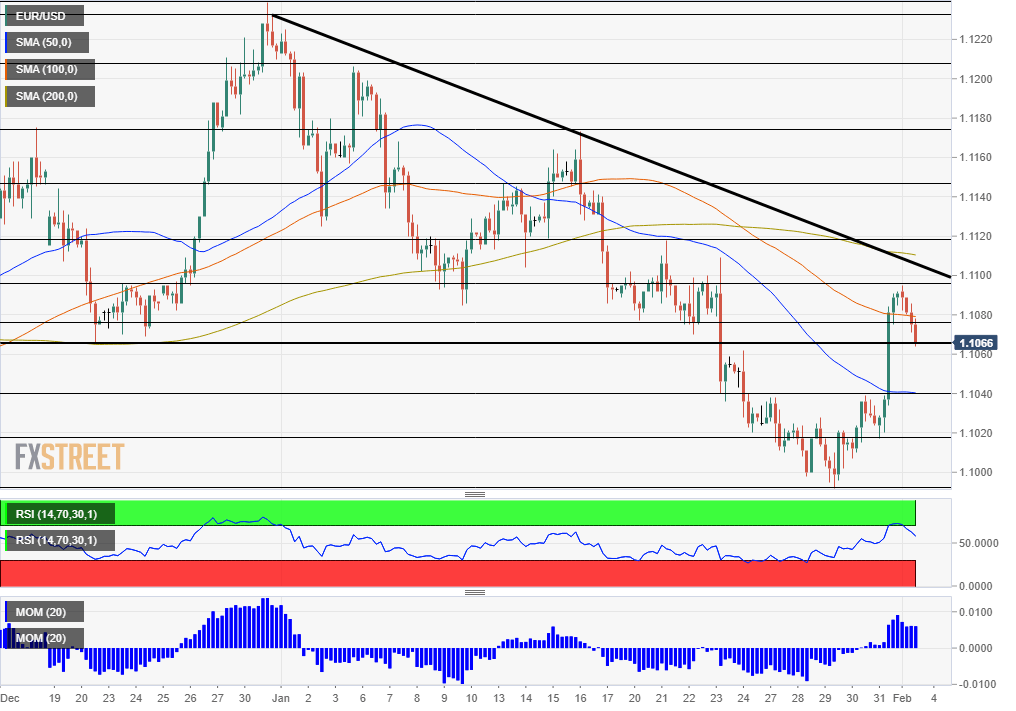

- Monday's four-hour chart is painting a mixed picture.

China has issued an urgent appeal for protective equipment amid the coronavirus outbreak – but traders are taking a break from running to the safety of US treasuries. Higher US bond yields are pushing the dollar higher, allowing it to recover from Friday's sell-off.

The outbreak continues gripping headlines. The respiratory disease has already taken the lives of around 360 people and more than 17,000 have been infected. The first fatality has been recorded out of China while new testing equipment and medication is applied.

The economic impact is becoming more severe. Airlines are canceling flights to the mainland and several Chinese provinces have extended their New Year holidays. Financial markets have reopened in the world's second-largest economy with a significant downfall. Shanghai closed 8% lower despite efforts by the People's Bank of China's stabilization efforts. The PBOC cut interest rates on reserve repo operations and also took other measures.

While China was catching up with last week's equity rout, stocks Europe is stable and S&P futures are pointing higher. Investors seem to be picking bargains on shares while taking profit on American bonds, allowing the greenback to recover.

Beyond the coronavirus

The euro has its own issues to grapple with. Luis de Guidos, Vice President of the European Central Bank, said that inflation will likely remain at low levels for some time. Markit's final Manufacturing Purchasing Managers' Indexes for January confirmed the initial read. The industry continues contracting, albeit at a slower pace than in late 2019.

The focus later shifts to the US ISM Manufacturing PMI. Similar to Europe, the industrial sector continues struggling while consumers are driving the economy forward. A small improvement is on the cards for January, yet the indicator is set to remain below 50 points – reflecting contraction.

See US Manufacturing PMI Preview: Trade takes back seat to the virus

US politics may also be of interest late in the day. The Democratic Party holds its first round of primaries in Iowa. Bernie Sanders, a firebrand US Senator, and Joe Biden, the centrist former Vice President, are in the lead.

While this is the first contest, the complex caucus system and the small size of the state may result in little market reaction. The race is long and set to end only in June. Nevertheless, investors prefer Biden's mainstream approach to the economy rather than Sanders' socialist ideas.

Overall, the coronavirus and also US data are set to dominate.

EUR/USD Technical Analysis

Euro/dollar is trading below a downtrend resistance line that is set to converge with Friday's high of 1.1095. Other indicators are mixed. The currency pair enjoys upside momentum on the four-hour chart and trades above the 50 Simple Moving Average. However, it has fallen below the 100 and 200 SMAs.

EUR/USD is battling 1.1065, which was a stubborn support line in December. Next, 1.1040 capped it during January and is also where the 50 SMA hits the price. 1.1020 and 1.0990 are next.

Some resistance awaits at 1.1075, a support line from January, and then 1.1095, Friday's high. It is followed by 1.1120 and 1.1145.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.