- Fed’s “hawkish” rate cut overshadowed by Trump escalating the trade war.

- European growth remained depressed in the second quarter of the year, backing ECB’s decision.

- EUR/USD may bounce further after nearing 1.1000, but no bullish potential to work with.

The EUR/USD pair started August flirting with the critical, psychological level of 1.1000 as a result of the chess game, a dangerous one, US President Trump is playing. Last Wednesday, the US Federal Reserve announced a 25bps preventive rate cut, with Chief Powell attributing the decision to "muted inflationary pressures" and "the implications of global developments." The US President rushed to say that “Powell let us down” following the almost hawkish Fed’s announcement, but he didn’t stop there. On Thursday, Trump announced a new round of tariffs on Chinese imports, a 10% fee on over $300B of goods. Such move pushed back up odds for another rate cut before the end of the year, as it boosted the risk of a recession. A bold move, to say the least, and a high price paid, as equities tumbled with the escalation of the trade war, giving back July’s gains.

Why happened what happened?

On Friday, the US released the July Nonfarm Payroll report, which showed that the US economy added 164K new jobs as expected in July, while the unemployment rate held steady at 3.7%. Wages grew by 0.3% MoM and by 3.2% YoY in the same month, barely above the market’s expectations. The report failed to impress, overshadowed by trade war concerns and fears of a possible US recession. US data, beyond employment one, spurred those concerns as the ISM Manufacturing PMI dropped to 51.2 in July, its lowest since September 2019.

Meanwhile, across the Atlantic, the EU’s economic growth continues decelerating. According to preliminary estimates, the Union’s Q2 GDP came in as expected at 0.2%, after a modest 0.4% gain in the first quarter of the year. German inflation, harmonized to that of the EU was estimated at 1.1% YoY in July, well below the previous 1.5% and the expected 1.3%, while the core annual CPI for the whole Union in the same period resulted at 0.9% also missing the market’s expectations. Furthermore, the German Markit Manufacturing PMI was downwardly revised to a seven-year low of 43.2 for July, while for the EU, the index resulted at 48.0 as previously estimated, and better than the market’s forecast of 47.7, both indicating that the Union’s economy keeps contracting.

What’s up next week?

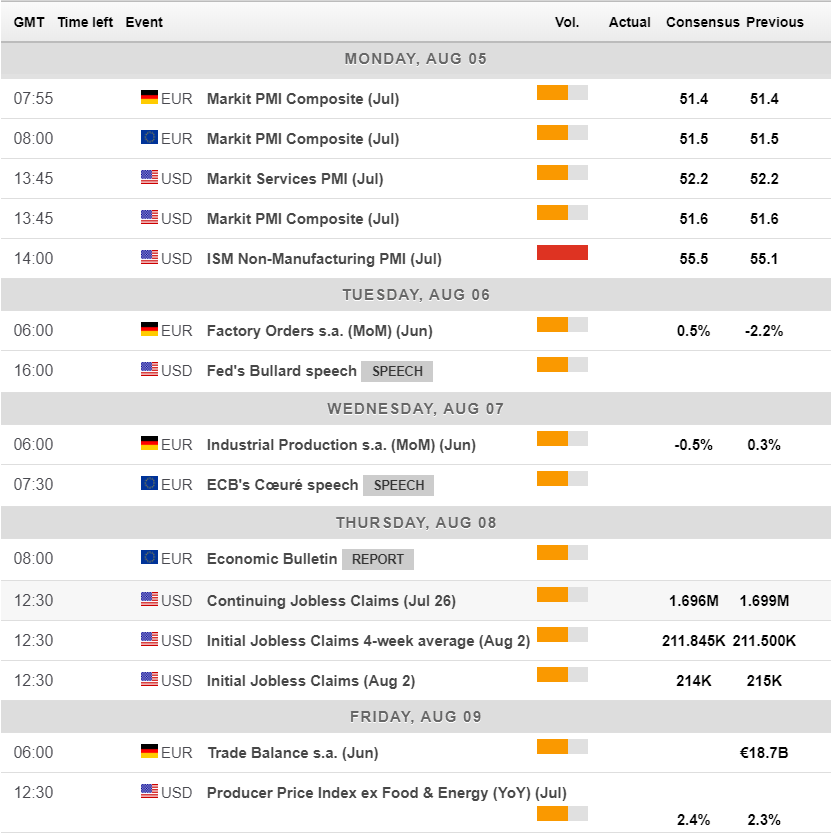

The macroeconomic calendar next week has little relevant to offer, as Markit will release the final versions of the Services PMI and the Composite PMI for both economies, seen unchanged from their preliminary estimates. The US official ISM Non-Manufacturing PMI is foreseen at 55.5 in July from 55.1 in June. All of these events will take place on Monday, with minor data scheduled throughout the rest of the week.

With that in mind, the market would probably keep on focusing on global economic growth and how trade tensions could affect it. US President Trump may revert its latest decision on tariffs on China if Wall Street extends the bleeding, something he already announced this Friday.

EUR/USD technical outlook

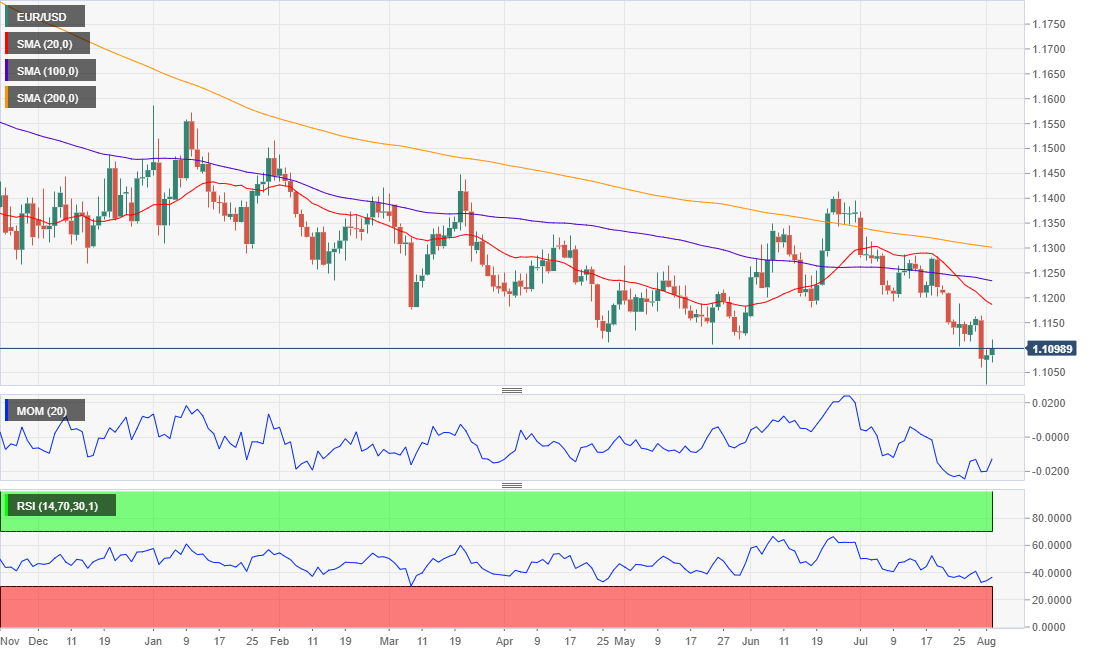

The EUR/USD pair is struggling with the 1.1100 figure, unable to advance beyond the level. Despite trimming most of its weekly losses, the risk remains skewed to the downside in the long term, as, in the weekly chart, it remains below all of its moving averages, and with the 20 SMA moving further below the larger ones. The Momentum indicator in the mentioned chart is directionless in neutral territory, although the RSI indicator has extended its decline within negative levels, currently at around 41. Its bearish strength is limited but is present.

In the daily chart, technical readings also indicate that the bearish case remains firmly in place, as the pair is developing some 100 pips below a bearish 20 DMA, which heads south below the larger ones. Technical indicators have bounced modestly from oversold readings, but their strength upward is limited and fall short of suggesting an interim bottom.

For the upcoming days, 1.1070 is the immediate support, ahead of the 1.1000 figure. If the pair loses this last, the decline could continue toward 1.0920. Above 1.1120, an upward corrective movement could continue toward 1.1200 first, and 1.1250 later, although it seems unlikely the pair could advance this much.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that bears account for the 58% of the polled experts in the weekly perspective, but that they decrease to just 34% in the monthly and quarterly views. Despite seen up in the longer-term perspectives, the average targets were downgraded to 1.1158 and 1.1159 respectively, a sign that demand for the shared currency remains subdued.

The Overview chart shows that the moving averages are bearish in the three time-frame under study, although in the monthly view, the most targets accumulate above the current level in the 1.12/1.14 area. The three-month view shows that there are multiple targets sub-1.1000, which means that the psychological barrier could be soon eroded.

Related Forecasts:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.