- EUR/USD has been struggling as higher US yields boost the dollar.

- US inflation, coronavirus headlines, and the ongoing US fiscal impasse are in play.

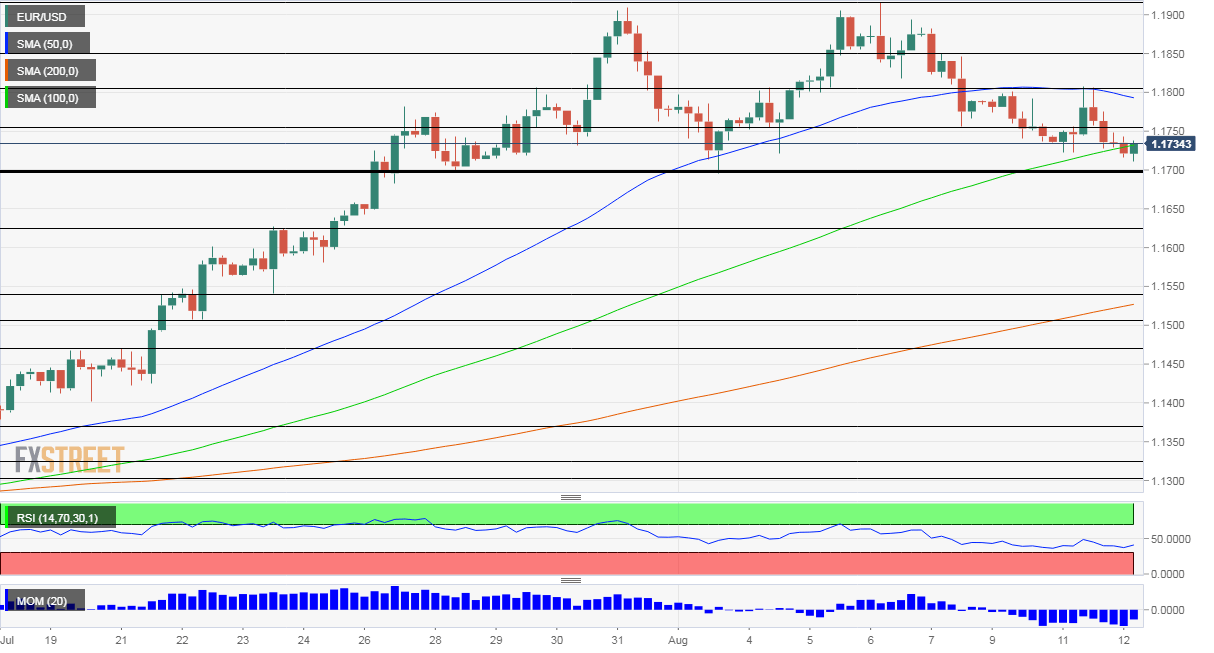

- Wednesday's four-hour chart is showing bears are gaining strength.

Too much of a good thing – Investors seemed to have an insatiable appetite for scooping up US debt, but that may have reached its limits. Uncle Sam is issuing a record amount of bonds this week, and this time, yields have been on the rise. In turn, that is supporting the dollar across the board.

President Donald Trump's suggestion of slashing capital tax gains would create a bigger hole in America's finance, requiring further funding.

US inflation figures for July due out later in the day, are set to show steady gains, potentially lifting yields and impacting the dollar.

See US CPI July Preview: Inflation loses its cachet

Another reason for the greenback's rise is safe-haven flows stemming from several concerns. Republicans and Democrats have yet to make headway in fiscal stimulus talks, which both sides describe as "stalemated."

After broad criticism, the White House waived its requirement from states to add $100/week in special unemployment benefits, leaving only Washington's $300/week – half the previous payment. In the meantime, it is unclear if executive orders on that topic and others have legal standing and how long it will take to roll them out.

The economy may suffer a consumption cliff as millions of unemployed have less cash in their pockets.

Sino-American tensions remain elevated with the focus shifting from Hong Kong – where media mogul Jimmy Lai was released – to Taiwan. Beijing reiterated that the island nation is an indispensable part of China after sending a fighter jet closer to Taiwan earlier this week.

Coronavirus cases are also worrying – with the US recording the highest daily deaths since May. That may be a one-off, with the broader trend showing a decline in infections and mortalities. Nevertheless, the improvement is slow and Texas decided to prolong restrictions despite its better situation.

Russia announced that it registered the world's first coronavirus vaccine – a declaration that received a lukewarm response. President Vladimir Putin said his daughter was inoculated, but could not explain why his country skipped the all-important Phase 3 trial.

The global race continues, with Massachusets-based Moderna receiving a pre-order of 100 million doses from the Trump administration. Hopes for developing rapid immunization may turn the tables against the dollar.

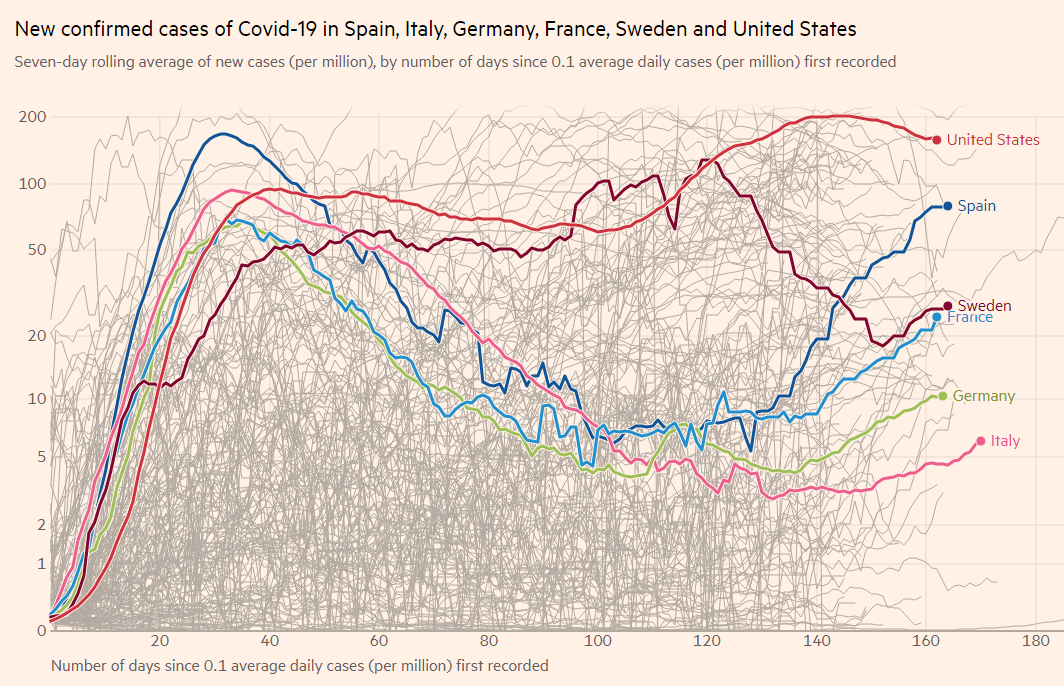

Europe's COVID-19 infections continue rising, with concerns growing in Germany and around new regions in Spain. So far, the US situation is worse, but Europe's coronavirus advantage is not set in stone.

Source: FT

Overall, most factors play in favor of the dollar and against the euro, at least for now.

EUR/USD Technical Analysis

Euro/dollar has dropped below the 100 Simple Moving Average on the four-hour chart, another bearish sign, joining the loss of the 50 SMA. Momentum remains to the downside and the Relative Strength Index is above 30, outside oversold conditions.

Critical support awaits at the double-bottom of 1.17, recorded in recent weeks. Beyond that line, 1.1625 was a stepping stone on the way up, 1.1540 was a swing low and 1.1510 provided support in mid-July.

Resistance is at 1.1750, which provided support last week, followed by 1.1805, which capped EUR/USD on Tuesday. Next, 1.1850 and 1.1915 await the currency pair.

More Market players don't believe the US Congress will fail to get a second “stimulus” spending package

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.