EUR/USD Current Price: 1.1788

- US President Trump signed four executive orders on coronavirus relief.

- The EU will publish the August Sentix Investor Confidence, foreseen at -15.2 from -18.2.

- EUR/USD decline corrective on the broader view but could extend its slump in the shorter-term.

The greenback closed the week appreciating against most major rivals, although EUR/USD settled in the 1.1780 price zone, holding on to modest weekly gains. The dollar got boosted by US President Trump´s announcement on executive orders and after an encouraging monthly employment report. The US administration imposed sanctions on Hong Kong’s chief leader, Carrie Lam, and ten other senior officials for their roles in the political turmoil in the region, also anticipating fiscal stimulus executive orders, which finally came on Saturday. The US Congress has been trying to reach an agreement on the matter for two weeks already, to no avail. The four orders extend unemployment benefits by $400, suspends the collection of payroll taxes till December, stop evictions from rental housing that has federal financial backing and extend zero per cent interest on federally financed student loans.

As for employment data, according to the Nonfarm Payroll report, the US added 1.76 million jobs in July, while the unemployment rate decreased to 10.2%, both figures better than anticipated. The numbers had a limited impact once out, as they reflect the long way to recovery the country still faces. In the last three months, the country recovered only 42% of the job positions lost in March and April. The US won’t publish relevant data this Monday, but the EU will unveil the August Sentix Investor Confidence, foreseen at -15.2 from -18.2 in the previous month.

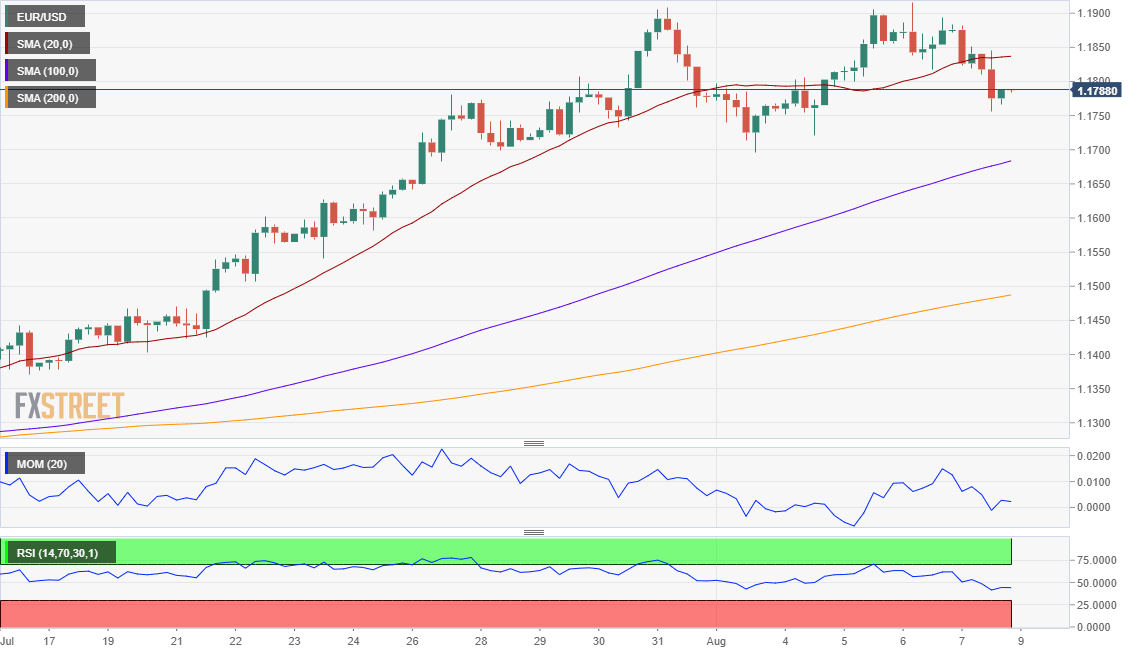

EUR/USD short-term technical outlook

The EUR/USD pair has closed above the 23.6% retracement of its 1.1184/1.1915 rally at 1.1742, the immediate support level. Daily basis, the latest decline seems corrective, as the pair continues to develop above a firmly bullish 20 DMA, which converges with the 38.2% of the mentioned advance at 1.1630, while technical indicators are barely retreating from overbought readings. In the 4-hour chart, and for the shorter-term, however, the risk is skewed to the downside, as the pair has broken below its 20 SMA, while technical indicators have entered bearish territory, the Momentum maintaining its downward slope.

Support levels: 1.1740 1.1700 1.1660

Resistance levels: 1.1810 1.1850 1.1900

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.