The euro fell to its lowest levels against the dollar since April of 2017 in early trading on Friday. The European single currency has been pressured by lackluster eurozone economic data while the US dollar has been lifted by its safe haven appeal as fears over the coronavirus persist.

On Friday, authorities in China reported 5,090 new coronavirus cases and 121 new deaths in the previous 24 hours. The latest official data indicates that in China over 63,000 people have been infected and at least 1,380 people have died. Meanwhile, a senior administration official told CNBC that the US does “not have high confidence in the information coming out of China” on the figures relating to coronavirus cases. Both the US dollar and Japanese yen were boosted by their safe haven status.

At the same time, weakness in eurozone data weighed on the euro this week. Figures released on Wednesday showed that euro-area industrial production fell by 2.1%, the most in almost 4 years. In addition, German GDP came in weaker than expected on Friday and reflected that the German economy stagnated at the end of 2019.

The disappointing eurozone figures contrast with recent positive US data. The US employment report last week showed that 225K new jobs were created and that the unemployment rate ticked up slightly to 3.6%. The New York Federal Reserve announced on Thursday that it will cut back the repo support it is providing in the overnight lending markets. Investors now turn their attention to today’s US retail sales report.

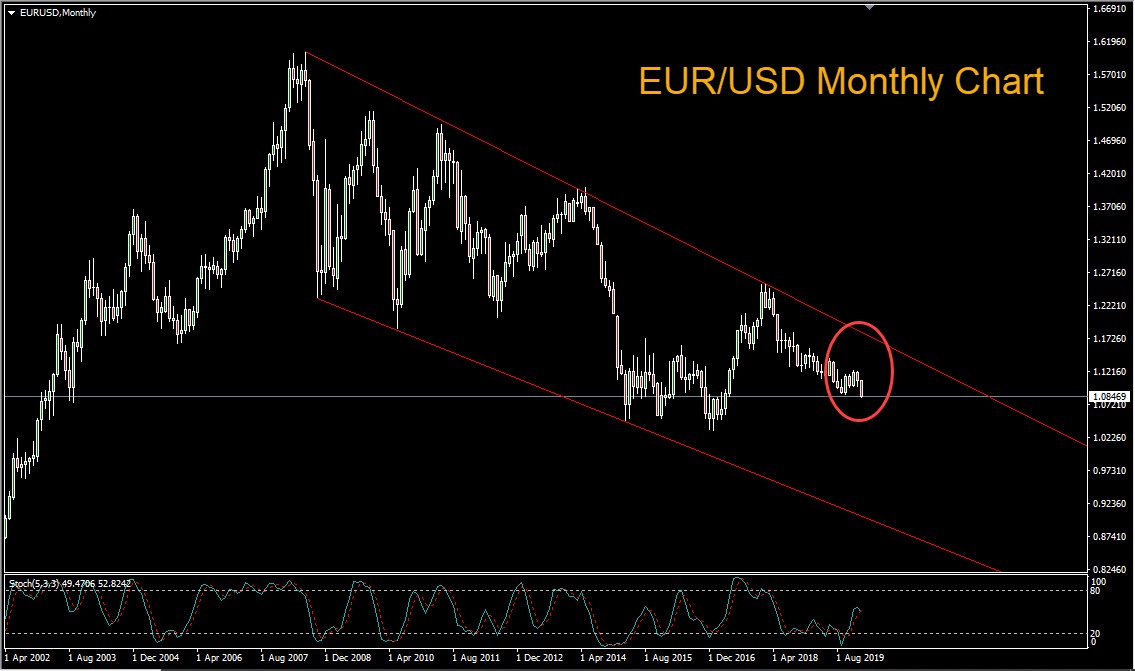

Looking at the EUR/USD monthly chart we can see that price has been in a steady downtrend since 2008 and that a major long term downward channel has formed. Bears begin to eye the prior low of 104.58, representing a potential major level of support.

Trading Futures, Options on Futures, and Foreign Exchange involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.