EUR/USD has started the trading week with small gains. Currently, the pair is trading at 1.1373, up 0.09% on the day. In economic news, German PPI declined by 0.4%, the first decline since February 2018. On Tuesday, Germany releases ZEW Economic Sentiment.

The markets were treated to disappointing news on Monday, with the release of Chinese data. The number 2 economy in the world grew 6.6% in 2018, marking its lowest level since 1990. GDP for the fourth quarter dipped to 6.4%, compared to 6.5% in the previous quarter. The soft GDP release comes on the heels of soft trade and manufacturing data, pointing to a slowdown due to the ongoing U.S-China trade war. The Trump administration has threatened further tariffs if a deal is not reached by March 1 , but a second round of negotiations between the sides is scheduled for the end of the month in Washington. Chinese officials will be under pressure to show more flexibility in the talks, in order to stem the economic bleeding.

The eurozone economy has softened in recent months, although the economy grew in 2018. The U.S-China trade war has taken a bite out of economic activity, and the eurozone export and manufacturing sectors have slowed. Germany, the largest economy in the bloc, has also been affected and growth for 2019 has been revised downwards. If the trade war continues or the U.S. economy slows down in 2019, the eurozone could lapse into a recession. Bottom line? The ECB, which finally terminated its massive stimulus program last month, is unlikely to raise rates before the fourth quarter of 2019. Just a few months ago, analysts were predicting a rate hike in the third quarter. This means that the euro will have to contend against the dollar without the benefit of higher rates, which would make the euro more attractive to investors.

EUR/USD Fundamentals

Monday (January 21)

-

7:00 German PPI. Estimate -0.1%. Actual -0.4%

-

11:00 German Buba Monthly Report

Tuesday (January 22)

- 10:00 German ZEW Economic Sentiment. Estimate -18.8

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1120 | 1.1212 | 1.1300 | 1.1434 | 1.1553 | 1.1685 |

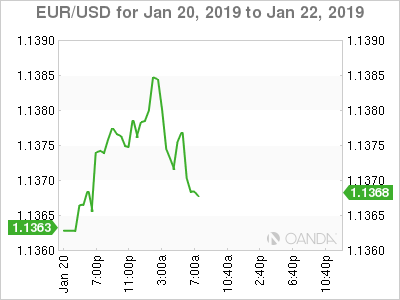

EUR/USD posted small gains in the Asians session. The pair added more gains in the European trade but has retracted

-

1.1300 is providing support

-

1.1434 is the next resistance line

-

Current range: 1.1300 to 1.1434

Further levels in both directions:

-

Below: 1.1300, 1.1212 and 1.1120

-

Above: 1.1434, 1.1553, 1.1685 and 1.1803

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.