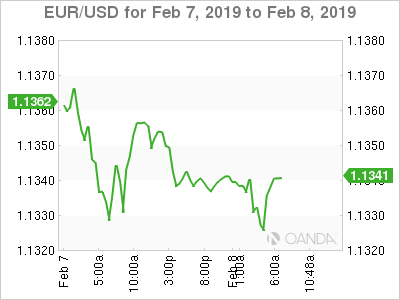

EUR/USD is unchanged in the Friday session. Currently, the pair is trading at 1.1341, up 0.02% on the day. On the release front, Germany’s trade surplus widened to EUR 19.4 billion, above the estimate of EUR 18.3 billion. With no U.S. events on the schedule, we’re unlikely to see much movement from the euro during the day.

It’s been a tough week for the euro, which has lost 1.0 percent. The euro lost ground on Thursday after the release of the European Commission economic forecasts. The EC has projected moderate growth in the EU, but plenty of uncertainty has dampened confidence. The forecast lowered its growth forecast for the eurozone to 1.9% in 2018, down from 2.1% in the November forecast. For 2019, the growth forecast has also been revised down to 1.5%, compared to 1.9% in the November forecast. Inflation slipped in late 2018 due to lower oil prices, with an average inflation level of 1.7%. This is expected to dip to 1.6% in 2019. The report highlighted Brexit and the slowdown in China as key sources of uncertainty for European economies, adding that the projections were subject to downside risks.

The Federal Reserve does not hold its policy meeting until mid-March, so investors will be left to focus on remarks from Fed Chair Jerome Powell and his colleagues. The Fed raised interest rates four times last year, but economic conditions are very different in 2019. The U.S-China trade war has dampened global growth and rocked the equity markets. With the U.S. unlikely to replicate the sparkling growth we saw in 2018, the Fed is projecting just two rate increases this year. The markets, however, are predicting no rate moves, and some analysts are even talking about the possibility of a rate cut late in 2019.

EUR/USD Fundamentals

Friday (February 8)

-

2:00 German Trade Balance. Estimate 18.3B. Actual 19.4B

-

2:45 French Industrial Production. Estimate 0.7%. Actual 0.8%

-

2:45 French Preliminary Private Payrolls. Estimate 0.1%. Actual 0.1%

-

4:00 Italian Industrial Production. Estimate 0.4%. Actual -0.8%

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1120 | 1.1212 | 1.1300 | 1.1434 | 1.1553 | 1.1685 |

EUR/USD was flat in the Asian session. The pair posted small losses in European trade but has recovered

-

1.1300 is providing support

-

1.1434 is the next resistance line

-

Current range: 1.1300 to 1.1434

Further levels in both directions:

-

Below: 1.1300, 1.1212 and 1.1120

-

Above: 1.1434, 1.1553, 1.1685 and 1.1803

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.