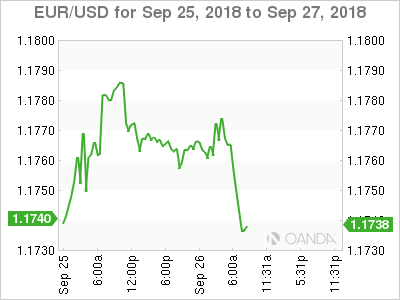

EUR/USD is steady in the Wednesday session. Currently, the pair is trading at 1.1771, up 0.03% on the day. On the release front, there are no eurozone or German events. In the U.S, the focus is on the Federal Reserve, which is virtually certain to raise the benchmark rate to a range between 2.00% and 2.25%. On Thursday, there are key indicators on both sides of the pond. Germany releases Preliminary CPI, while the U.S will publish Final GDP and durable goods orders.

All eyes are on the Federal Reserve, which is widely expected to raise rates by 25 basis points at the conclusion of its policy meeting on Wednesday. What will be the tone of the rate statement? The U.S economy is in excellent shape, with GDP for Q2 expected at 4.2%, and unemployment hovering below 4 percent. However, the escalating global trade war has raised concerns that it could cool down global economic growth and hurt the U.S economy as well. Still, another rate hike in December is pegged at 78%, according to the CME, and some experts are predicting up to four rate hikes in 2019.

The euro briefly pushed past the 1.18 line on Monday. This followed hawkish remarks from ECB President Mario Draghi, who was testifying before the European Parliament Economic and Monetary Affairs Committee. Draghi said there had been a “relatively vigorous pick-up in underlying inflation”. With regard to the ECB’s forward guidance, Draghi said that the ‘”through the summer of 2019″ was a timeline in which conditions warrant a first rate increase. This means that the September meeting will be a live meeting, with many analysts predicting a rate hike in December.

Trade tensions have escalated this week, with the U.S and China slapping tariffs on each other. On Monday, the U.S imposed tariffs on some $200 billion worth of Chinese goods, while China responded with tariffs of $60 billion on U.S products. There may be more headwinds ahead, as China sharply attacked the U.S, saying it had plunged “a knife to China’s neck” with the new tariffs. The Chinese have canceled trade talks with the Trump administration, and no new talks are likely to be held until the mood improves between the world’s two largest economies. Previous rounds of tariffs between the two economic giants have boosted the U.S dollar, but so far, investors have reacted calmly and have not dumped their euro assets in favor of the greenback.

EUR/USD Fundamentals

Wednesday (September 26)

-

10:00 US New Home Sales. Estimate 630K

-

10:30 US Crude Oil Inventories. Actual -0.7M

-

14:00 US FOMC Economic Projections

-

14:00 US FOMC Statement

-

14:00 US Federal Funds Rate. Estimate <2.25%

-

14:30 FOMC Press Conference

Thursday (September 27)

-

2:00 German GfK Consumer Climate. Estimate 10.6

-

All Day – German Preliminary CPI. Estimate 0.1%

-

8:30 US Core Durable Goods Orders. Estimate 0.4%

-

8:30 US Final GDP. Estimate 4.2%

-

8:30 US Durable Goods Orders. Estimate 1.9%

-

9:30 ECB President Draghi Speaks

-

16:30 US Fed Chair Powell Speaks

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1553 | 1.1637 | 1.1718 | 1.1840 | 1.1961 | 1.2055 |

EUR/USD was mostly flat in the Asian session. The pair is steady in European trade

-

1.1718 is providing support

-

1.1840 is the next resistance line

Further levels in both directions:

-

Below: 1.1718, 1.1637, 1.1553 and 1.1434

-

Above: 1.1840, 1.1961 and 1.2055

-

Current range: 1.1718 to 1.1840

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.