Key Highlights

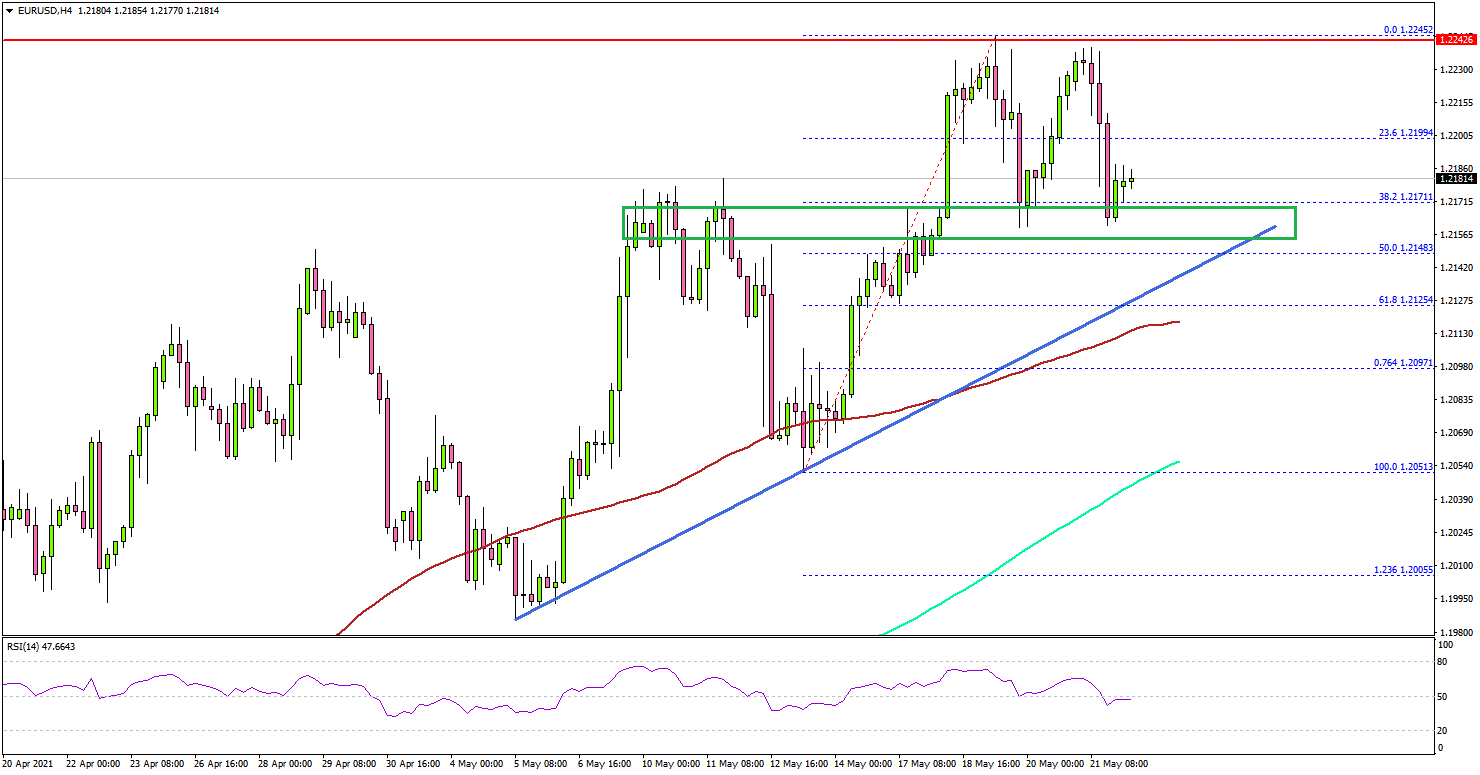

- EUR/USD climbed towards 1.2250 before correcting lower.

- A major bullish trend line is forming with support near 1.2140 on the 4-hours chart.

EUR/USD Technical Analysis

Looking at the 4-hours chart, the pair traded as high as 1.2245 before starting a downside correction. There was a break above the 1.2200 level, but the pair is trading well above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

On the downside, there is a major support forming near the 1.2140 level. There is also a major bullish trend line forming with support near 1.2140 on the same chart.

The trend line is close to the 50% Fib retracement level of the upward move from the 1.2053 swing low to 1.2245 high. The next major support on the downside is near the 1.2115 level and the 100 SMA.

Any more losses could possibly lead the pair towards the 1.2050 support zone. On the upside, the pair is facing hurdles near 1.2225 and 1.2250. A clear break above the 1.2250 zone is likely to clear the path for a move towards the 1.2320 level.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.