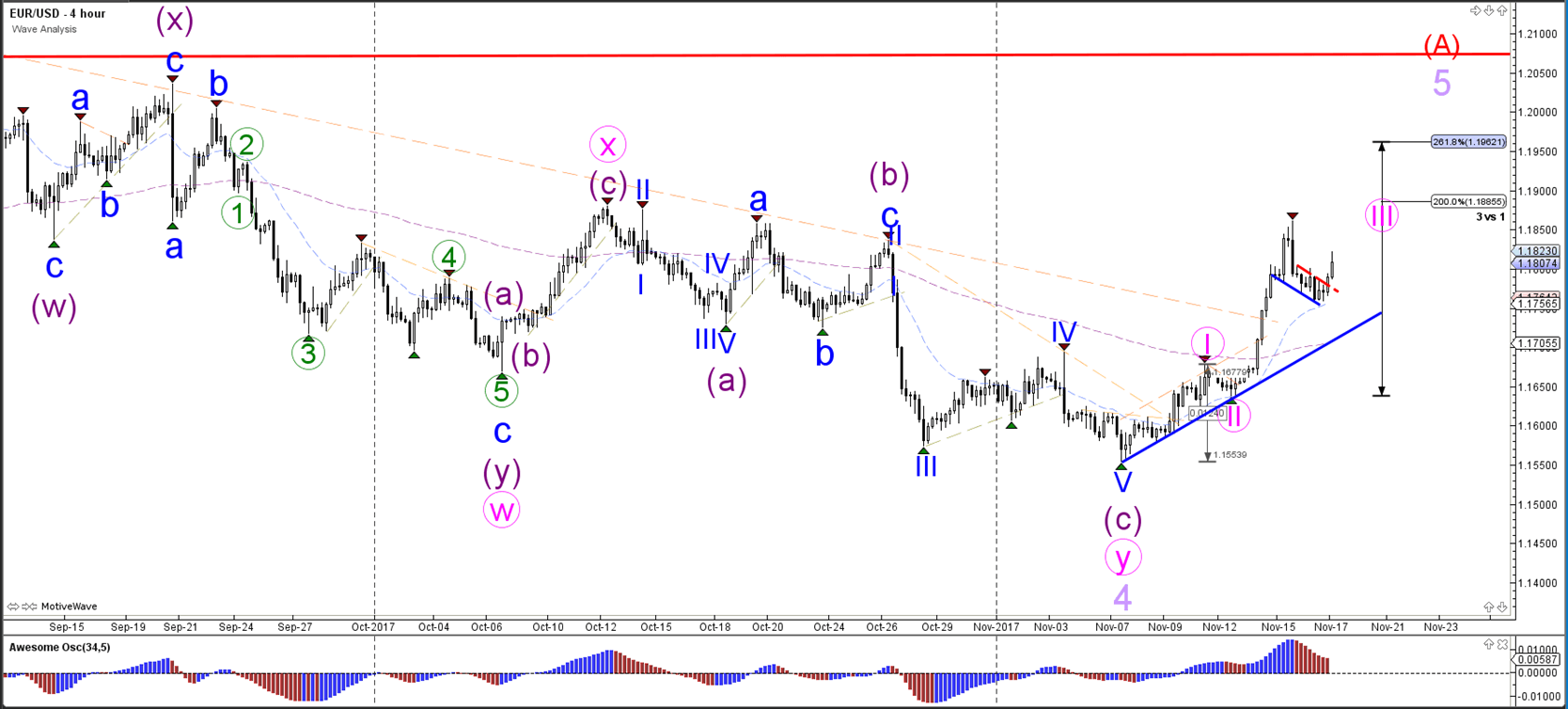

EUR/USD

4 hour

EUR/USD retraced back to and bounced at the 1.1750 support level. Price then broke above the resistance trend line (dotted red) and therefore could be extending the wave 3 (pink).

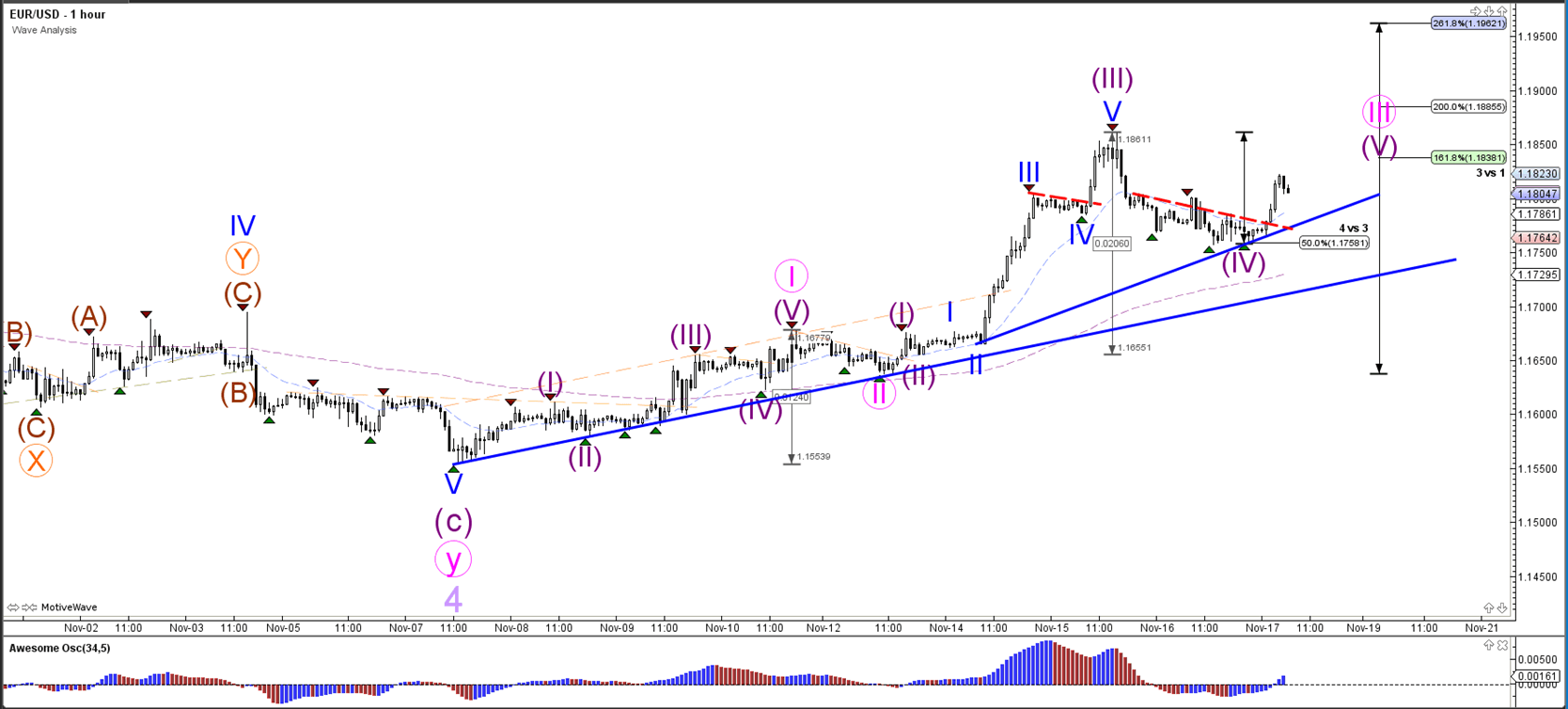

1 hour

The EUR/USD bounced at the 50% Fibonacci level of wave 4 (purple). There could be a wave 5 (purple) continuation as long as price stays above the support trend line (blue).

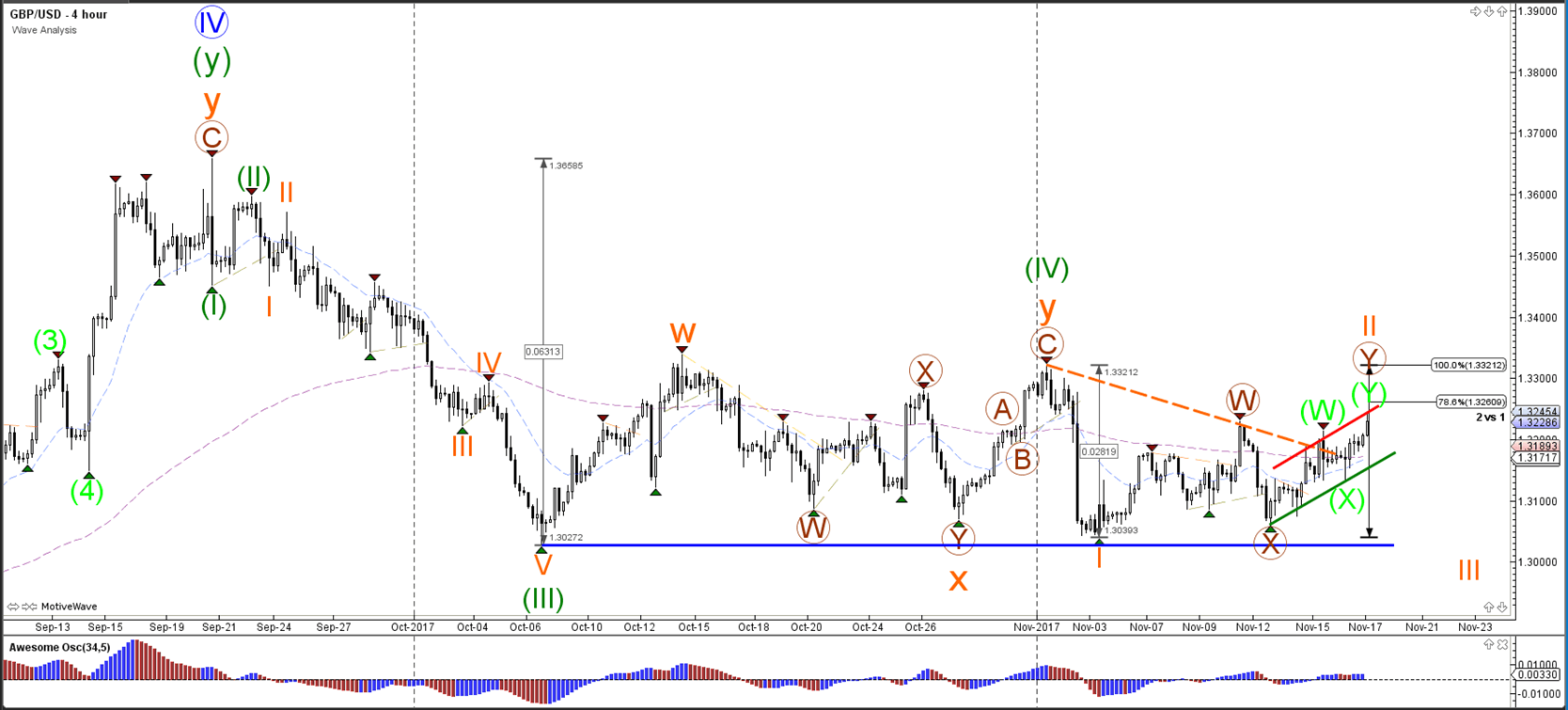

GBP/USD

4 hour

The GBP/USD broke above the resistance (dotted orange) trend line and moved up to retest the higher Fibonacci level at 1.3260. A breakout above the top (100% Fib) or below the support trend line (green) is needed before a larger directional move can be expected.

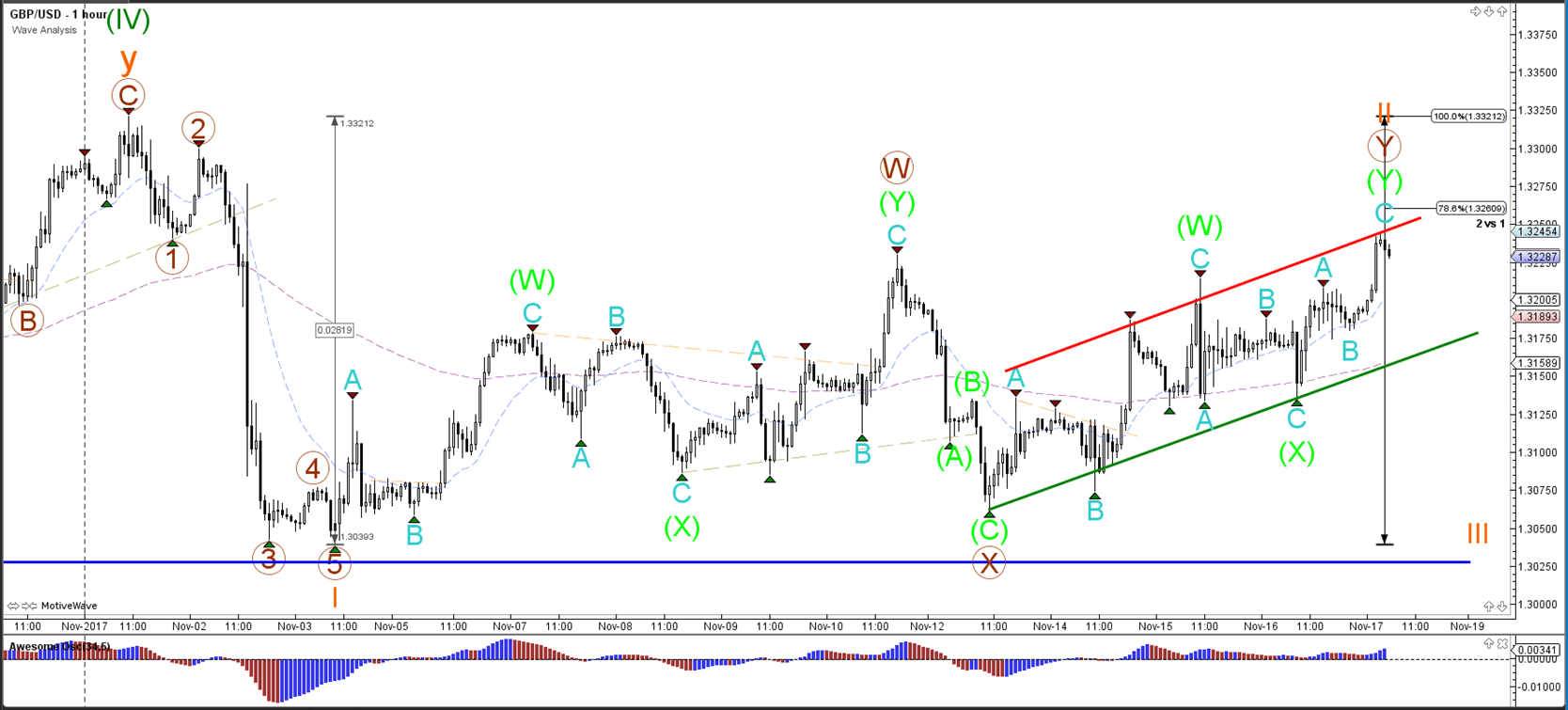

1 hour

The GBP/USD has expanded the choppy correction via a complex correction of WXY (green) and price has now reached the top of the channel (red), which could create a bearish bounce back to test the bottom of the channel.

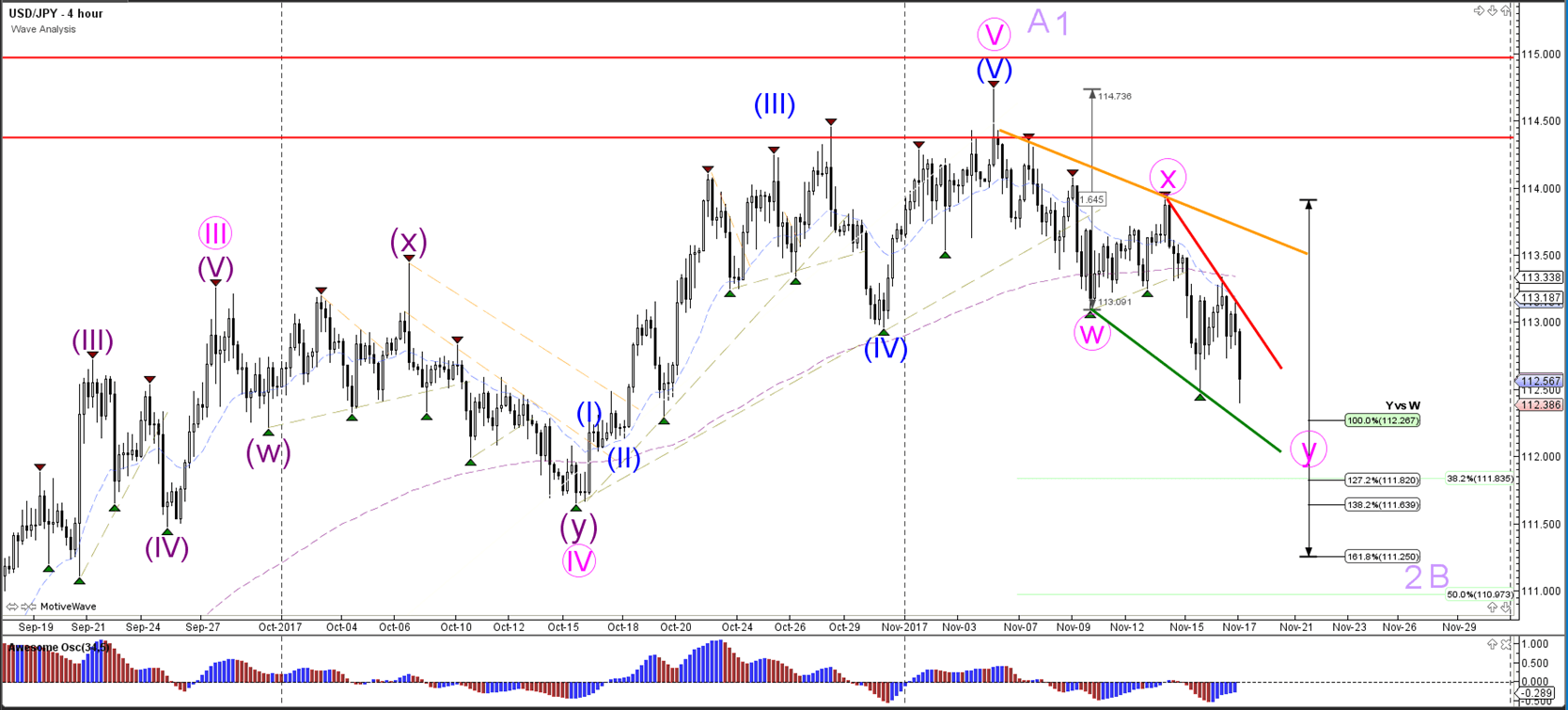

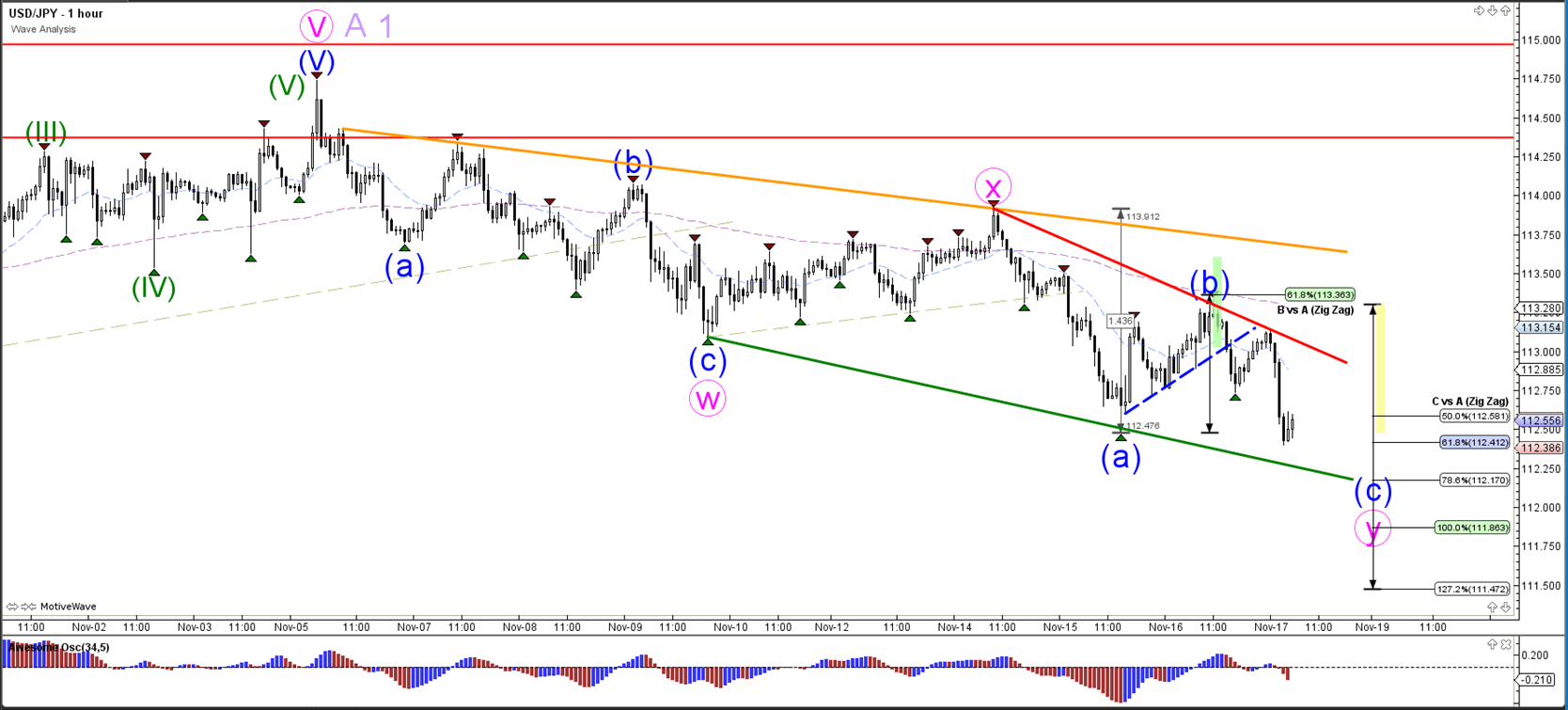

USD/JPY

4 hour

The USD/JPY’s is moving lower as part of wave 2 or wave B (light purple). The 38.2% Fibonacci support level could be the next target of the bearish price action at 111.83.

1 hour

The USD/JPY completed an ABC (blue) within wave B (blue) and broke below support (dotted blue) to continue with wave C (blue). Price is now building a falling wedge chart pattern (green/red lines). Price will need to break below support if it is able to accelerate the downtrend.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.